Question: Please help with the full question and I'll give a thumbs up Suppose a firm has 35.90 million shares of common stock outstanding at a

Please help with the full question and I'll give a thumbs up

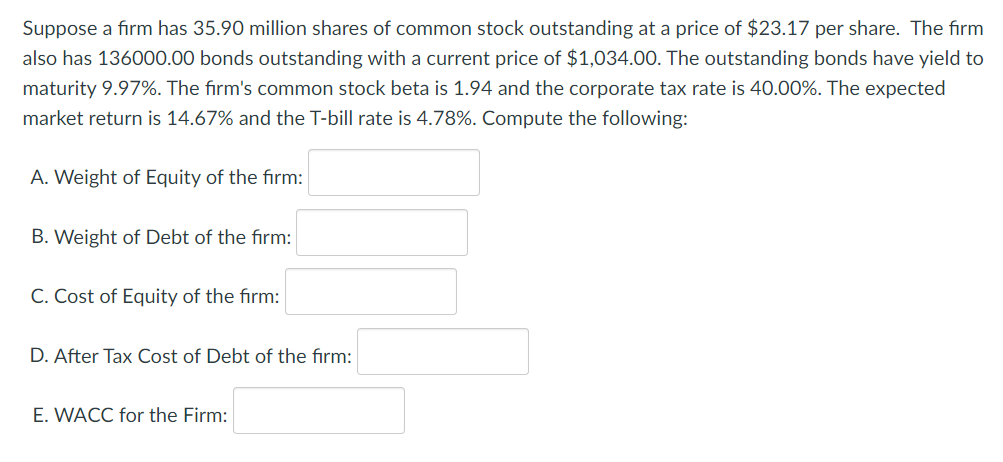

Suppose a firm has 35.90 million shares of common stock outstanding at a price of $23.17 per share. The firm also has 136000.00 bonds outstanding with a current price of $1,034.00. The outstanding bonds have yield to maturity 9.97%. The firm's common stock beta is 1.94 and the corporate tax rate is 40.00%. The expected market return is 14.67% and the T-bill rate is 4.78%. Compute the following: A. Weight of Equity of the firm: B. Weight of Debt of the firm: C. Cost of Equity of the firm: D. After Tax Cost of Debt of the firm: E. WACC for the Firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts