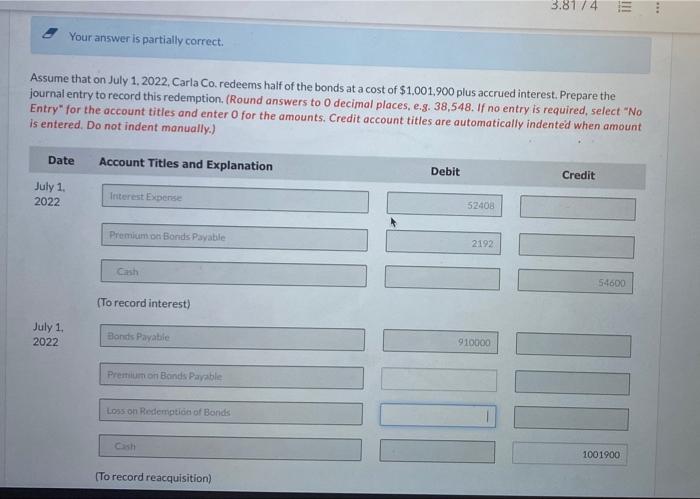

Question: please help with the last part and show calculations for the different parts of the journal entry for recording the reaquisition Carla Co. is building

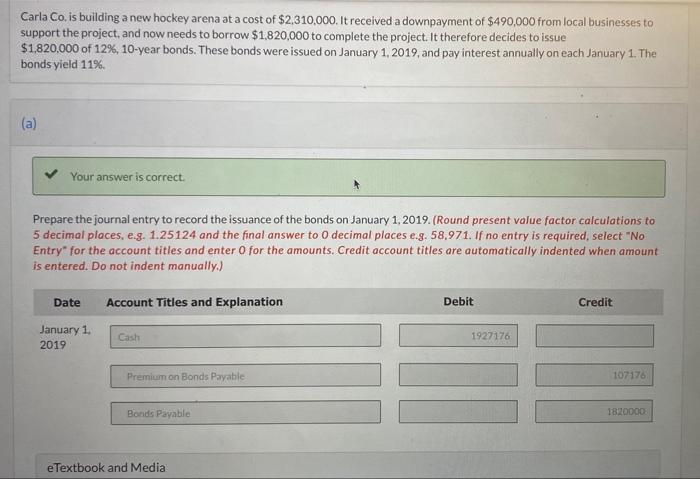

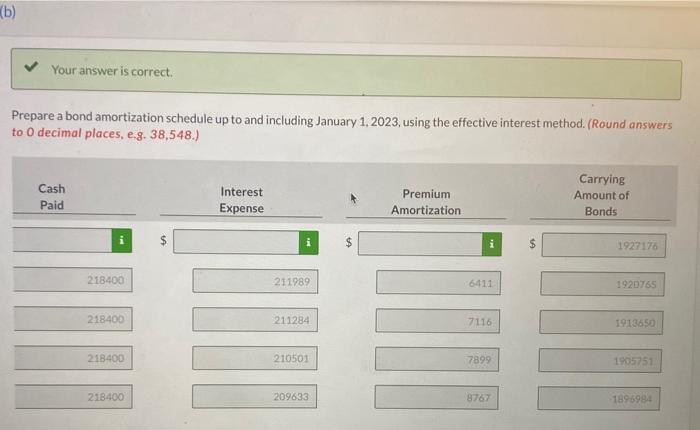

Carla Co. is building a new hockey arena at a cost of $2,310,000. It received a downpayment of $490,000 from local businesses to support the project, and now needs to borrow $1,820,000 to complete the project. It therefore decides to issue $1,820,000 of 12%,10-year bonds. These bonds were issued on January 1,2019 , and pay interest annually on each January 1 . The bonds yield 11%. (a) Prepare the journal entry to record the issuance of the bonds on January 1,2019. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places e.g. 58.971. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Your answer is correct. Prepare a bond amortization schedule up to and including January 1, 2023, using the effective interest method. (Round answers. to 0 decimal places, e.g. 38,548 .) Assume that on July 1, 2022, Carla Co. redeems half of the bonds at a cost of $1.001,900 plus accrued interest. Prepare the journal entry to record this redemption. (Round answers to 0 decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts