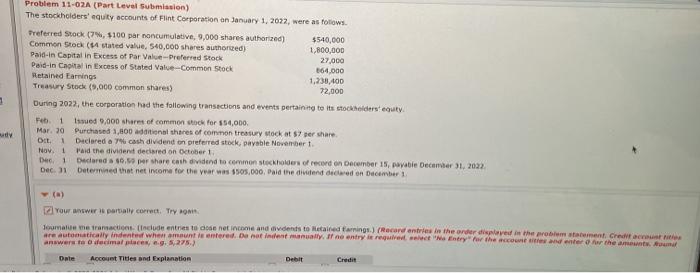

Question: please help with the ones that are wrong Date Account Titles and Explanation Debit Credit Feb. 1 Cash 54000 Common Stock 36000 Paid-in Capital in

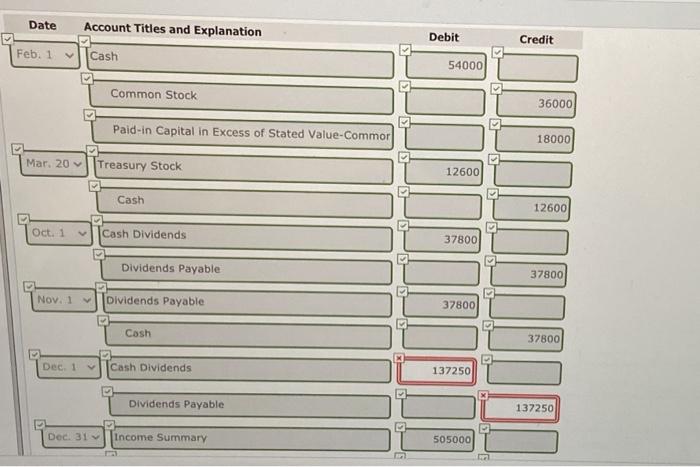

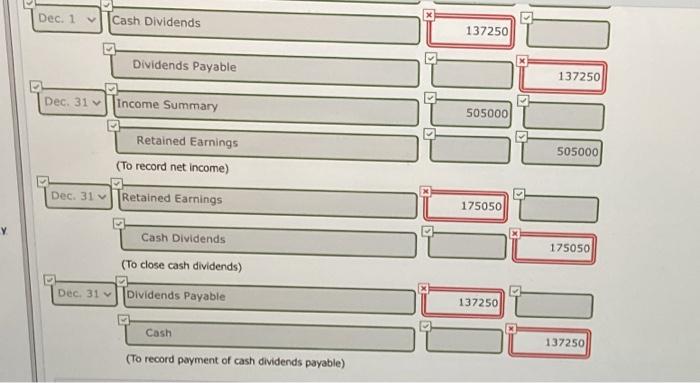

Date Account Titles and Explanation Debit Credit Feb. 1 Cash 54000 Common Stock 36000 Paid-in Capital in Excess of Stated Value-Commor 18000 Mar. 20 Treasury Stock 12600 Cash 12600 Oct. 1 Cash Dividends 37800 Dividends Payable 37800 Nov. 1 V Dividends Payable 37800 Cash 37800 Dec. 1 Cash Dividends 137250 Dividends Payable 137250 Dec. 31 Income Summary 505000 Dec. 1 Cash Dividends 137250 Dividends Payable 137250 Dec. 31 Income Summary 505000 Retained Earnings (To record net income) 505000 Dec. 31 Retained Earnings 175050 Cash Dividends 175050 (To close cash dividends) Dec. 31 Dividends Payable 137250 Cash 137250 (To record payment of cash dividends payable) Date Account Titles and Explanation Debit Credit Feb. 1 Cash 54000 Common Stock 36000 Paid-in Capital in Excess of Stated Value-Commor 18000 Mar. 20 Treasury Stock 12600 Cash 12600 Oct. 1 Cash Dividends 37800 Dividends Payable 37800 Nov. 1 V Dividends Payable 37800 Cash 37800 Dec. 1 Cash Dividends 137250 Dividends Payable 137250 Dec. 31 Income Summary 505000 Dec. 1 Cash Dividends 137250 Dividends Payable 137250 Dec. 31 Income Summary 505000 Retained Earnings (To record net income) 505000 Dec. 31 Retained Earnings 175050 Cash Dividends 175050 (To close cash dividends) Dec. 31 Dividends Payable 137250 Cash 137250 (To record payment of cash dividends payable)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts