Question: Please help with the excel calculations. I'm struggling with knowing what formula to use. Assume you are conducting a capital budgeting analysis. The proposed project

Please help with the excel calculations. I'm struggling with knowing what formula to use.

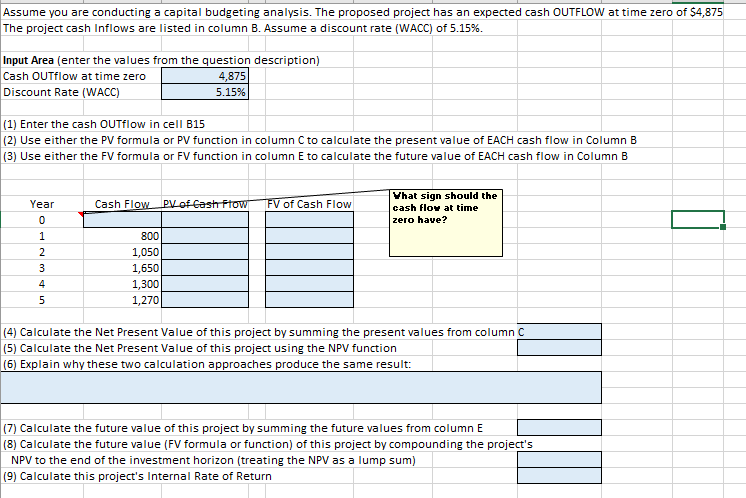

Assume you are conducting a capital budgeting analysis. The proposed project has an expected cash OUTFLOW at time zero of $4,875 The project cash Inflows are listed in column B. Assume a discount rate (WACC) of 5.15%. Input Area (enter the values from the question description) Cash OUTflow at time zero 4,875 Discount Rate (WACC) 5.15% (1) Enter the cash OUTflow in cell B15 (2) Use either the PV formula or PV function in column C to calculate the present value of EACH cash flow in Column B (3) Use either the FV formula or FV function in column E to calculate the future value of EACH cash flow in Column B Cash Flow_PV of Cash Flow FV of Cash Flow Vhat sign should the cash flow at time zero have? Year 0 1 2 3 4 5 800 1,050 1,650 1,300 1,270 (4) Calculate the Net Present Value of this project by summing the present values from column (5) Calculate the Net Present Value of this project using the NPV function (6) Explain why these two calculation approaches produce the same result: (7) Calculate the future value of this project by summing the future values from column E (8) Calculate the future value (FV formula or function) of this project by compounding the project's NPV to the end of the investment horizon (treating the NPV as a lump sum) (9) Calculate this project's Internal Rate of Return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts