Question: Please help with the following question: A Bond has a modified duration of 5.5 and trades for $934. Average daily yield change standard deviation is

Please help with the following question:

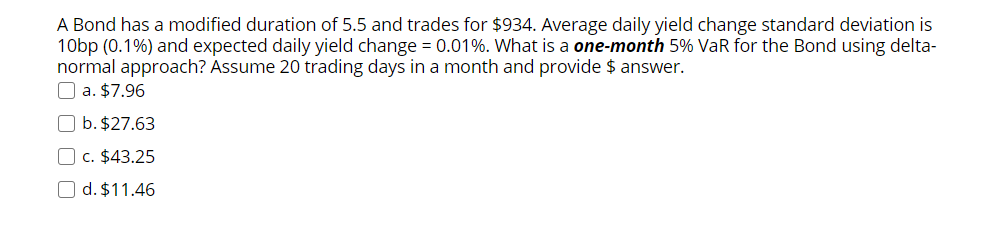

A Bond has a modified duration of 5.5 and trades for $934. Average daily yield change standard deviation is 10bp (0.1%) and expected dailyr yield change 2 0.01 %. What is a one-month 5% VaR for the Bond using delta- normal approach? Assume 20 trading days in a month and provide $ answer. C] a. $7.96 E] b. $27.63 C] c. $43.25 C] d. $1 1 .46

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts