Question: please help with the question A and B a. Calculate Eatervan's value added (EVA) b . What is the company's return on capital? ( Use

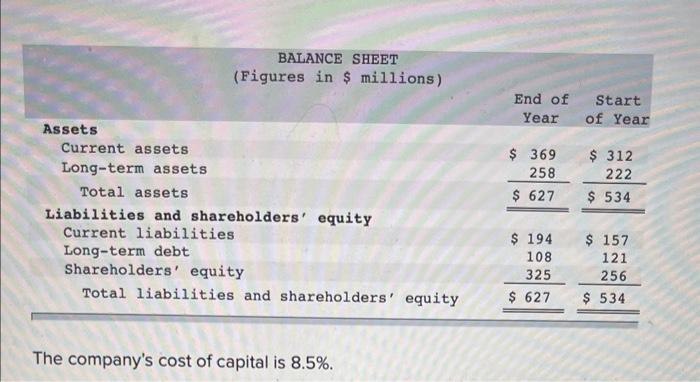

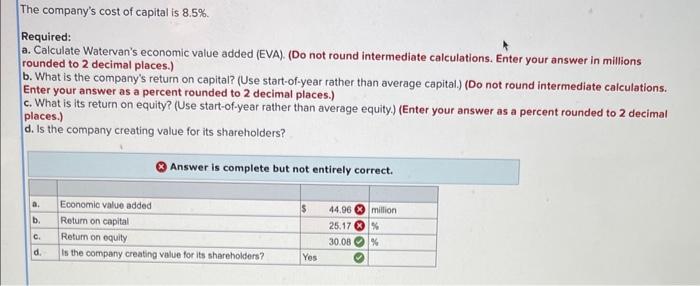

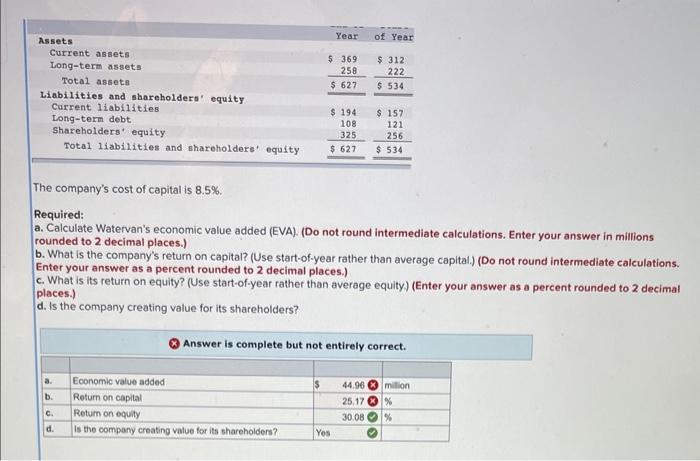

The company's cost of capital is 8.5%. The company's cost of capital is 8.5%. Required: a. Calculate Watervan's economic value added (EVA). (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) b. What is the company's retum on capital? (Use start-of-year rather than average capital.) (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. What is its return on equity? (Use start-of-year rather than average equity.) (Enter your answer as a percent rounded to 2 decimal places.) d. Is the company creating value for its shareholders? The company's cost of capital is 8.5%. Required: a. Calculate Watervan's economic value added (EVA). (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) b. What is the company's return on capital? (Use start-of-year rather than average capital.) (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. What is its return on equity? (Use start-of-year rather than average equity.) (Enter your answer as a percent rounded to 2 decimal places.) d. Is the company creating value for its shareholders? The company's cost of capital is 8.5%. The company's cost of capital is 8.5%. Required: a. Calculate Watervan's economic value added (EVA). (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) b. What is the company's retum on capital? (Use start-of-year rather than average capital.) (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. What is its return on equity? (Use start-of-year rather than average equity.) (Enter your answer as a percent rounded to 2 decimal places.) d. Is the company creating value for its shareholders? The company's cost of capital is 8.5%. Required: a. Calculate Watervan's economic value added (EVA). (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) b. What is the company's return on capital? (Use start-of-year rather than average capital.) (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. What is its return on equity? (Use start-of-year rather than average equity.) (Enter your answer as a percent rounded to 2 decimal places.) d. Is the company creating value for its shareholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts