Question: Please help with these 2 questions with explanation please Question 14 175 On January 1, 2020, Jensen Corp. purchased a truck for $80,000, with an

Please help with these 2 questions with explanation please

Please help with these 2 questions with explanation please

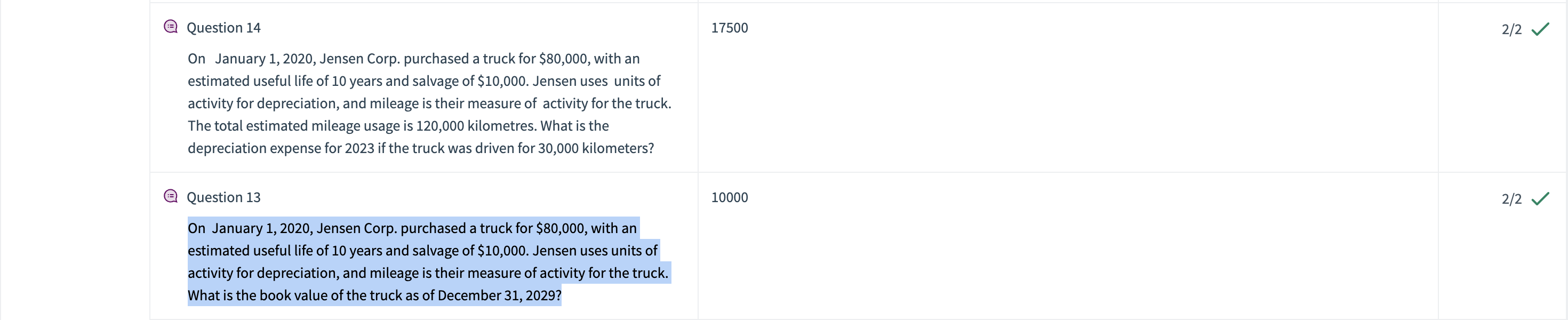

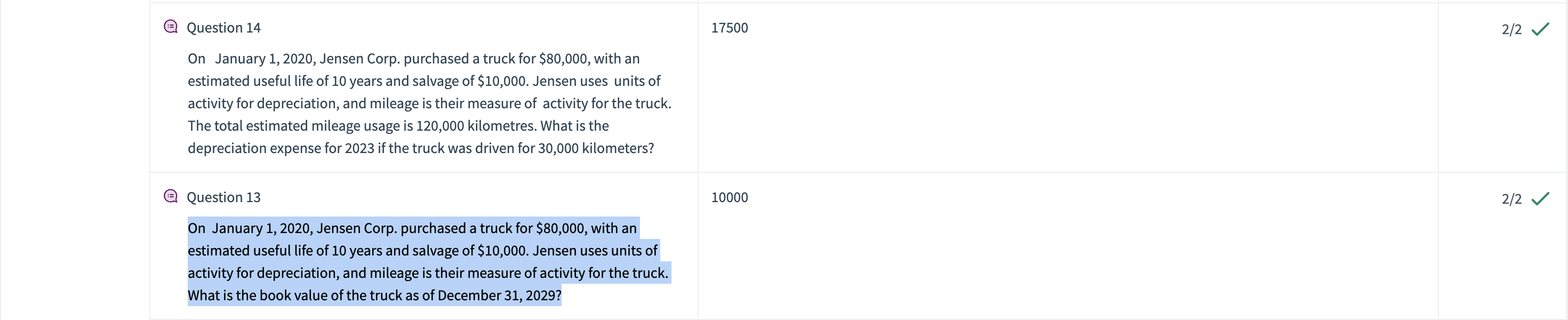

Question 14 175 On January 1, 2020, Jensen Corp. purchased a truck for $80,000, with an estimated useful life of 10 years and salvage of $10,000. Jensen uses units of activity for depreciation, and mileage is their measure of activity for the truck. The total estimated mileage usage is 120,000 kilometres. What is the depreciation expense for 2023 if the truck was driven for 30,000 kilometers? (- Question 13 100 On January 1, 2020, Jensen Corp. purchased a truck for $80,000, with an estimated useful life of 10 years and salvage of $10,000. Jensen uses units of activity for depreciation, and mileage is their measure of activity for the truck. What is the book value of the truck as of December 31,2029

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts