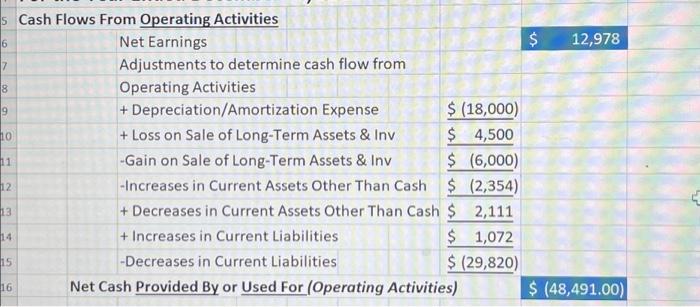

Question: please help with the last two blue boxes Cash Flows From Operating Activities Net Earnings $12,978 Adjustments to determine cash flow from Operating Activities +

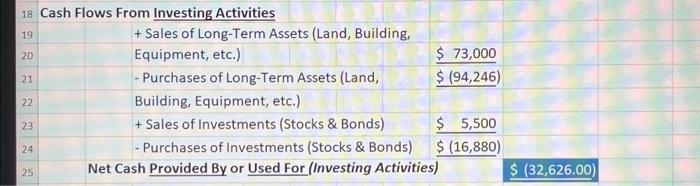

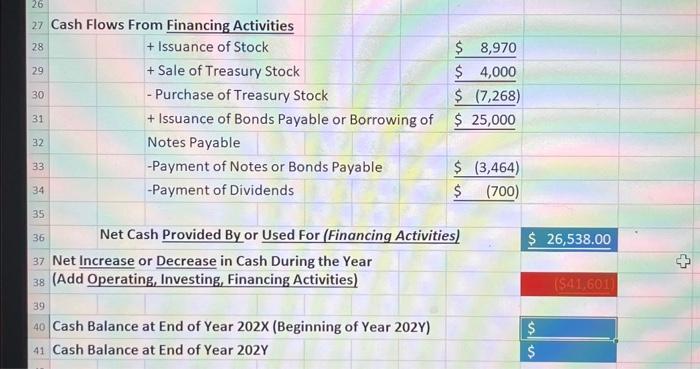

Cash Flows From Operating Activities Net Earnings $12,978 Adjustments to determine cash flow from Operating Activities + Depreciation/Amortization Expense + Loss on Sale of Long-Term Assets \& Inv -Gain on Sale of Long-Term Assets \& Inv -Increases in Current Assets Other Than Cash $(18,000) + Decreases in Current Assets Other Than Cash $4,500 + Increases in Current Liabilities -Decreases in Current Liabilities $(6,000) $(2,354) $2,111 $1,072 $(29,820) Net Cash Provided By or Used For (Operating Activities) (48,491.00) Net Cash Provided By or Used For (Financing Activities) $26,538.00 Net Increase or Decrease in Cash During the Year (Add Operating, Investing, Financing Activities) Cash Balance at End of Year 202X (Beginning of Year 202Y) 41 Cash Balance at End of Year 202Y Cash Flows From Operating Activities Net Earnings $12,978 Adjustments to determine cash flow from Operating Activities + Depreciation/Amortization Expense + Loss on Sale of Long-Term Assets \& Inv -Gain on Sale of Long-Term Assets \& Inv -Increases in Current Assets Other Than Cash $(18,000) + Decreases in Current Assets Other Than Cash $4,500 + Increases in Current Liabilities -Decreases in Current Liabilities $(6,000) $(2,354) $2,111 $1,072 $(29,820) Net Cash Provided By or Used For (Operating Activities) (48,491.00) Net Cash Provided By or Used For (Financing Activities) $26,538.00 Net Increase or Decrease in Cash During the Year (Add Operating, Investing, Financing Activities) Cash Balance at End of Year 202X (Beginning of Year 202Y) 41 Cash Balance at End of Year 202Y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts