Question: Please help with the Retained Earning Statement 1. Services performed but unbilled and uncollected at March 31 was $210. 2. Depreciation on equipment for the

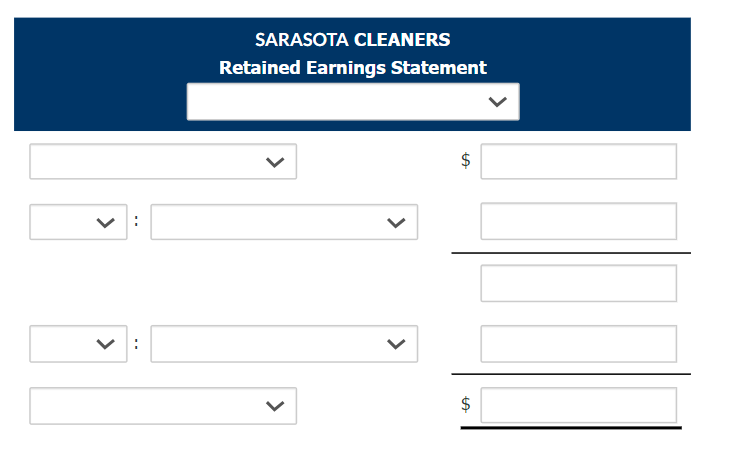

Please help with the Retained Earning Statement

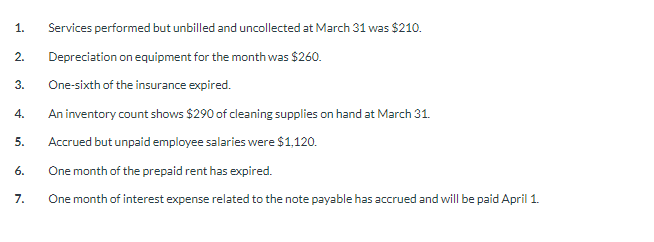

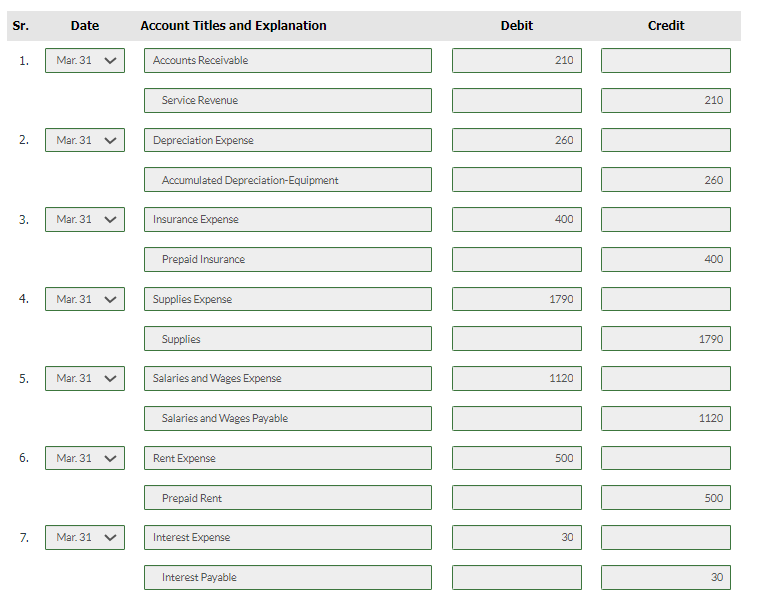

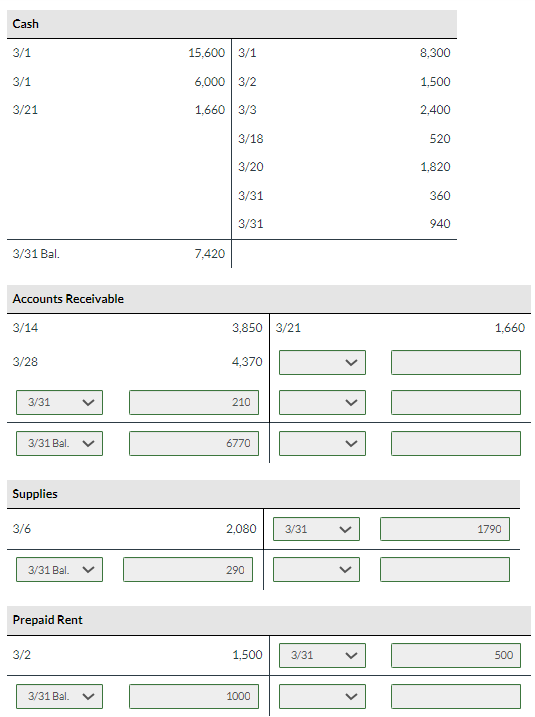

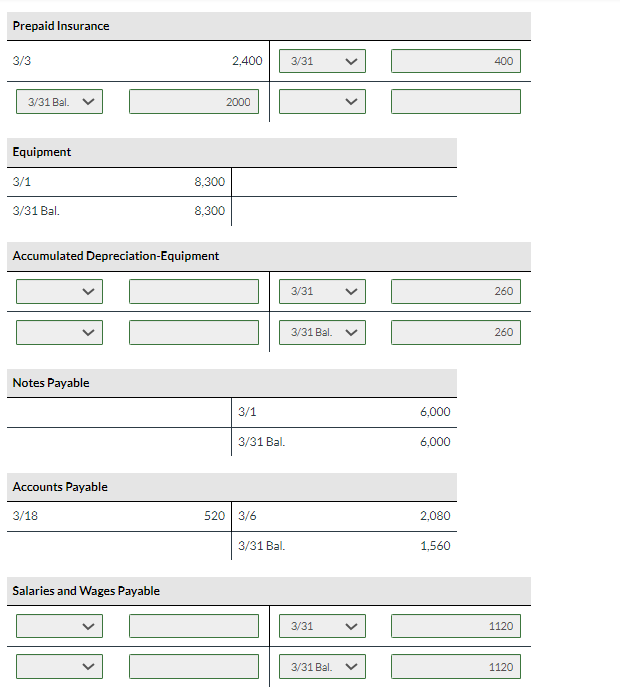

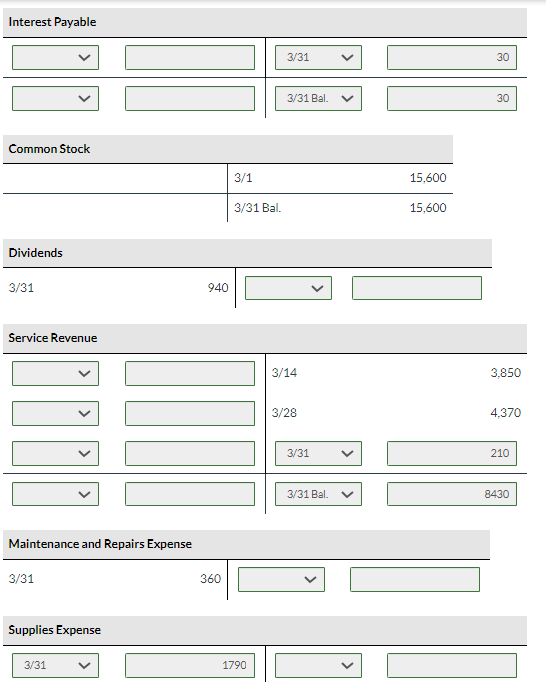

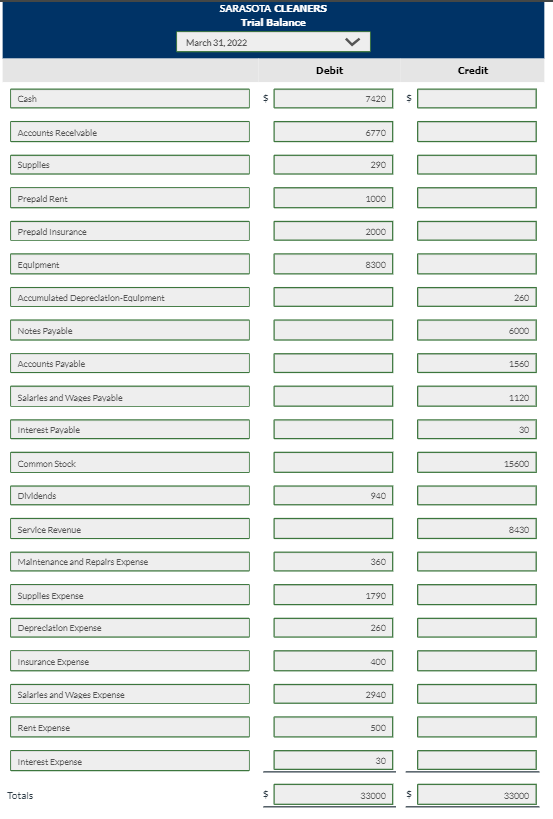

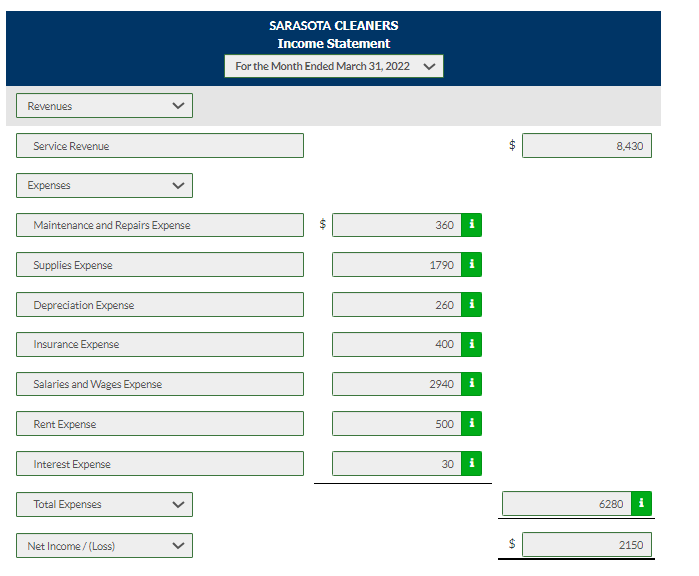

1. Services performed but unbilled and uncollected at March 31 was $210. 2. Depreciation on equipment for the month was $260. 3. One-sixth of the insurance expired. 4. An inventory count shows $290 of cleaning supplies on hand at March 31 . 5. Accrued but unpaid employee salaries were $1,120. 6. One month of the prepaid rent has expired. 7. One month of interest expense related to the note payable has accrued and will be paid April 1 . Sr. Date Account Titles and Explanation Debit Credit 1. Mar. 31 Accounts Receivable Service Revenue 2. Mar. 31 Mar. 31 3. 4. Mar. 31 5. Mar. 31 Mar. 31 6. Mar. 31 Rent Expense Prepaid Rent 7. Mar. 31 Accumulated Depreciation-Equipment Insurance Expense Prepaid Insurance Supplies Expense Supplies Salaries and Wages Expense Salaries and Wages Payable 1790 1790 1120 1120 500 500 30 \begin{tabular}{r} \hline \\ \hline \\ \hline \\ 30 \end{tabular} Interest Payable \begin{tabular}{lr|ll} Cash \\ \hline 3/1 & 15,600 & 3/1 & 8,300 \\ 3/1 & 6,000 & 3/2 & 1,500 \\ 3/21 & 1,660 & 3/3 & 2,400 \\ & & 3/18 & 520 \\ & & 3/20 & 1,820 \\ & & 3/31 & 360 \\ & & 3/31 & 940 \\ \hline 3/31 Bal. & 7,420 & & \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Accounts Receivable } \\ \hline 3/14 & 3,850 & 3/21 & 1,660 \\ \hline 3/28 & 4,370 & & \\ \hline 3/31 & 210 & & \\ \hline 3/31 Bal. & 6770 & & \\ \hline \multicolumn{4}{|l|}{ Supplies } \\ \hline 3/6 & 2,080 & 3/31 & 1790 \\ \hline 3/31 Bal. & 290 & & \\ \hline \multicolumn{4}{|l|}{ Prepaid Rent } \\ \hline 3/2 & 1,500 & 3/31 & 500 \\ \hline 3/31 Bal. & 1000 & & \\ \hline \end{tabular} Prepaid Insurance \begin{tabular}{|c|c|c|c|} \hline 3/3 & 2,400 & 3/31 & 400 \\ \hline 3/31 Bal. & 2000 & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Equipment } \\ \hline 3/1 & 8,300 & \\ \hline 3/31 Bal. & 8,300 & \\ \hline \end{tabular} Accumulated Depreciation-Equipment \begin{tabular}{|c|c|c|} \hline & 3/31 & 260 \\ \hline & 3/31 Bal. & 260 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{5}{|l|}{ Notes Payable } & \\ \hline & & \multicolumn{2}{|c|}{3/1} & 6,000 & \\ \hline & & \multicolumn{2}{|c|}{ 3/31 Bal. } & 6,000 & \\ \hline \multicolumn{5}{|l|}{ Accounts Payable } & \\ \hline \multirow[t]{2}{*}{ 3/18 } & 520 & \multicolumn{2}{|c|}{3/6} & 2,080 & \\ \hline & & \multicolumn{2}{|c|}{ 3/31 Bal. } & 1,560 & \\ \hline \multicolumn{6}{|c|}{ Salaries and Wages Payable } \\ \hline & & & 3/31 & & 1120 \\ \hline & & & 3/31 Bal. & & 1120 \\ \hline \end{tabular} Interest Payable \begin{tabular}{l|ll} \hline Common Stock \\ \hline & 3/1 & 15,600 \\ \hline & 3/31Bal. & 15,600 \end{tabular} Dividends \begin{tabular}{|c|c|c|} \hline 3/31 & 940 & \\ \hline \end{tabular} Service Revenue \begin{tabular}{|c|c|c|} \hline & 3/14 & 3,850 \\ \hline & 3/28 & 4,370 \\ \hline & 3/31 & 210 \\ \hline & 3/31 Bal. & 8430 \\ \hline \end{tabular} Maintenance and Repairs Expense SARASOTA CIEANERS Trial Balance March 31, 2022 Debit Cash Accounts Recelvable Supplies Prepald Rent Prepald Insurance Equlpment Accumulated Depreclation-Equlpment Notes Pryable Accounts Payable Salarles and Wares Payable Interest Payable Common Stock Divldends Service Revenue Malntenance and Repalrs Expense Supplies Expense Depreclation Expense Insurance Expense Salarles and Wakes Expense Rent Expense Interest Expense Totals $ 7420 5 \begin{tabular}{|r|} \hline \\ \hline \\ \hline 2970 \\ \hline \\ \hline 1000 \\ \hline 2000 \\ \hline 8300 \\ \hline \end{tabular} \begin{tabular}{r} 260 \\ \hline 6000 \\ \hline \end{tabular} 1560 1120 \begin{tabular}{r} 30 \\ \hline 15600 \\ \hline \end{tabular} 940 8430 360 \begin{tabular}{r} \hline 1790 \\ \hline 260 \\ \hline \end{tabular} \begin{tabular}{|r|} \hline 400 \\ \hline 2940 \\ \hline \end{tabular} SARASOTA CLEANERS Income Statement For the Month Ended March 31, 2022 Revenues Service Revenue $8,430 Expenses Maintenance and Repairs Expense $ 360 i Supplies Expense \begin{tabular}{|l|l|} \hline 1790 & i \\ \hline \end{tabular} Depreciation Expense \begin{tabular}{|l|l|} \hline 260 & i \\ \hline \end{tabular} Insurance Expense \begin{tabular}{|l|l|} \hline 400 & i \\ \hline \end{tabular} Salaries and Wages Expense \begin{tabular}{|l|l|} \hline 2940 & i \\ \hline \end{tabular} Rent Expense \begin{tabular}{|l|l|} \hline 500 & i \\ \hline \end{tabular} Interest Expense \begin{tabular}{|r|r|} \hline 30 & i \\ \hline \end{tabular} Total Expenses \begin{tabular}{|c|c|} \hline & 6280 \\ \hline$ & 2150 \\ \hline \end{tabular} SARASOTA CLEANERS Retained Earnings Statement $ $ 1. Services performed but unbilled and uncollected at March 31 was $210. 2. Depreciation on equipment for the month was $260. 3. One-sixth of the insurance expired. 4. An inventory count shows $290 of cleaning supplies on hand at March 31 . 5. Accrued but unpaid employee salaries were $1,120. 6. One month of the prepaid rent has expired. 7. One month of interest expense related to the note payable has accrued and will be paid April 1 . Sr. Date Account Titles and Explanation Debit Credit 1. Mar. 31 Accounts Receivable Service Revenue 2. Mar. 31 Mar. 31 3. 4. Mar. 31 5. Mar. 31 Mar. 31 6. Mar. 31 Rent Expense Prepaid Rent 7. Mar. 31 Accumulated Depreciation-Equipment Insurance Expense Prepaid Insurance Supplies Expense Supplies Salaries and Wages Expense Salaries and Wages Payable 1790 1790 1120 1120 500 500 30 \begin{tabular}{r} \hline \\ \hline \\ \hline \\ 30 \end{tabular} Interest Payable \begin{tabular}{lr|ll} Cash \\ \hline 3/1 & 15,600 & 3/1 & 8,300 \\ 3/1 & 6,000 & 3/2 & 1,500 \\ 3/21 & 1,660 & 3/3 & 2,400 \\ & & 3/18 & 520 \\ & & 3/20 & 1,820 \\ & & 3/31 & 360 \\ & & 3/31 & 940 \\ \hline 3/31 Bal. & 7,420 & & \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Accounts Receivable } \\ \hline 3/14 & 3,850 & 3/21 & 1,660 \\ \hline 3/28 & 4,370 & & \\ \hline 3/31 & 210 & & \\ \hline 3/31 Bal. & 6770 & & \\ \hline \multicolumn{4}{|l|}{ Supplies } \\ \hline 3/6 & 2,080 & 3/31 & 1790 \\ \hline 3/31 Bal. & 290 & & \\ \hline \multicolumn{4}{|l|}{ Prepaid Rent } \\ \hline 3/2 & 1,500 & 3/31 & 500 \\ \hline 3/31 Bal. & 1000 & & \\ \hline \end{tabular} Prepaid Insurance \begin{tabular}{|c|c|c|c|} \hline 3/3 & 2,400 & 3/31 & 400 \\ \hline 3/31 Bal. & 2000 & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Equipment } \\ \hline 3/1 & 8,300 & \\ \hline 3/31 Bal. & 8,300 & \\ \hline \end{tabular} Accumulated Depreciation-Equipment \begin{tabular}{|c|c|c|} \hline & 3/31 & 260 \\ \hline & 3/31 Bal. & 260 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{5}{|l|}{ Notes Payable } & \\ \hline & & \multicolumn{2}{|c|}{3/1} & 6,000 & \\ \hline & & \multicolumn{2}{|c|}{ 3/31 Bal. } & 6,000 & \\ \hline \multicolumn{5}{|l|}{ Accounts Payable } & \\ \hline \multirow[t]{2}{*}{ 3/18 } & 520 & \multicolumn{2}{|c|}{3/6} & 2,080 & \\ \hline & & \multicolumn{2}{|c|}{ 3/31 Bal. } & 1,560 & \\ \hline \multicolumn{6}{|c|}{ Salaries and Wages Payable } \\ \hline & & & 3/31 & & 1120 \\ \hline & & & 3/31 Bal. & & 1120 \\ \hline \end{tabular} Interest Payable \begin{tabular}{l|ll} \hline Common Stock \\ \hline & 3/1 & 15,600 \\ \hline & 3/31Bal. & 15,600 \end{tabular} Dividends \begin{tabular}{|c|c|c|} \hline 3/31 & 940 & \\ \hline \end{tabular} Service Revenue \begin{tabular}{|c|c|c|} \hline & 3/14 & 3,850 \\ \hline & 3/28 & 4,370 \\ \hline & 3/31 & 210 \\ \hline & 3/31 Bal. & 8430 \\ \hline \end{tabular} Maintenance and Repairs Expense SARASOTA CIEANERS Trial Balance March 31, 2022 Debit Cash Accounts Recelvable Supplies Prepald Rent Prepald Insurance Equlpment Accumulated Depreclation-Equlpment Notes Pryable Accounts Payable Salarles and Wares Payable Interest Payable Common Stock Divldends Service Revenue Malntenance and Repalrs Expense Supplies Expense Depreclation Expense Insurance Expense Salarles and Wakes Expense Rent Expense Interest Expense Totals $ 7420 5 \begin{tabular}{|r|} \hline \\ \hline \\ \hline 2970 \\ \hline \\ \hline 1000 \\ \hline 2000 \\ \hline 8300 \\ \hline \end{tabular} \begin{tabular}{r} 260 \\ \hline 6000 \\ \hline \end{tabular} 1560 1120 \begin{tabular}{r} 30 \\ \hline 15600 \\ \hline \end{tabular} 940 8430 360 \begin{tabular}{r} \hline 1790 \\ \hline 260 \\ \hline \end{tabular} \begin{tabular}{|r|} \hline 400 \\ \hline 2940 \\ \hline \end{tabular} SARASOTA CLEANERS Income Statement For the Month Ended March 31, 2022 Revenues Service Revenue $8,430 Expenses Maintenance and Repairs Expense $ 360 i Supplies Expense \begin{tabular}{|l|l|} \hline 1790 & i \\ \hline \end{tabular} Depreciation Expense \begin{tabular}{|l|l|} \hline 260 & i \\ \hline \end{tabular} Insurance Expense \begin{tabular}{|l|l|} \hline 400 & i \\ \hline \end{tabular} Salaries and Wages Expense \begin{tabular}{|l|l|} \hline 2940 & i \\ \hline \end{tabular} Rent Expense \begin{tabular}{|l|l|} \hline 500 & i \\ \hline \end{tabular} Interest Expense \begin{tabular}{|r|r|} \hline 30 & i \\ \hline \end{tabular} Total Expenses \begin{tabular}{|c|c|} \hline & 6280 \\ \hline$ & 2150 \\ \hline \end{tabular} SARASOTA CLEANERS Retained Earnings Statement $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts