Question: Please help with the A to C lessee computations and entries G (Lessor Computations and Entries, Sales-Type Lease with Unguaranteed Residual Value) (LO 2, 4)

Please help with the A to C "lessee computations and entries"

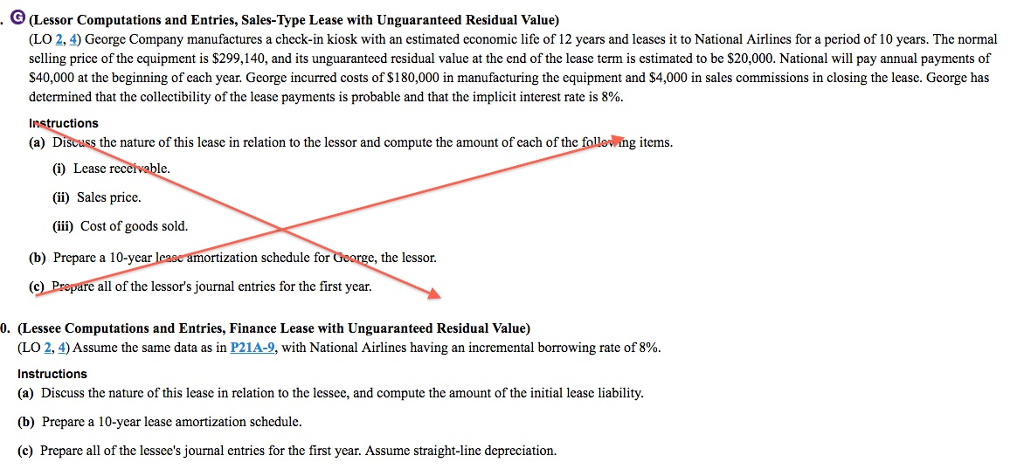

G (Lessor Computations and Entries, Sales-Type Lease with Unguaranteed Residual Value) (LO 2, 4) George Company manufactures a check-in kiosk with an estimated cconomic life of 12 years and leases it to National Airlines for a period of 10 years. The normal selling price of the equipment is $299,140, and its unguaranteed residual value at the end of the lease term is estimated to be $20,000. National will pay annual payments of $40,000 at the beginning of each year. George incurred costs of $180,000 in manufacturing the equipment and $4,000 in sales commissions in closing the lease. George has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 8%. uctions Discuss the nature of this lease in relation to the lessor and compute the amount of cach of the (i) Lease receivable. (ii) Sales price (ii) Cost of goods sold. (a) g items. (b) Prepare a 10-year leaoc amortization schedule for George, the lessor (c e all of the lessor's journal entries for the first year. 0. (Lessee Computations and Entries, Finance Lease with Unguaranteed Residual Value) (LO 2, 4) Assume the same data as in P21-9, with National Airlines having an incremental borrowing rate of 8%. Instructions (a) Discuss the nature of this lease in relation to the lessee, and compute the amount of the initial lease liability (b) Prepare a 10-year lease amortization schedule (c) Prepare all of the lessee's journal entries for the first year. Assume straight-line depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts