Question: Please help with the question, no caculation process is needed, just help give the outcome is ok. Question 10 Not yet answered Marked out of

Please help with the question, no caculation process is needed, just help give the outcome is ok.

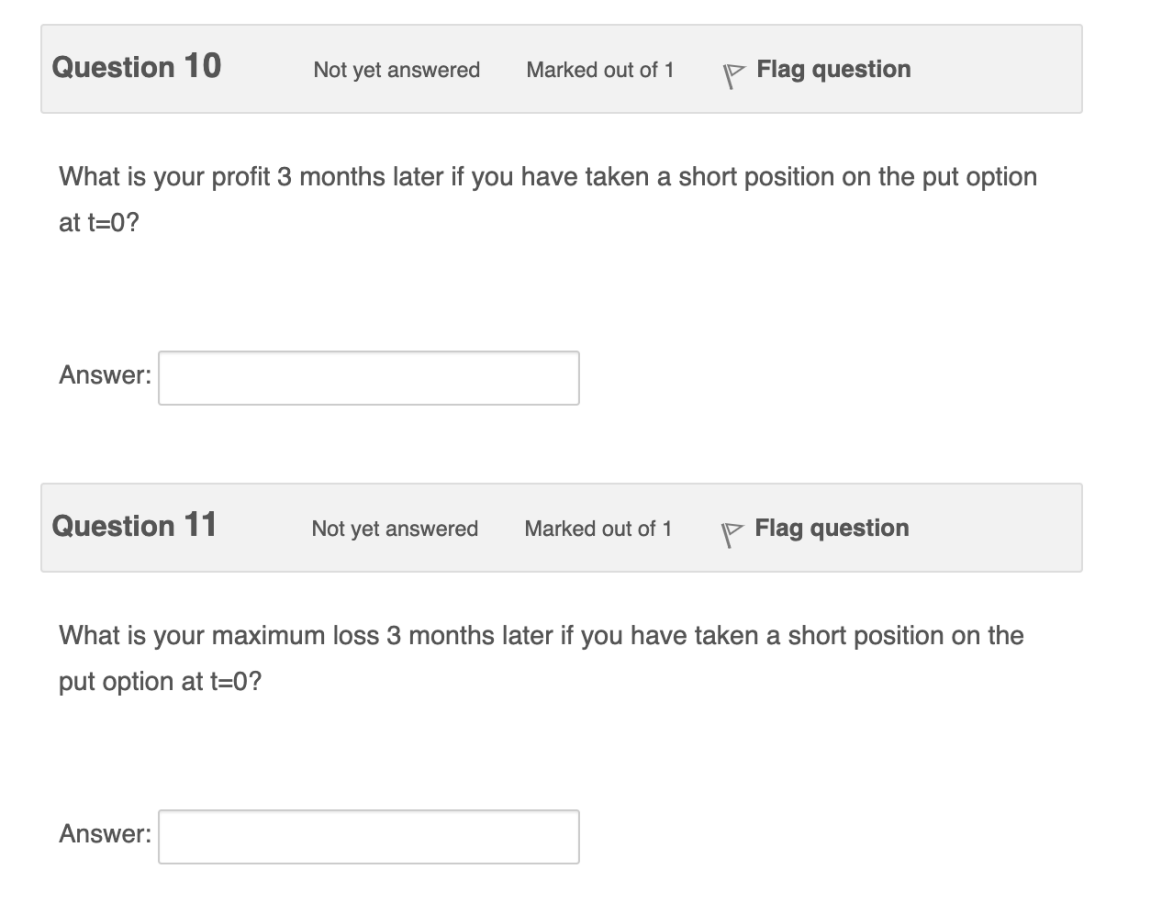

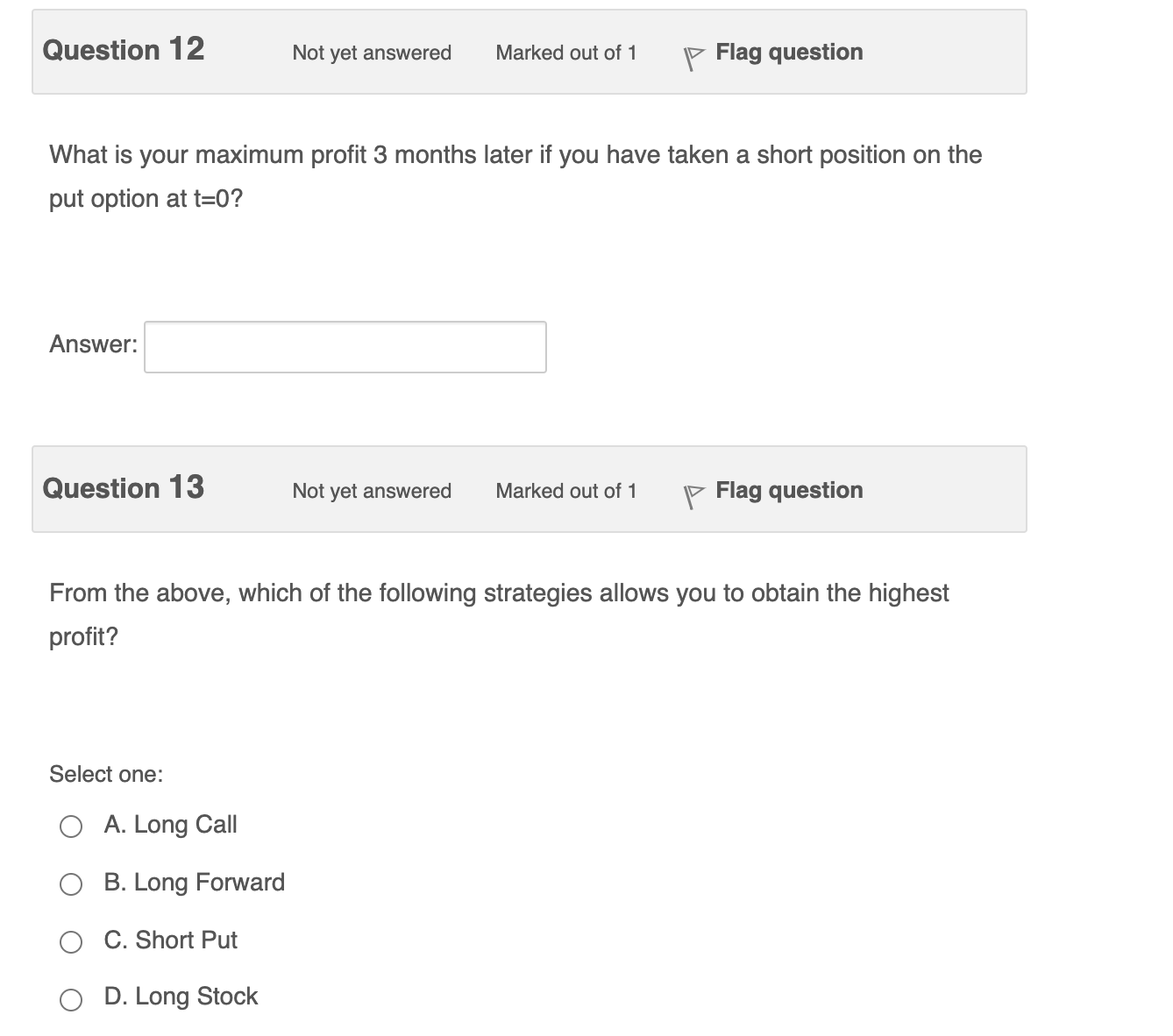

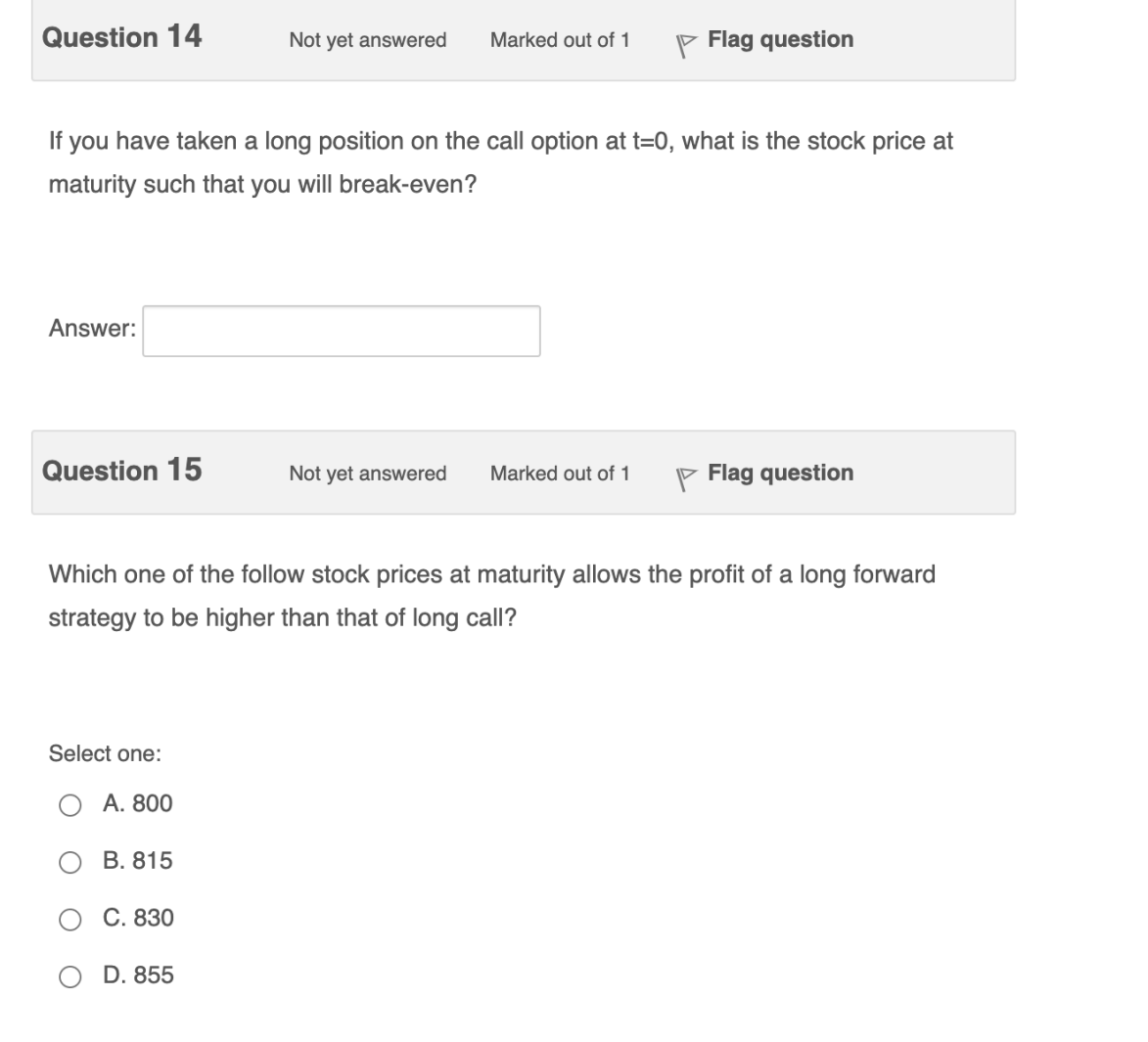

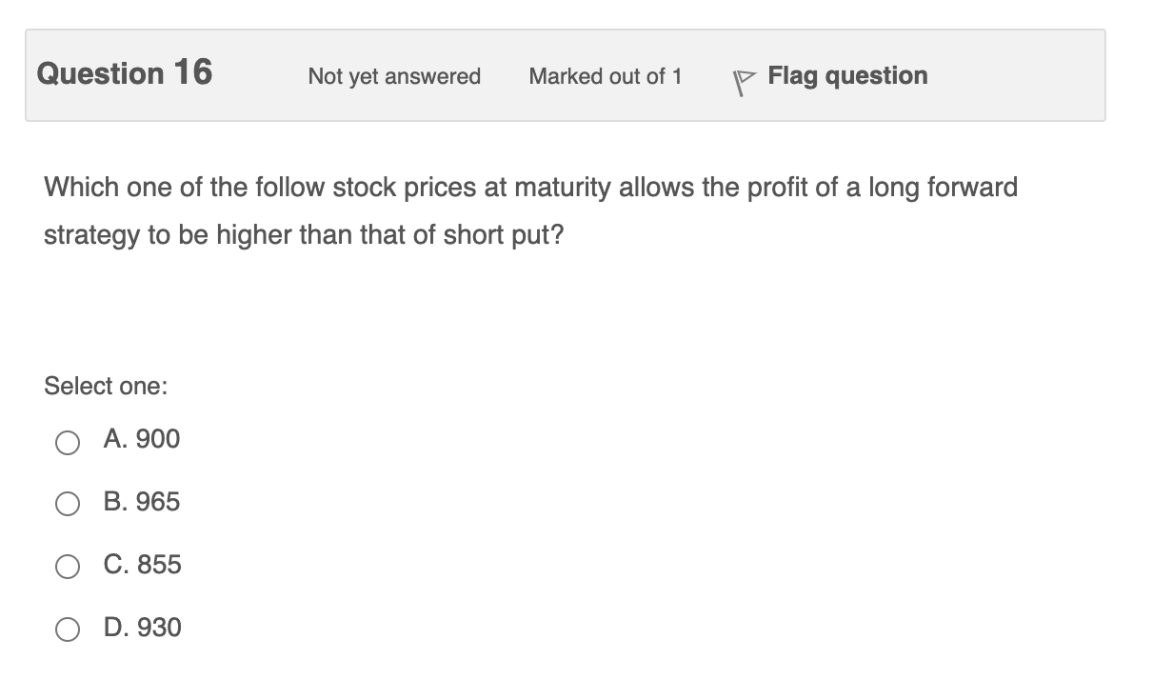

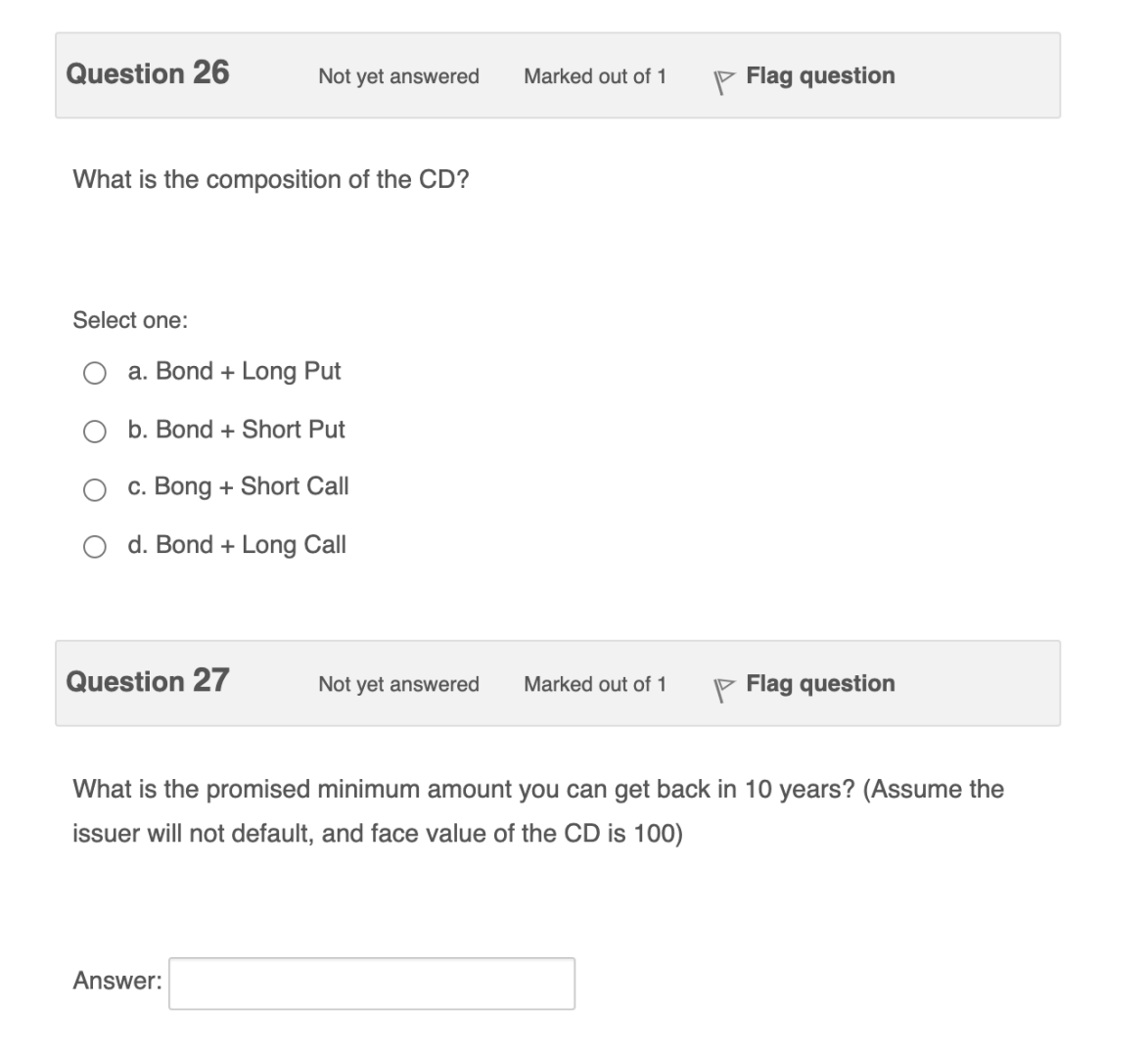

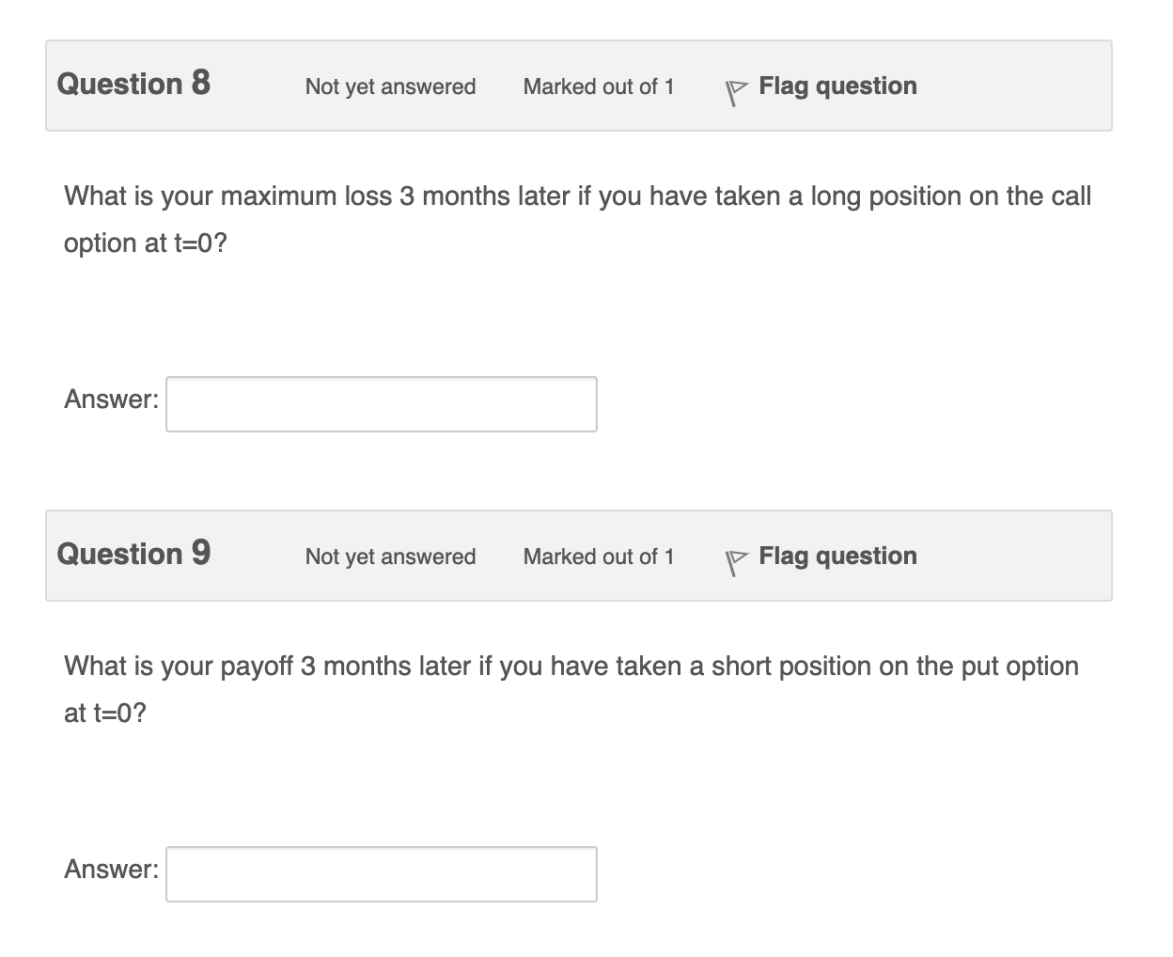

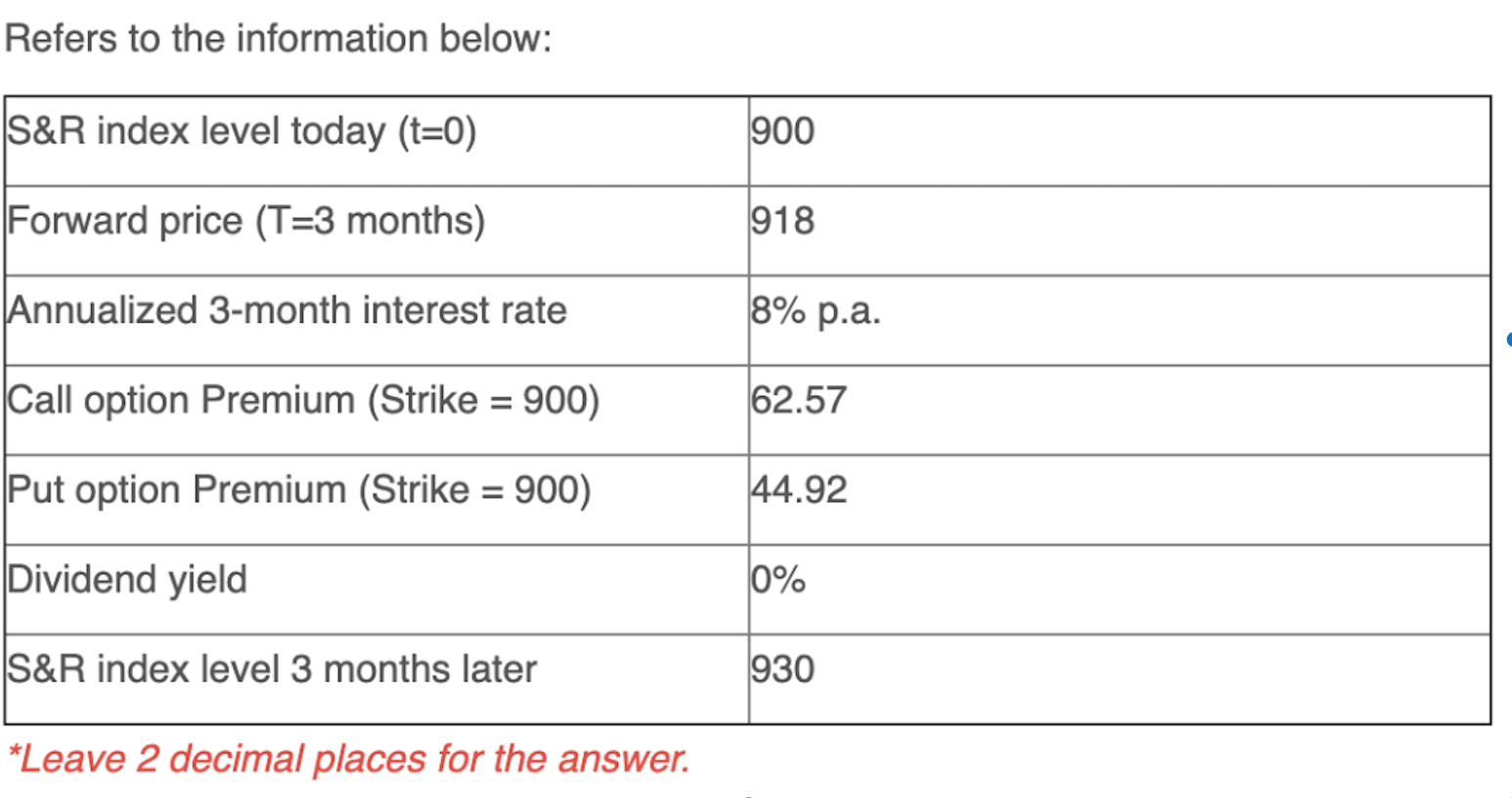

Question 10 Not yet answered Marked out of 1 {7 Flag question What is your profit 3 months later if you have taken a short position on the put option at t=0? Answer: Question 1 1 Not yet answered Marked out of 1 V Flag question What is your maximum loss 3 months later if you have taken a short position on the put option at t=0? Answer: Question 1 2 Not yet answered Marked out of 1 \\V Flag question What is your maximum profit 3 months later if you have taken a short position on the put option at t=0? Answer: Question 13 Not yet answered Marked out of 1 \\V Flag question From the above, which of the following strategies allows you to obtain the highest profit? Select one: Q A. Long Call 0 B. Long FonNard O C. Short Put 0 D. Long Stock Question 14 Not yet answered Marked out of 1 V Flag question If you have taken along position on the call option at t=0. what is the stock price at maturity such that you will break-even? Answer: Question 15 Not yet answered Marked out of 1 f7 Flag question Which one of the follow stock prices at maturity allows the profit of a long forward strategy to be higher than that of long call? Select one: o A. 300 o B. 815 o 0.830 O D. 855 Question 16 Not yet answered Marked out of 1 V Flag questlon Which one of the follow stock prices at maturity allows the profit of a long forward strategy to be higher than that of short put? Select one: 0 A. 900 o 3.965 O c. 855 O D. 930 Question 26 Not yet answered Marked out of1 V Flag question What is the composition of the CD? Select one: Q a. Bond + Long Put 0 b. Bond + Short Put 0 c. Bong + Short Call 0 d. Bond + Long Call Question 27 Not yet answered Marked out of 1 V Flag questlon What is the promised minimum amount you can get back in 10 years? (Assume the issuer will not default, and face value of the CD is 100) Answer: Question 8 Not yet answered Marked out of 1 V Flag question What is your maximum loss 3 months later if you have taken along position on the call option at t=0? Answer: Question 9 Not yet answered Marked out of 1 '5' Flag question What is your payoff 3 months later if you have taken a short position on the put option at t=0? Answer: Refers to the information below: &R index level today (t=0) Forward price (T=3 months) 'nnualized 3-month interest rate all option Premium (Strike = 900) Put option Premium (Strike = 900) Dividend yield &R index level 3 months later *Leave 2 decimal places for the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts