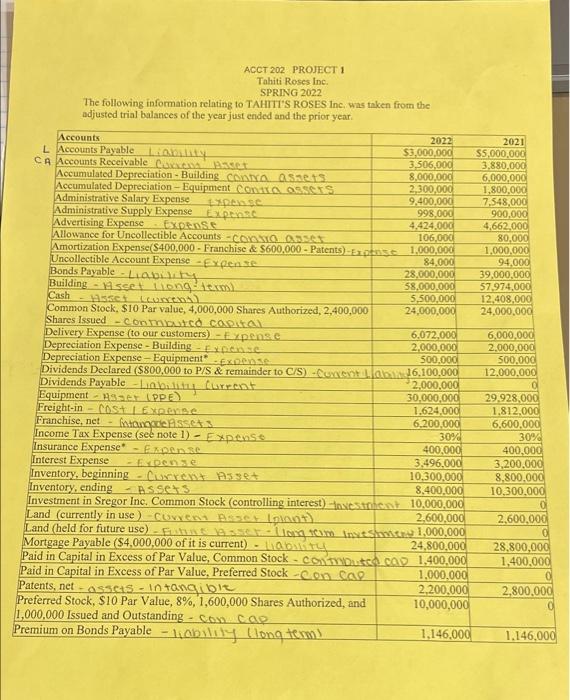

Question: please help with the income statement for 2021 ACCT 202 PROJECT 1 Tahiti Roses Inc SPRING 2022 The following information relating to TAHITIS ROSES Inc.

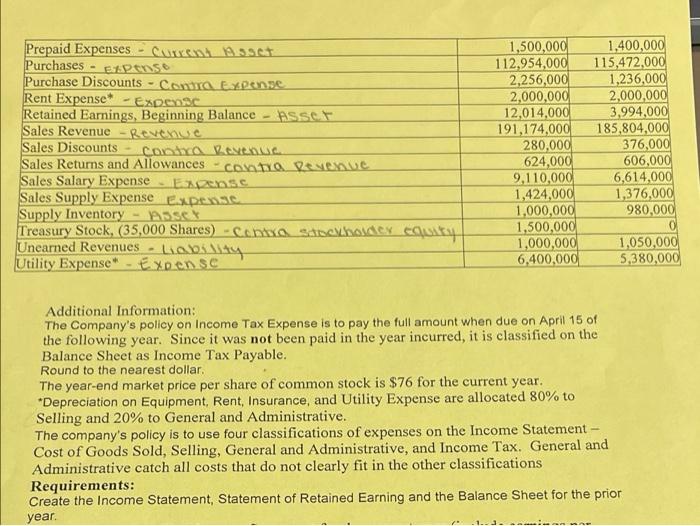

ACCT 202 PROJECT 1 Tahiti Roses Inc SPRING 2022 The following information relating to TAHITIS ROSES Inc. was taken from the adjusted trial balances of the year just ended and the prior year. Accounts 2022 2021 L Accounts Payable LOY $3,000,000 S5,000,000 CA Accounts Receivable C Buset 3.506,000 3,880,000 Accumulated Depreciation - Building Con Sets 8,000,000 6.000.000 Accumulated Depreciation - Equipment COM OSSEUS 2,300,000 1,800,000 Administrative Salary Expense SC 9.400.000 7,548,000 Administrative Supply Expense Expens 998.000 900,000 Advertising Expense ESPRISE 4.424.000 4,662,000 Allowance for Uncollectible Accounts - COM O QUE 106,000 80,000 Amortization Expense/S400,000 - Franchise & $600,000 - Patents)-Ezotas 1,000,000 1.000.000 Uncollectible Account Expense - Expense 84.000 94.000 Bonds Payable - Liability 28.000.000 39,000,000 Building - set longit 58.000.000 57,974.000 Cash - Asset LLC 5,500,000 12,408,000 Common Stock, S10 Par value, 4,000,000 Shares Authorized, 2,400,000 24,000,000 24,000,000 Shares Issued - CoomutCO CODILAR Delivery Expense (to our customers) - Expense 6,072,000 6.000.000 Depreciation Expense - Building - Expense 2,000,000 2.000.000 Depreciation Expense - Equipment - Expense 500,000 500.000 Dividends Declared ($800,000 to P/S & remainder to C/S) Coxxent Lab 16.100.000 12.000.000 Dividends Payable - Liability current 2.000.000 Equipment Aer (PPE) 30,000,000 29.928,000 Freight-in - COSTE Xperise 1.624.000 1.812.000 Franchise, net- Intongessen 6,200,000 6,600,000 Income Tax Expense (see note 1) - Expense 30% 30% Insurance Expense" Expense 400.000 400,000 Interest Expense FEDERE 3.496.000 3,200.000 Inventory, beginning - exs. Asse 10.300.000 8.800.000 Inventory, ending - Assets 8,400,000 10.300.000 Investment in Sregor Inc. Common Stock (controlling interest) Investment 10,000,000 Land (currently in use ) - Coven Asserloor) 2.600,000 2.600.000 Land (held for future use) - F - 10 In the 1,000,000 Mortgage Payable ($4,000,000 of it is current) - Liability 24,800.000 28,800,000 Paid in Capital in Excess of Par Value, Common Stock - Couts AD 1,400,000 1,400,000 Paid in Capital in Excess of Par Value, Preferred Stock -con CAO 1.000.000 Patents, net ASSCUS - Intangible 2,200.000 2,800,000 Preferred Stock, S10 Par Value, 8%, 1,600,000 Shares Authorized, and 10,000,000 1,000,000 Issued and Outstanding - COM CAO Premium on Bonds Payable - habity long term) 1,146,000 1.146.000 - Prepaid Expenses Current Asset Purchases Espense Purchase Discounts - Contra Expense Rent Expense Expense Retained Earnings, Beginning Balance Asset Sales Revenue Revenue Sales Discounts contra Revenue Sales Returns and Allowances -contro Revenue Sales Salary Expense Ess Sales Supply Expense Expense Supply Inventory - Asses Treasury Stock, (35,000 Shares) - Centro Schody equity Unearned Revenues - Lab Utility Expense" - Expense 1,500,000 112,954,000 2,256,000 2,000,000 12,014,000 191,174,000 280,000 624,000 9,110,000 1,424,000 1,000,000 1,500,000 1,000,000 6,400,000 1,400,000 115,472,000 1,236,000 2,000,000 3,994,000 185,804,000 376,000 606,000 6,614,000 1,376,000 980,000 0 1,050,000 5,380,000 Additional Information: The Company's policy on Income Tax Expense is to pay the full amount when due on April 15 of the following year. Since it was not been paid in the year incurred, it is classified on the Balance Sheet as Income Tax Payable. Round to the nearest dollar The year-end market price per share of common stock is $76 for the current year. *Depreciation on Equipment Rent Insurance, and Utility Expense are allocated 80% to Selling and 20% to General and Administrative. The company's policy is to use four classifications of expenses on the Income Statement Cost of Goods Sold, Selling, General and Administrative, and Income Tax. General and Administrative catch all costs that do not clearly fit in the other classifications Requirements: Create the Income Statement, Statement of Retained Earning and the Balance Sheet for the prior year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts