Question: please help with the breakdowns text states Module 3 Assignment: Bonds and Stock Valuations Snowbirds Resort, Inc. has a chain of facilities located in the

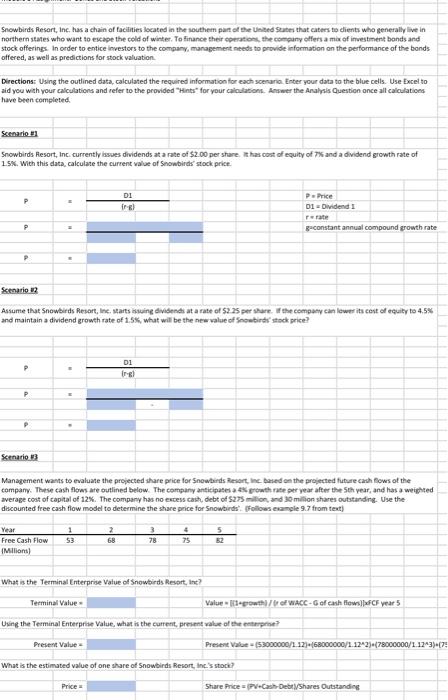

Snowbirds Resart, inc. has a chain of facilties located in the southem part of the Uaiged 9 user that caters to dients who generally live in northern states who want to excape the cold of winter. To finance their operatons, the company alfers a mix of irvestinerat bonds and stock offerings. in order to entice investors to the company, manapement needs to provide information on the performance of the bonds offered, as well as predictions for stock valuation. Directions: Using the outlined data, calculated the required information for each scenana. Enter your data to the blue cells. Use Excel to aid you with your calculations and refer to the provided "Hints" for your caloulatont. Answer the Aralynis Question once all caloulatioes have been completed. Snowbirds Resort, Inc. currently iasves dividends at a rate of $2.00 per share. it has cost of equity of TXS and a dividend growth rate of 1.5\%. With this data, calculate the current value of Senowbirat's stock price. Assume that Snowbirds Resort, line, starts diving dvisendi at a rate of 52.25 per thare. if the compaty can lewer its cest of equity to 4.5% and maintain a dividend growth rate of 1.5\%, what will be the new walue of Snowbirat' stack price? Management wants to evaluate the projected thare price for Snowbirds Resort, inc, based on the projected future cach fows of the camparm. These cash flows are outlined below. The company anticipased a 4% growth race per year after the 5 th year, and has a weighted average cost of capital of 12%. The company has no excess cash, debt of 5275 milion, and 30 mition shares outstandirg. Use the discounted free cash flow model to determine the share price for Snowbirds'. (follows example 9.7 from text) \begin{tabular}{|l|c|c|ccc} Year & 1 & 2 & 3 & 4 & 5 \\ \hline Free Cash Flow & 53 & 68 & 78 & 75 & 52 \end{tabular} What is the Terminal Enterprise Vatue of Snowbirds Resart, inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts