Question: Please help with the ones that are all wrong! Data regarding Petrilla Corp. in March 20X9: Selected opening balances: GST payable CPP payable EI payable

Please help with the ones that are all wrong!

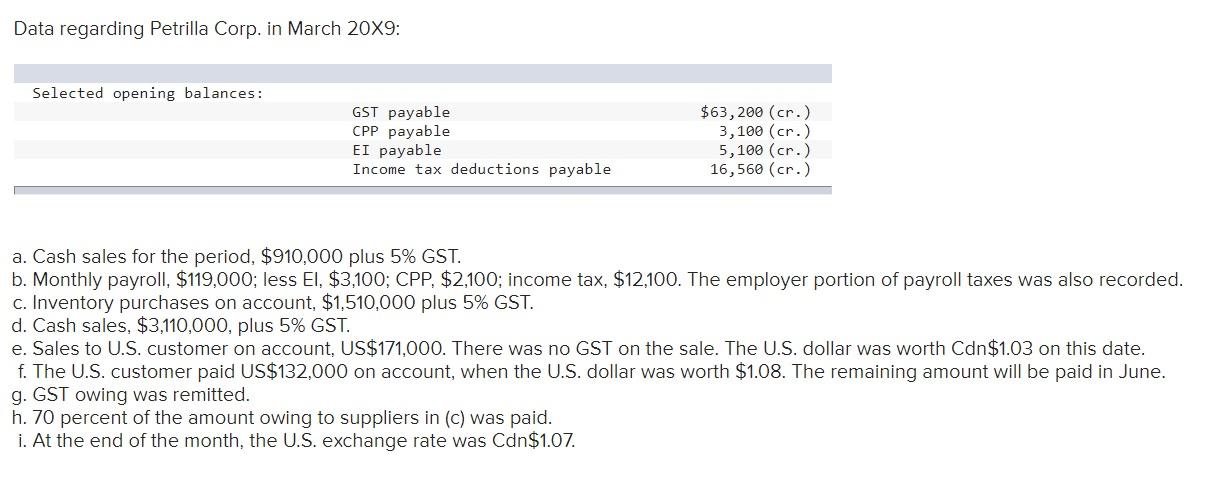

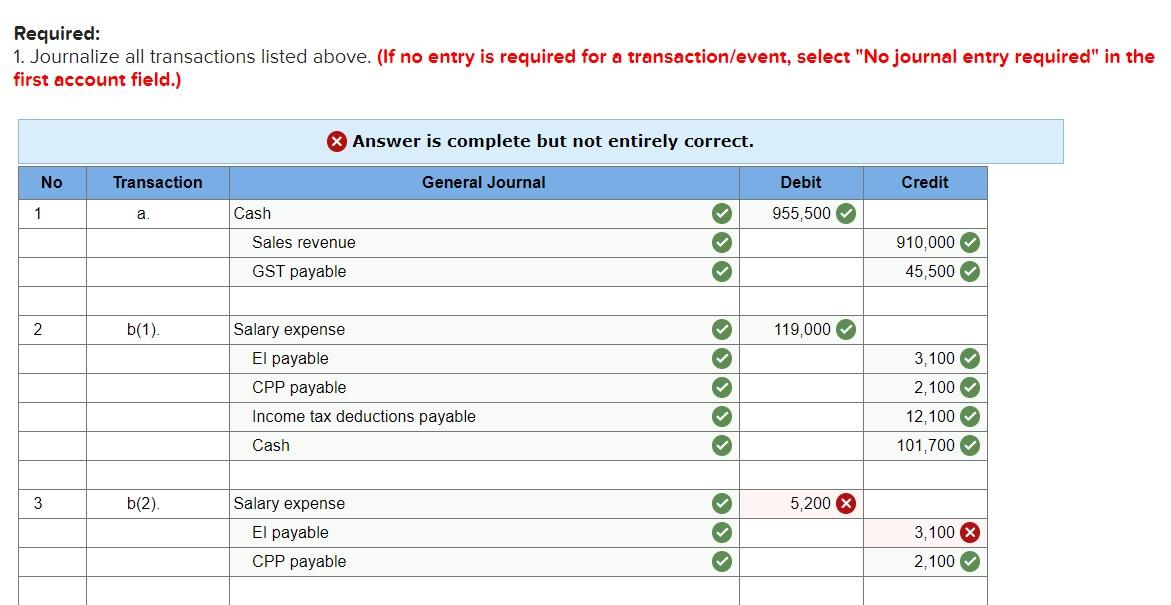

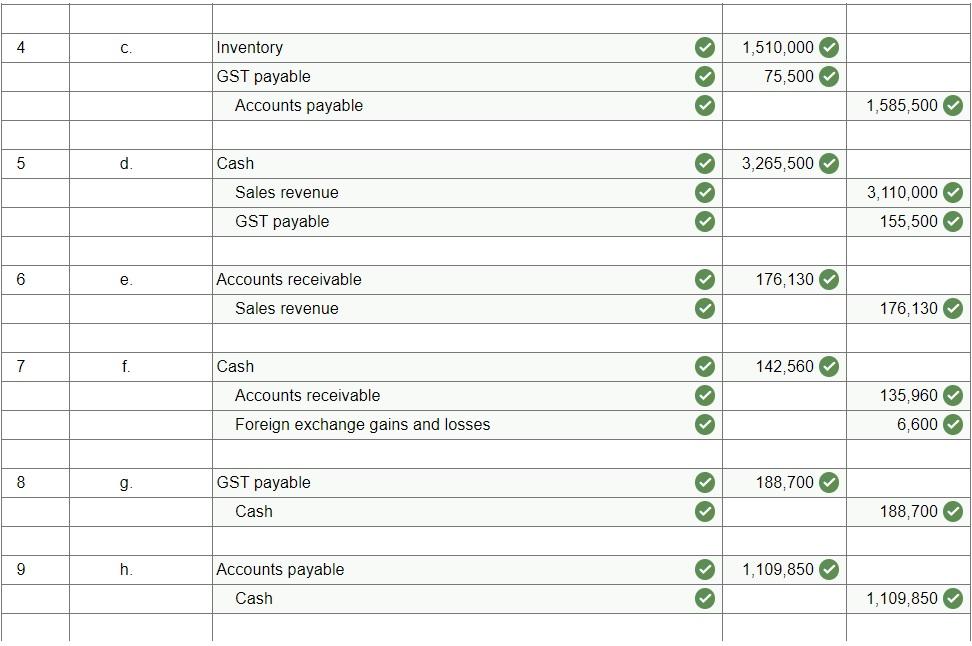

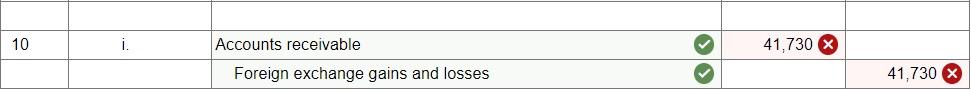

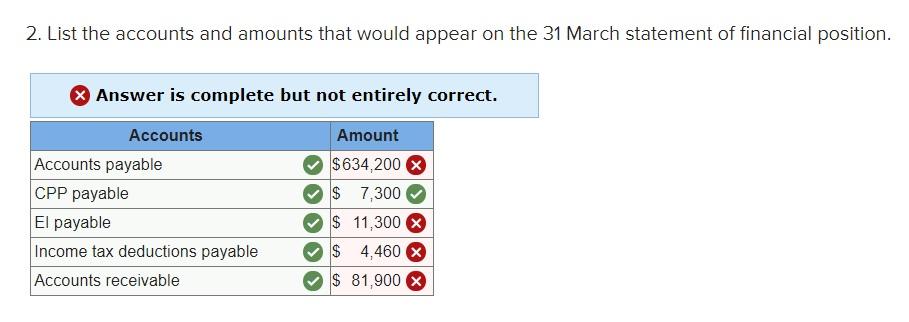

Data regarding Petrilla Corp. in March 20X9: Selected opening balances: GST payable CPP payable EI payable Income tax deductions payable $63,200 (cr.) 3,100 (cr.) 5,100 (cr.) 16,560 (cr.) a. Cash sales for the period, $910,000 plus 5% GST. b. Monthly payroll, $119,000; less El, $3,100; CPP, $2,100; income tax, $12,100. The employer portion of payroll taxes was also recorded. C. Inventory purchases on account, $1,510,000 plus 5% GST. d. Cash sales, $3,110,000, plus 5% GST. e. Sales to U.S. customer on account, US$171,000. There was no GST on the sale. The U.S. dollar was worth Cdn$1.03 on this date. f. The U.S. customer paid US$132,000 on account, when the U.S. dollar was worth $1.08. The remaining amount will be paid in June. g. GST owing was remitted. h. 70 percent of the amount owing to suppliers in (C) was paid. i. At the end of the month, the U.S. exchange rate was Cdn$1.07. Required: 1. Journalize all transactions listed above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is complete but not entirely correct. No Transaction General Journal Debit Credit 1 a Cash 955,500 Sales revenue GST payable 910,000 45,500 2. b(1). 119,000 3,100 Salary expense El payable CPP payable Income tax deductions payable Cash OOOOO 2,100 12,100 101,700 b(2). Salary expense 5,200 X x El payable CPP payable 3,100 2,100 4 C. 1,510,000 Inventory GST payable Accounts payable 75,500 1,585,500 5 d. 3,265,500 Cash Sales revenue GST payable OOO 3,110,000 155,500 6 e Accounts receivable 176,130 Sales revenue 176,130 7 f. Cash 142,560 Accounts receivable 135,960 6,600 Foreign exchange gains and losses 8 g GST payable 188,700 Cash 188,700 9 h 1,109,850 Accounts payable Cash O 1,109,850 10 i. Accounts receivable 41,730 X 00 Foreign exchange gains and losses 41,730 2. List the accounts and amounts that would appear on the 31 March statement of financial position. Answer is complete but not entirely correct. Accounts Accounts payable CPP payable El payable Income tax deductions payable Accounts receivable Amount $634,200 $ $ 7,300 $ 11,300 X $ 4,460 X $ 81,900 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts