Question: Please help with the wrong ones. Thanks :) Brooks Plumbing Products Inc. (BPP) manufactures plumbing fixtures and other home Improvement products that are sold in

Please help with the wrong ones. Thanks :)

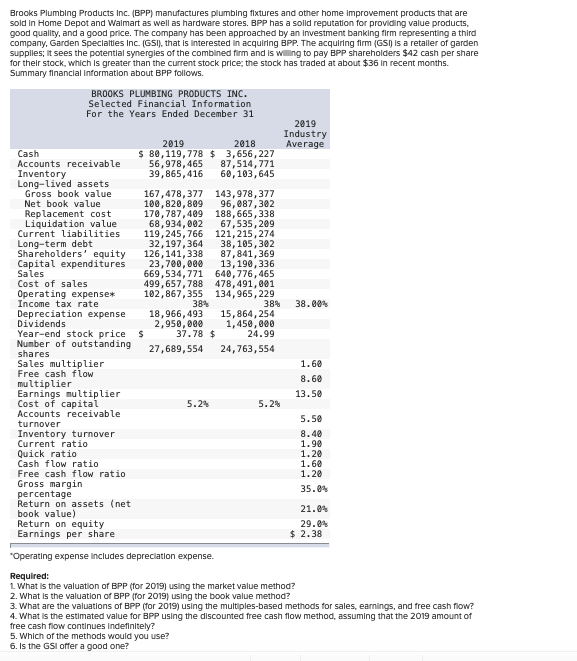

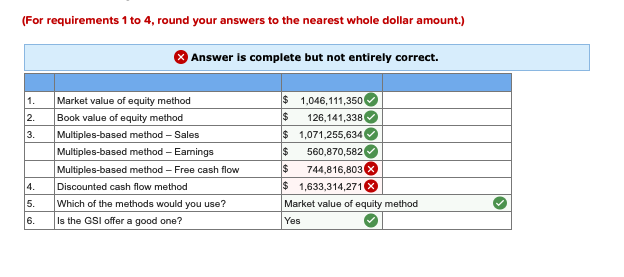

Brooks Plumbing Products Inc. (BPP) manufactures plumbing fixtures and other home Improvement products that are sold in Home Depot and Walmart as well as hardware stores. BPP has a solid reputation for providing value products good quality, and a good price. The company has been approached by an investment banking firm representing a thing company, Garden Specialties Inc. (GSI, that is interested in acquiring BPP. The acquiring firm GS is a retailer of garden Supplies it sees the potential synergies of the combined firm and is wing to pay BPP shareholders $42 cash per share for their stock, which is greater than the current stock price: the stock has traded at about $36 in recent months. Summary financial Information about BPP follows. BROOKS PLUMBING PRODUCTS INC. Selected Financial Information For the Years Ended December 31 2019 Industry Average 2019 2018 $ 80, 119,778 $ 3,656, 227 56,978,46587,514,771 39,865,416 60.103.645 Cash Accounts receivable Inventory Long-lived assets Gross book value Net book value Replacement cost Liquidation value Current liabilities Long-term debt Shareholders' equity Capital expenditures Sales Cost of sales Operating expenses Income tax rate Depreciation expense Dividends Year-end stock price Number of outstanding shares Sales multiplier Free cash flow multiplier Earnings multiplier Cost of capital Accounts receivable turnover Inventory turnover Current ratio Quick ratio Cash flow ratio Free cash flow ratio Gross margin percentage Return on assets (net book value) Return on equity Earnings per share 167,478,377 143,978,377 100,820, 80996, 87,302 170,787,409 188,665, 338 68,934,882 67,535,209 119,245,766 121, 215, 274 32,197, 364 38, 105, 302 126, 141,338 87,841,369 23,700,000 13, 190,336 669,534,771 640, 776, 465 499,657, 788 478, 491,001 102,867,355 134,965, 229 384 384 18,966, 493 15,864,254 2,950,000 1,450,000 $ 37.78 $ 24.99 27.689,554 24,763,554 38.00% 1.60 8.60 13.50 5.2% 5.2% 5.50 8.42 1.92 1.22 1.60 1.20 35.04 21.04 29.24 $ 2.38 "Operating expense includes depreciation expense. Required: L What is the valuation of BPP for 20191 using the market value method? 2. What is the valuation of BPP for 2019) using the book value method? 3. What are the valuations of BPP (for 2019) using the multiples-based methods for sales, earnings, and free cash flow? 4. What is the estimated value for BPP using the discounted free cash flow method, assuming that the 2019 amount of free cash flow continues indefinitely 5. Which of the methods would you use? 6. Is the GSI offer a good one? (For requirements 1 to 4, round your answers to the nearest whole dollar amount.) Answer is complete but not entirely correct. Market value of equity method Book value of equity method Multiples-based method - Sales Multiples-based method - Earnings Multiples-based method - Free cash flow Discounted cash flow method Which of the methods would you use? s the GSI offer a good one? $ 1,046, 111,350 $ 126,141,338 $ 1,071,255,634 $ 560,870,582 $ 744,816,803 X $ 1,633,314,271 Market value of equity method Yes 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts