Question: Please help with the second part and explain, so I know how to do it. Thank you!!! Ray Ray made the following contributions this year.

Please help with the second part and explain, so I know how to do it. Thank you!!!

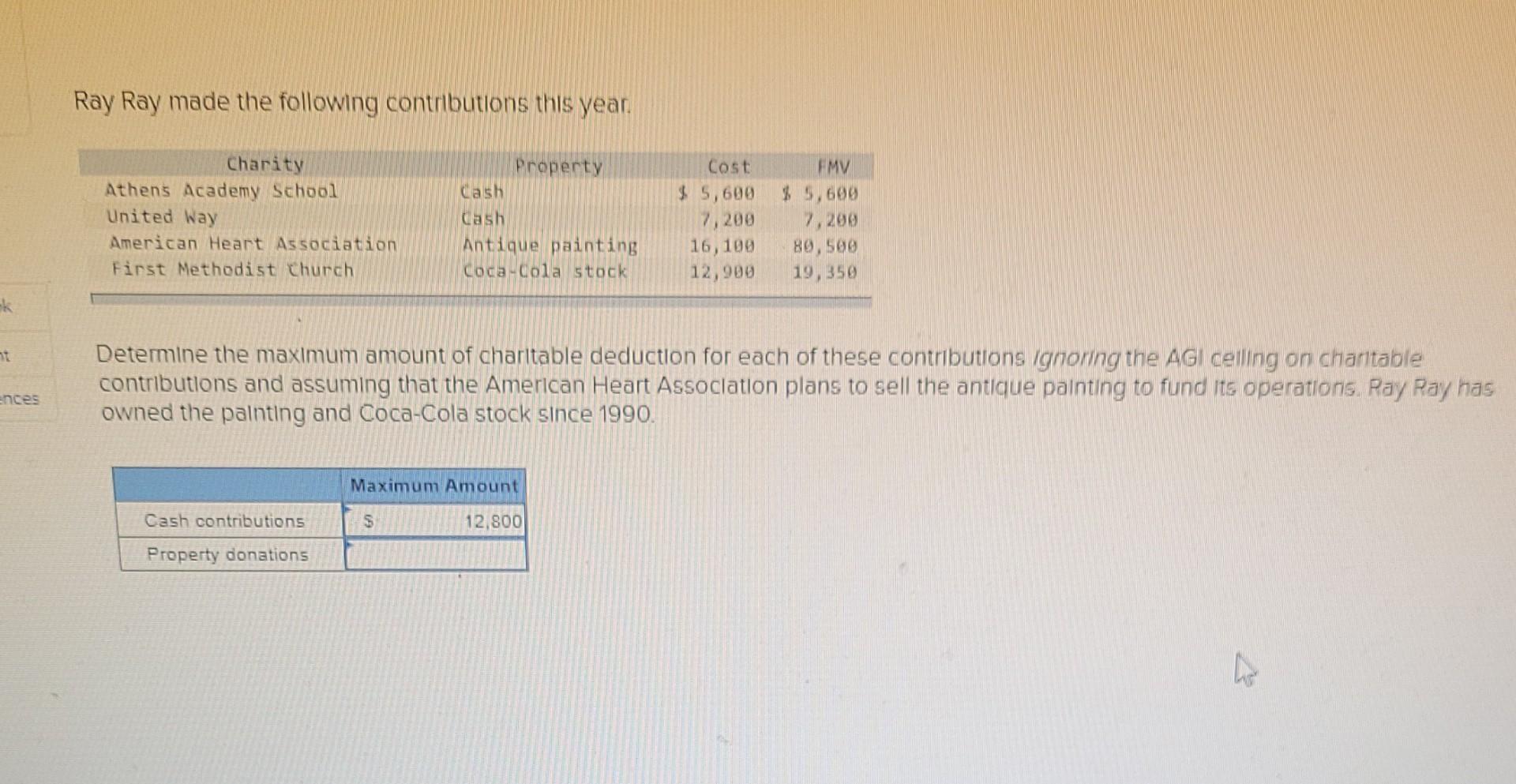

Ray Ray made the following contributions this year. Property Cash Charity Athens Academy School United Way American Heart Association First Methodist Church Cash Antique painting Coca-Cola Stock Cost $ 5,600 7,200 16,100 12,900 FMV $ 5,699 7,200 80, 500 19,359 k Determine the maximum amount of charitable deduction for each of these contributions ignoring the AG celling on chantable contributions and assuming that the American Heart Association plans to sell the antique painting to fund its operations. Ray Ray has owned the painting and Coca-Cola stock since 1990. ences Maximum Amount Cash contributions $ 12,800 Property donations ho

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts