Question: Please help with the following problem. If possible, explain your steps. Thanks in advance! Carbon Company is considering a project with an initial investment of

Please help with the following problem. If possible, explain your steps. Thanks in advance!

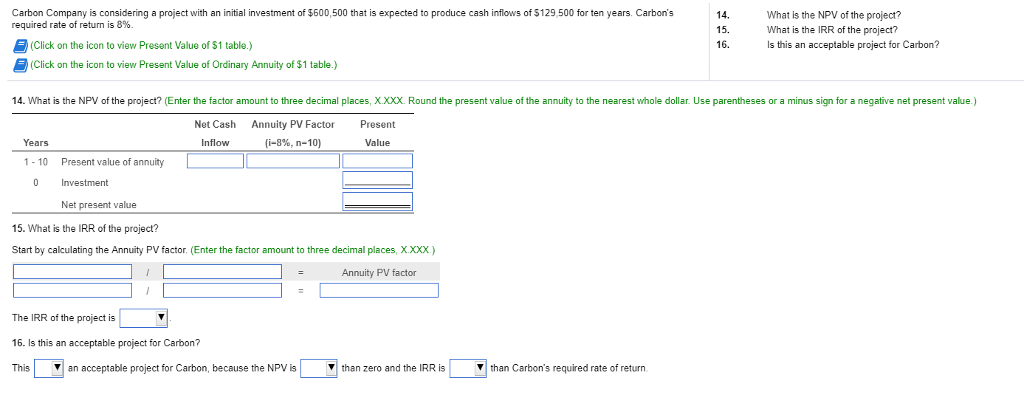

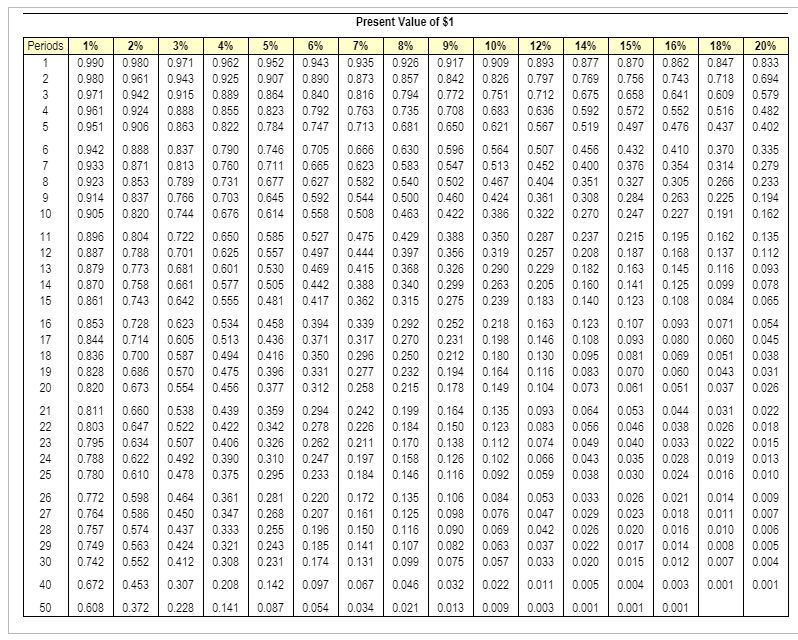

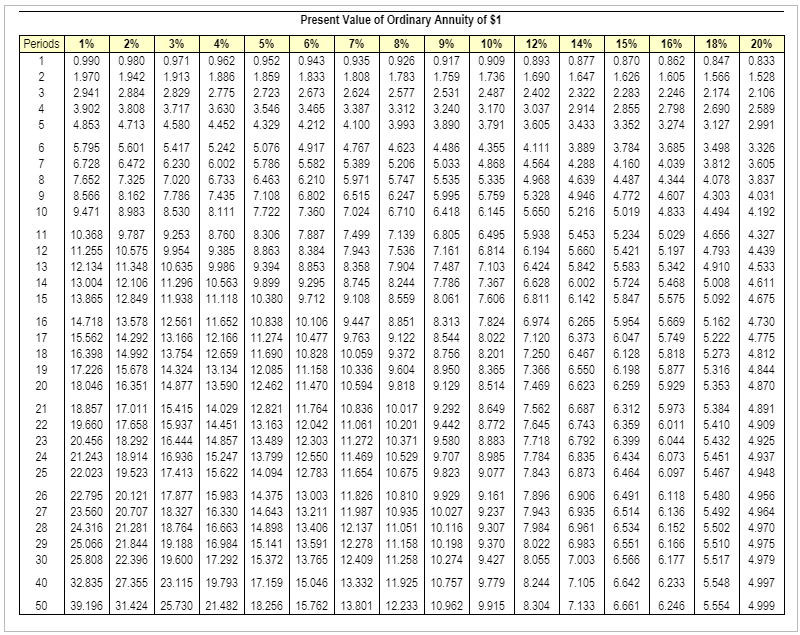

Carbon Company is considering a project with an initial investment of $600,500 that is expected to produce cash inflows of $129,500 for ten years. Carbon's required rate of return is 8%. 14. 15. 16. What is the NPV of the project? What is the IRR of the project? Is this an acceptable project for Carbon? (Click on the icon to view Present Value of $1 table.) (Click on the icon to view Present Value of Ordinary Annuity of $1 table.) 14. What is the NPV of the project? (Enter the factor amount to three decimal places, X.xXX. Round the present value of the annuity to the nearest whole dollar. Use parentheses or a minus sign for a negative net present value.) Net Cash Annuity PV Factor (1-8%, -10) Present Years Inflow Value 110 Present value of annuity 0 Investment Net present value 15. What is the IRR of the project? Start by callating the Annuity PV factor. (Enter the factor amount to three decimal places, x.xxx) Annuity PV factor The IRR of the project is 16. Is this an acceptable project for Carbon? This an acceptable project for Carbon, because the NPV is than zero and the IRR is than Carbon's required rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts