Question: Please help with the below question. 5) What is the expected net advantage of leasing for FranklinCovey if the refinance option is available? Exhibit 5

Please help with the below question.

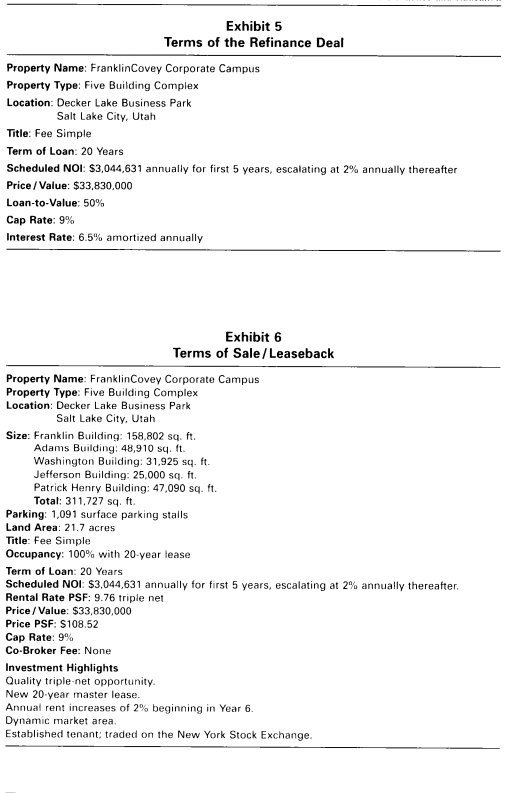

5) What is the expected net advantage of leasing for FranklinCovey if the refinance option is available?

Exhibit 5 Terms of the Refinance Deal Property Name: FranklinCovey Corporate Campus Property Type: Five Building Complex Location: Decker Lake Business Park Salt Lake City, Utah Title: Fee Simple Term of Loan: 20 Years Scheduled NOI: $3,044,631 annually for first 5 years, escalating at 2% annually thereafter Price / Value: $33,830,000 Loan-to-Value: 50% Cap Rate: 9% Interest Rate: 6.5% amortized annually Exhibit 6 Terms of Sale / Leaseback Property Name: FranklinCovey Corporate Campus Property Type: Five Building Complex Location: Decker Lake Business Park Salt Lake City, Utah Size: Franklin Building: 158,802 sq. ft. Adams Building: 48,910 sq. ft. Washington Building: 31,925 sq. ft. Jefferson Building: 25,000 sq. ft. Patrick Henry Building: 47,090 sq. ft. Total: 311,727 sq. ft. Parking: 1,091 surface parking stalls Land Area: 21.7 acres Title: Fee Simple Occupancy: 100% with 20-year lease Term of Loan: 20 Years Scheduled NOI: $3,044,631 annually for first 5 years, escalating at 2% annually thereafter. Rental Rate PSF: 9.76 triple net Price / Value: $33,830,000 Price PSF: $108.52 Cap Rate: 9% Co-Broker Fee: None Investment Highlights Quality triple-net opportunity. New 20-year master lease. Annual rent increases of 2% beginning in Year 6. Dynamic market area. Established tenant; traded on the New York Stock Exchange

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts