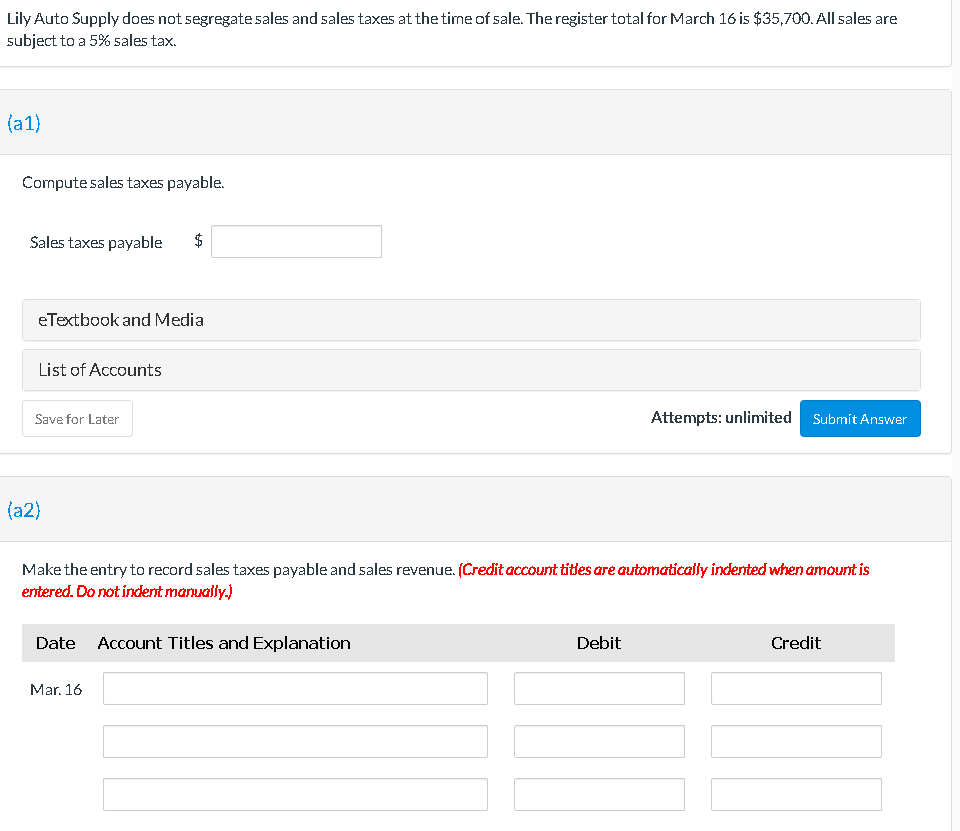

Question: Please help with the below questions. Lily Auto Supply does not segregate sales and sales taxes at the time of sale. The register total for

Please help with the below questions.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock