Question: please help with the very last journal entry. you can see what is correct in the photos. David Wallace, Olena Dunn, and Danny Lin were

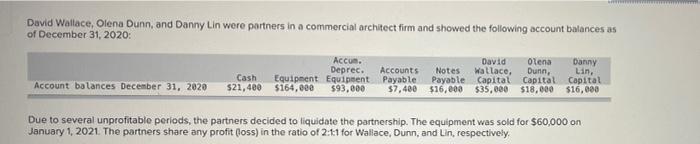

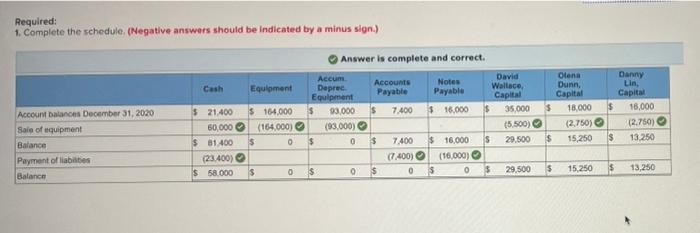

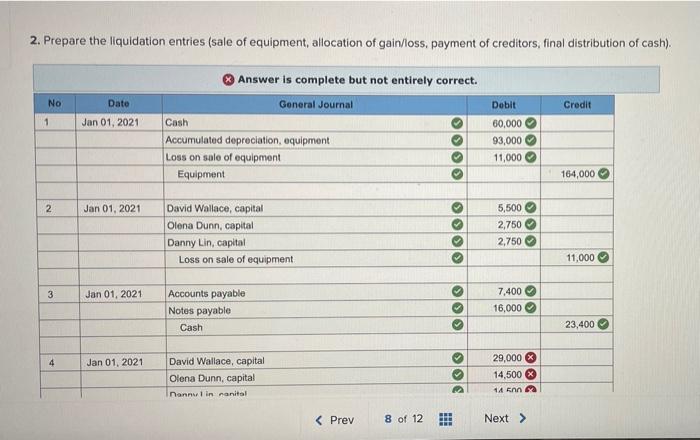

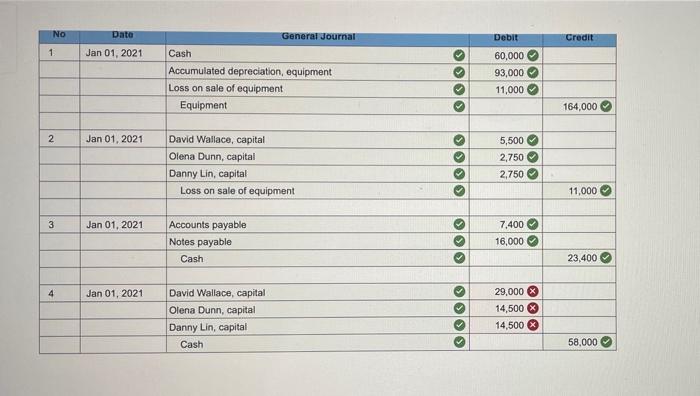

David Wallace, Olena Dunn, and Danny Lin were partners in a commercial architect firm and showed the following account balances as of December 31, 2020: Accun. David Olena Danny Deprec. Accounts Notes Wallace, Cash Dunn, Lin, Equipment Equipment Payable Payable Capital Capital Capital $21,400 $164,000 $93,000 $7,400 $16,000 $35,000 $18,000 $16,000 Account balances December 31, 2020 Due to several unprofitable periods, the partners decided to liquidate the partnership. The equipment was sold for $60,000 on January 1, 2021. The partners share any profit (oss) in the ratio of 2:1:1 for Wallace, Dunn, and Lin, respectively, Required: 1. Complete the schedule (Negative answers should be indicated by a minus sign.) Olena Dunn, Cash Equipment $ $ $ 164,000 (164,000) $ 0 Answer is complete and correct. Accum Accounts Notes David Deprec Equipment Payable Wallace Payable Capital $ 93,000 $ 7.400 $ 16,000 $ 35,000 (93.000) $5.500) $ 0 $ 7.400 $ 16,000 $ 29.500 (7.400) (16,000) $ 0 $ 0 3 0 $ 29.500 Danny Lin, Capital 16,000 (2.750) 13.250 Capital 18.000 (2.750) 15,250 $ 21.400 60,000 $ 1.400 (23.400) $ 58.000 Account balances December 31, 2020 Sale of equipment Balance Payment of liabilities Balance $ $ $ 0 $ 13,250 15,250 $ 2. Prepare the liquidation entries (sale of equipment, allocation of gain/loss, payment of creditors, final distribution of cash). Answer is complete but not entirely correct. No Date Credit 1 Jan 01, 2021 General Journal Cash Accumulated depreciation, equipment Loss on sale of equipment Equipment Dobit 60,000 93,000 11,000 OOO 164,000 2 Jan 01, 2021 David Wallace, capital Olena Dunn, capital Danny Lin, capital Loss on sale of equipment 5,500 2,750 2,750 0 11,000 3 Jan 01, 2021 Accounts payable Notos payable 7.400 16,000 0 Cash 23,400 4 Jan 01, 2021 David Wallace, capital Olena Dunn, capital nannul in ranital DOO 29,000 14,500 14 En NO Date Debit Credit 1 Jan 01, 2021 General Journal Cash Accumulated depreciation, equipment Loss on sale of equipment Equipment 60,000 93,000 11,000 OO 164,000 2 Jan 01, 2021 David Wallace, capital Olena Dunn, capital Danny Lin, capital Loss on sale of equipment OOO 5,500 2,750 2.750 OOO 11,000 3 Jan 01, 2021 Accounts payable Notes payable Cash 7.400 16,000 9 00 23,400 4 Jan 01, 2021 David Wallace, capital Olena Dunn, capital Danny Lin, capital Cash OOOO 29,000 14,500 14,500X 58.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts