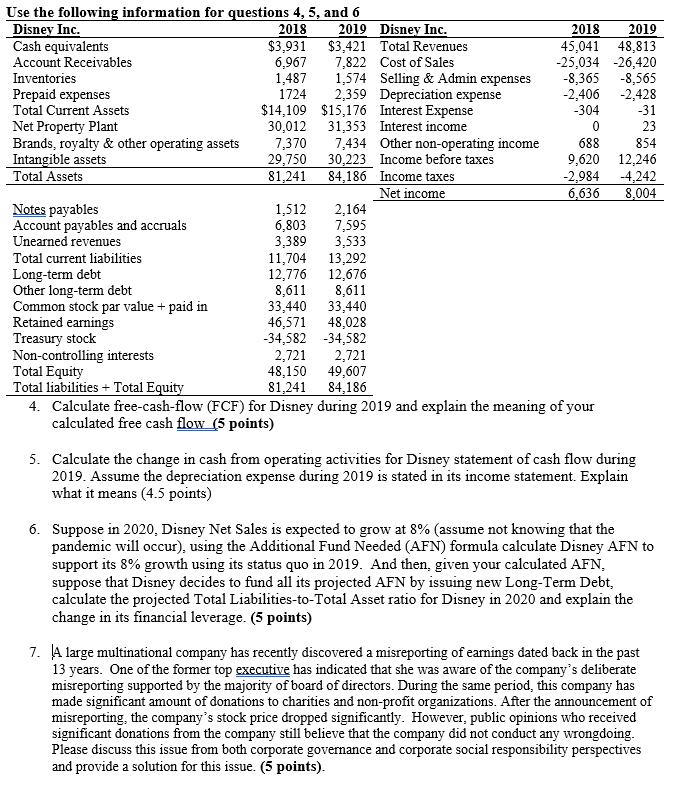

Question: Please help with the questions from the image below. Use the following information for Questions 4, 5, and 6 Disnev Inc. 2013 2019 Disnev Inc.

Please help with the questions from the image below.

Use the following information for Questions 4, 5, and 6 Disnev Inc. 2013 2019 Disnev Inc. 1013 1019 Cash Equivalents $3,931 $3,421 Total Revenues 45,041 43,313 Account Receivables 6,962 2,322 Cost of Sales 25,034 2 6,420 Inventories 1,432 1,524 Selling :3: Admin expenses 3,365 3,565 Prepaid Expenses 1224 2,359 Depreciation expense 2,406 2,423 Total Current Assets $14,109 $15,126 Interest Expense 304 31 Net Property Plant 30,012 31,353 Interest income 0 23 Brands, royalty 3:. other operating assets 2,320 2,434 Other non-operating income 633 354 Intang'ble assets 29,250 30,223 Iueome before taxes 9,620 12,246 Total Assets 31,241 34,136 Iueome taxes 2,934 4,242 Net ineome 6 636 3 004 Notespayables 1,512 2,164 Account payable; and accruals 6,303 2,595 Unearned revere-res 3,339 3,533 Total current liabilities 11,204 13,292 Longterm debt 12,226 12,626 Other longterm debt 3,611 3,611 Common stock par value + paid in 33,440 33,440 Retained earnings 46,521 43,023 Treasury stock 34,532 34,532 Noncontrolling interests 2,221 2,221 Total Equity 43,150 49,602 Total liabilities + Total Eguig 31,241 34,136 4- Calculate eecashow {FCFJ for Disney during 2019 and explain the meaning of your calculated ee cash M points} 5- Calculate the change in cash from operating activities for Disney statement of cash ow during 2019- Assume the depreciation expense during 2019 is stated in its income statement. Explain what it means {4.5 points} 6- Suppose in 2020, Disney Net Sales is expected to grow at 3% I[assume not knowing that the pandemic will occur), using the Additional Fund Needed {AFN} formula calculate Disney AFN to support its 3% growth using its status quo in 2019. And then, given your calculated AFN, suppose that Disney decides to ind all its projected AFN by issuing new LongTerm Debt, calculate the projected Total LiabilitiestoTotal Asset ratio for Disney in 2020 and explain the change in its nancial leverage. (5 points} 2- lA large multinational company has recently discovered a misreporting of earnings dated back in the past 13 years. One of the former top minister has indicated that she was aware of the company's deliberate misreporting supported by the majority of board of directors. During the same period, this company has made signicant amount of donations to charities and nonprot organizations. After the announcement of misreporting, the company's stock price dropped signicantly. However, public opinions who received signicant donations om the company still believe that the company did not conduct any wrongdoing. Please discuss this issue om both corporate governance and corporate social responsibility perspectives and provide a solution for this issue. {5 points]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts