Question: Please help with the Activity based depreciation expense, and the journal entry. Thank you! Part 2 of 2 2. Prepare the journal entry to record

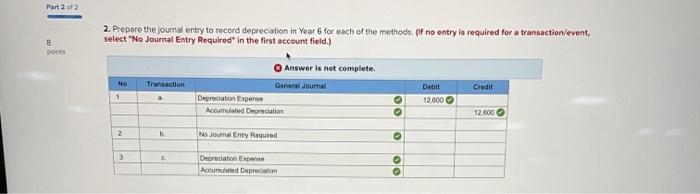

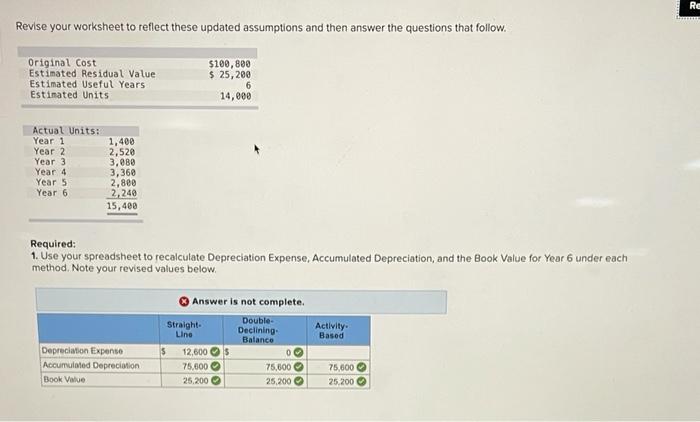

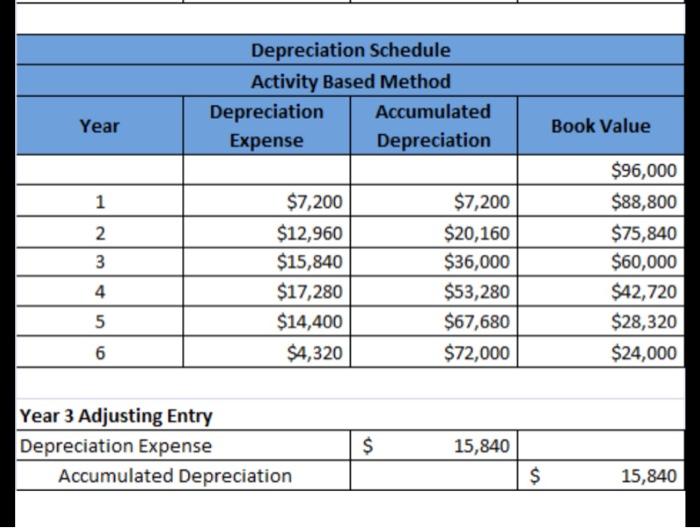

Part 2 of 2 2. Prepare the journal entry to record depreciation in Year 6 for each of the methods. If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.) B bois No 1 Transaction a Answer is not complete. Canal Journal Depreciation Expense Accumulated Depreciation Credit Debit 12.600 OO 12.000 2 Na Jou Emy Required 3 Depreciation Expert Accu Depreciation OO RE Revise your worksheet to reflect these updated assumptions and then answer the questions that follow. Original Cost Estimated Residual Value Estimated Useful Years Estimated Units $100,880 $ 25,200 6 14,000 Actual Units: Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 1,400 2,520 3,089 3,360 2,800 2,240 15,400 Required: 1. Use your spreadsheet to recalculate Depreciation Expense. Accumulated Depreciation, and the Book Value for Year 6 under each method. Note your revised values below. Activity Based Answer is not complete Straight- Double- Line Declining Balance 12,600 o 75,600 75,600 25,200 25,200 Depreciation Expense Accumulated Depreciation Book Value 75,600 25.200 Depreciation Schedule Activity Based Method Depreciation Accumulated Expense Depreciation Year Book Value 1 Nm $7,200 $12,960 $15,840 $17,280 $14,400 $4,320 $7,200 $20,160 $36,000 $53,280 $67,680 $72,000 $96,000 $88,800 $75,840 $60,000 $42,720 $28,320 $24,000 4 5 6 Year 3 Adjusting Entry Depreciation Expense Accumulated Depreciation $ 15,840 $ 15,840

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts