Question: Please help with the attached images, I cannot figure this out for the life of me. Income Statements under Absorption and Variable Costing Shawnee Motors

Please help with the attached images, I cannot figure this out for the life of me.

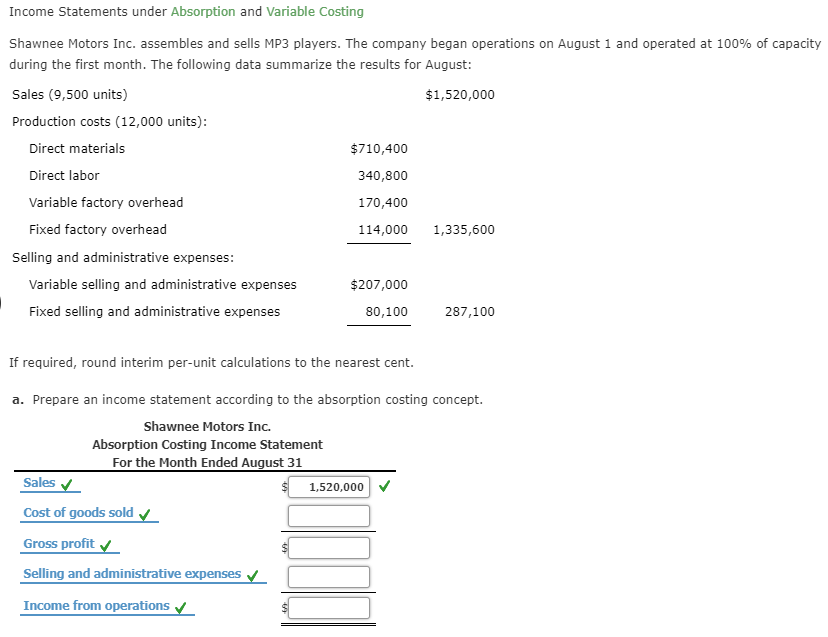

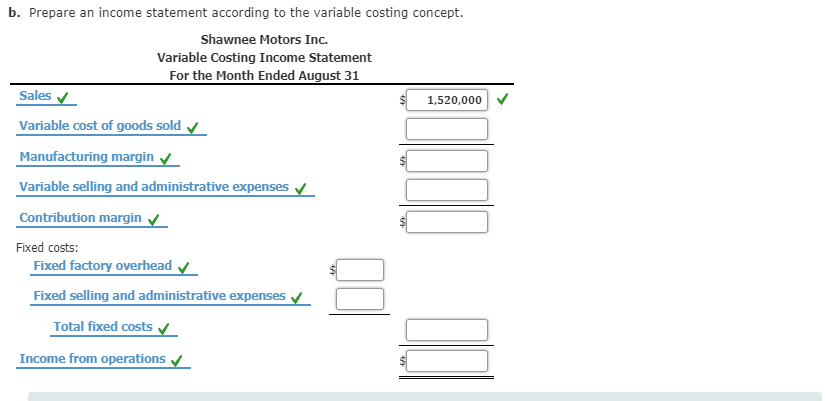

Income Statements under Absorption and Variable Costing Shawnee Motors Inc. assembles and sells MP3 players. The company began operations on August 1 and operated at 100% of capacity during the first month. The following data summarize the results for August: $1,520,000 Sales (9,500 units) Production costs (12,000 units): Direct materials $710,400 340,800 Direct labor Variable factory overhead 170,400 Fixed factory overhead 114,000 1,335,600 Selling and administrative expenses: Variable selling and administrative expenses $207,000 80,100 Fixed selling and administrative expenses 287,100 If required, round interim per-unit calculations to the nearest cent. a. Prepare an income statement according to the absorption costing concept. Shawnee Motors Inc. Absorption Costing Income Statement For the Month Ended August 31 Sales $ 1,520,000 Cost of goods sold Gross profit Selling and administrative expenses Income from operations b. Prepare an income statement according to the variable costing concept. Shawnee Motors Inc. Variable Costing Income Statement For the Month Ended August 31 Sales $ 1,520,000 Variable cost of goods sold Manufacturing margin Variable selling and administrative expenses Contribution margin Fixed costs: Fixed factory overhead Fixed selling and administrative expenses Total fixed costs Income from operations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts