Question: Please Help with these 2 problems Problem 1: Problem 2: The Shamrock Corporation has just issued a ( $ 1,000 ) par value zero-coupon bond

Please Help with these 2 problems

Problem 1:

Problem 2:

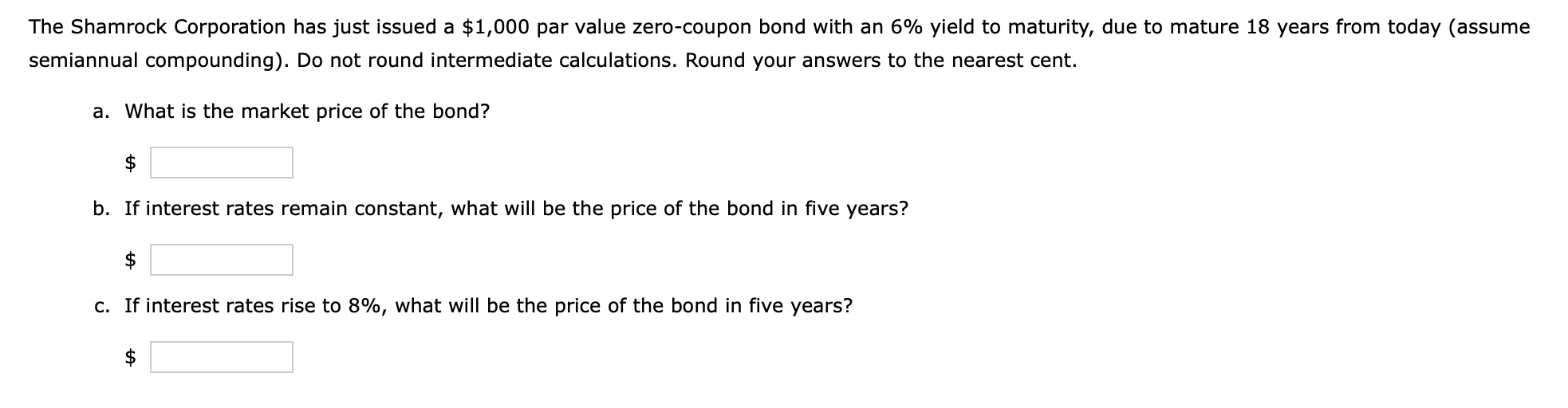

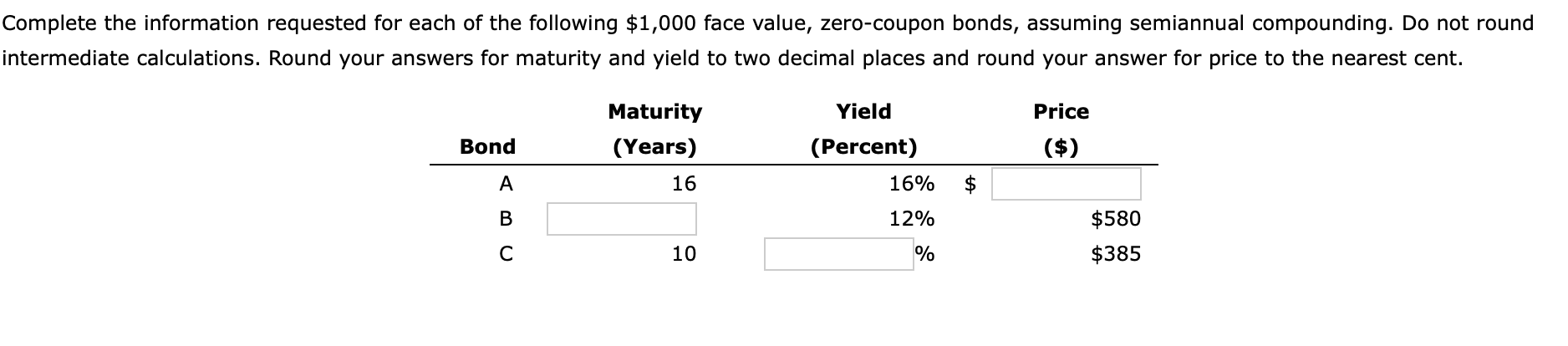

The Shamrock Corporation has just issued a \\( \\$ 1,000 \\) par value zero-coupon bond with an \6 yield to maturity, due to mature 18 years from today (assume semiannual compounding). Do not round intermediate calculations. Round your answers to the nearest cent. a. What is the market price of the bond? \\[ \\$ \\] b. If interest rates remain constant, what will be the price of the bond in five years? \\[ \\$ \\] c. If interest rates rise to \8, what will be the price of the bond in five years? \\[ \\$ \\] Complete the information requested for each of the following \\( \\$ 1,000 \\) face value, zero-coupon bonds, assuming semiannual compounding. Do not round itermediate calculations. Round your answers for maturity and yield to two decimal places and round your answer for price to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts