Question: Please help with the questions from the image below. 4. A mutual manager is managing the account of a large investor. The investor holds the

Please help with the questions from the image below.

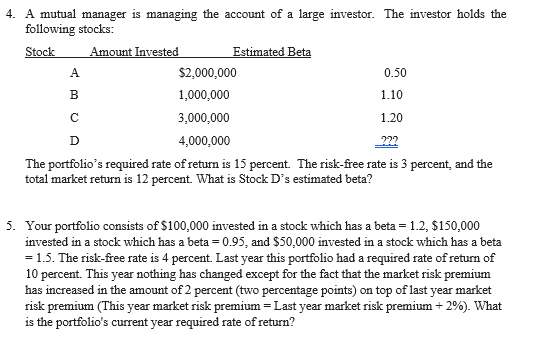

4. A mutual manager is managing the account of a large investor. The investor holds the following stocks: Stock Amount Invested Estimated Beta A $2,000,000 0.50 B 1,000,000 1.10 C 3,000,000 1.20 D 4,000,000 The portfolio's required rate of return is 15 percent. The risk-free rate is 3 percent, and the total market return is 12 percent What is Stock D's estimated beta? 5. Your portfolio consists of $100,000 invested in a stock which has a beta = 1.2, $150,000 invested in a stock which has a beta = 0.95, and $50,000 invested in a stock which has a beta = 1.5. The risk-free rate is 4 percent. Last year this portfolio had a required rate of return of 10 percent. This year nothing has changed except for the fact that the market risk premium has increased in the amount of 2 percent (two percentage points) on top of last year market risk premium (This year market risk premium = Last year market risk premium + 2%). What is the portfolio's current year required rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts