Question: Please help with the red boxes and show all calculations. Thanks in advance! Exercise 12-6 Agentel Corporation is a U.S.-based importing-exporting company. The company entered

Please help with the red boxes and show all calculations. Thanks in advance!

Please help with the red boxes and show all calculations. Thanks in advance!

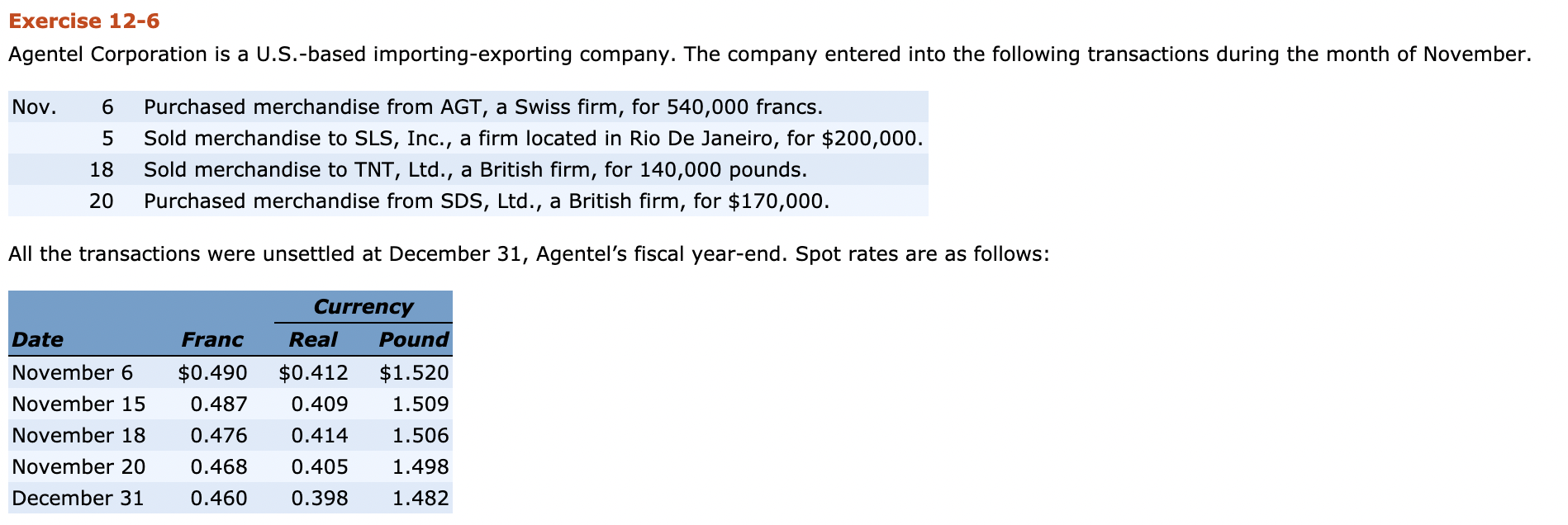

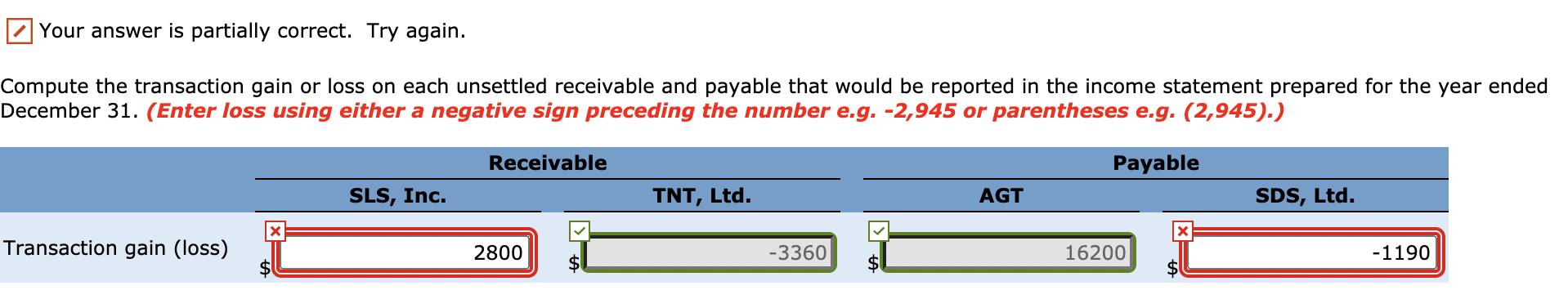

Exercise 12-6 Agentel Corporation is a U.S.-based importing-exporting company. The company entered into the following transactions during the month of November. Nov. 6 5 Purchased merchandise from AGT, a Swiss firm, for 540,000 francs. Sold merchandise to SLS, Inc., a firm located in Rio De Janeiro, for $200,000. Sold merchandise to TNT, Ltd., a British firm, for 140,000 pounds. Purchased merchandise from SDS, Ltd., a British firm, for $170,000. 18 20 All the transactions were unsettled at December 31, Agentel's fiscal year-end. Spot rates are as follows: Date November 6 November 15 November 18 November 20 December 31 Franc $0.490 0.487 0.476 0.468 Currency Real Pound $0.412 $1.520 0.409 1.509 0.414 1.506 0.405 1.498 0.398 1.482 0.460 Your answer is partially correct. Try again. Compute the transaction gain or loss on each unsettled receivable and payable that would be reported in the income statement prepared for the year ended December 31. (Enter loss using either a negative sign preceding the number e.g. -2,945 or parentheses e.g. (2,945).) Receivable Payable SLS, Inc. TNT, Ltd. AGT SDS, Ltd. x X Transaction gain (loss) 2800 -3360 16200 -1190

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts