Question: Please help with these multiple choice questions. Thank you :) QUESTION 1 The adjusted trial balance of Norton Company contained the following information. Assume the

Please help with these multiple choice questions. Thank you :)

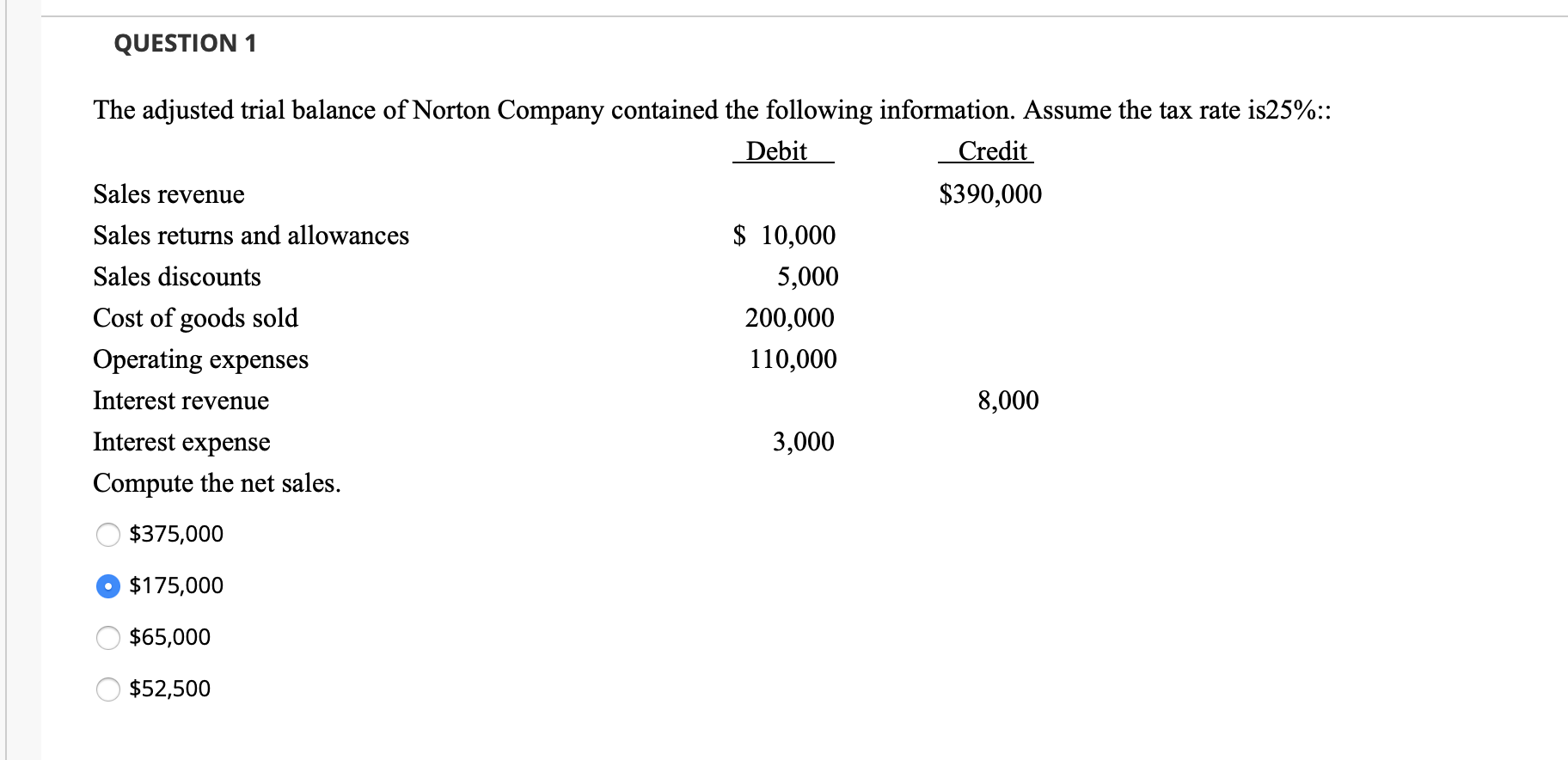

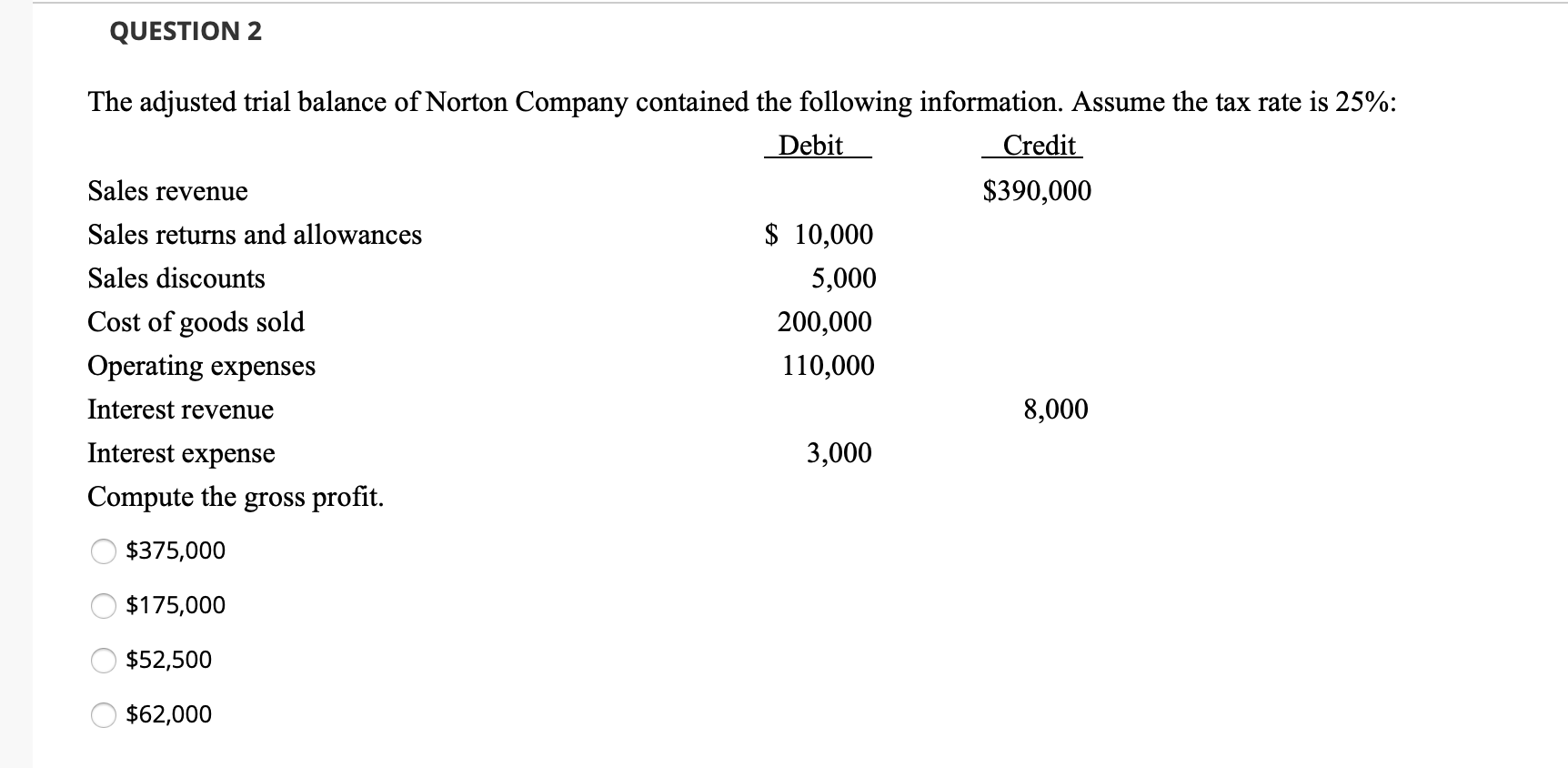

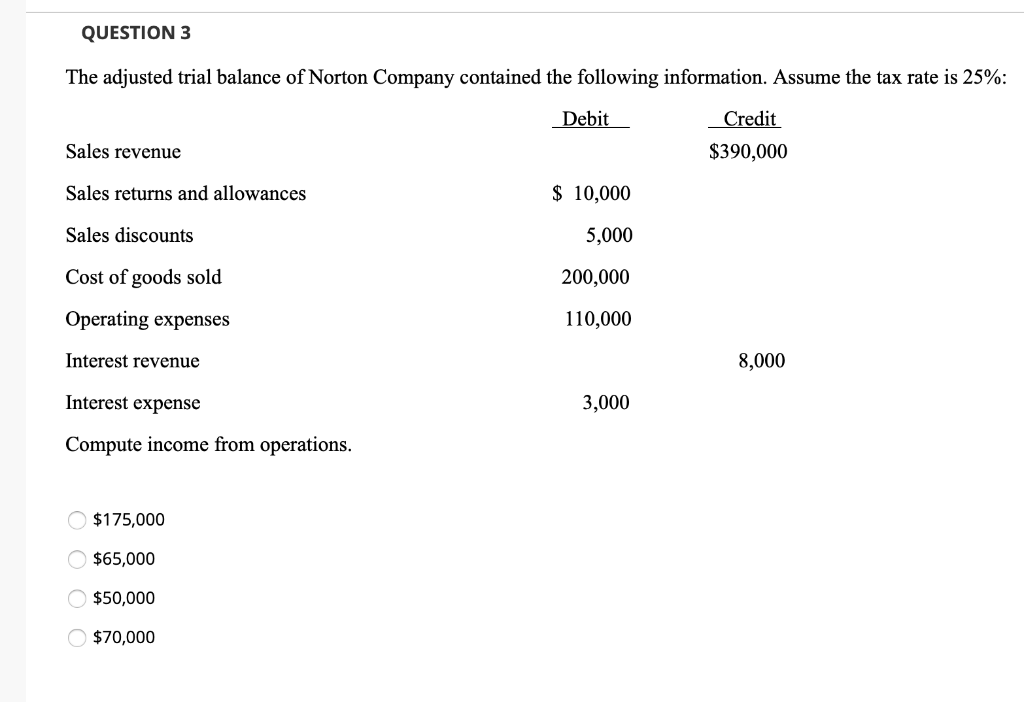

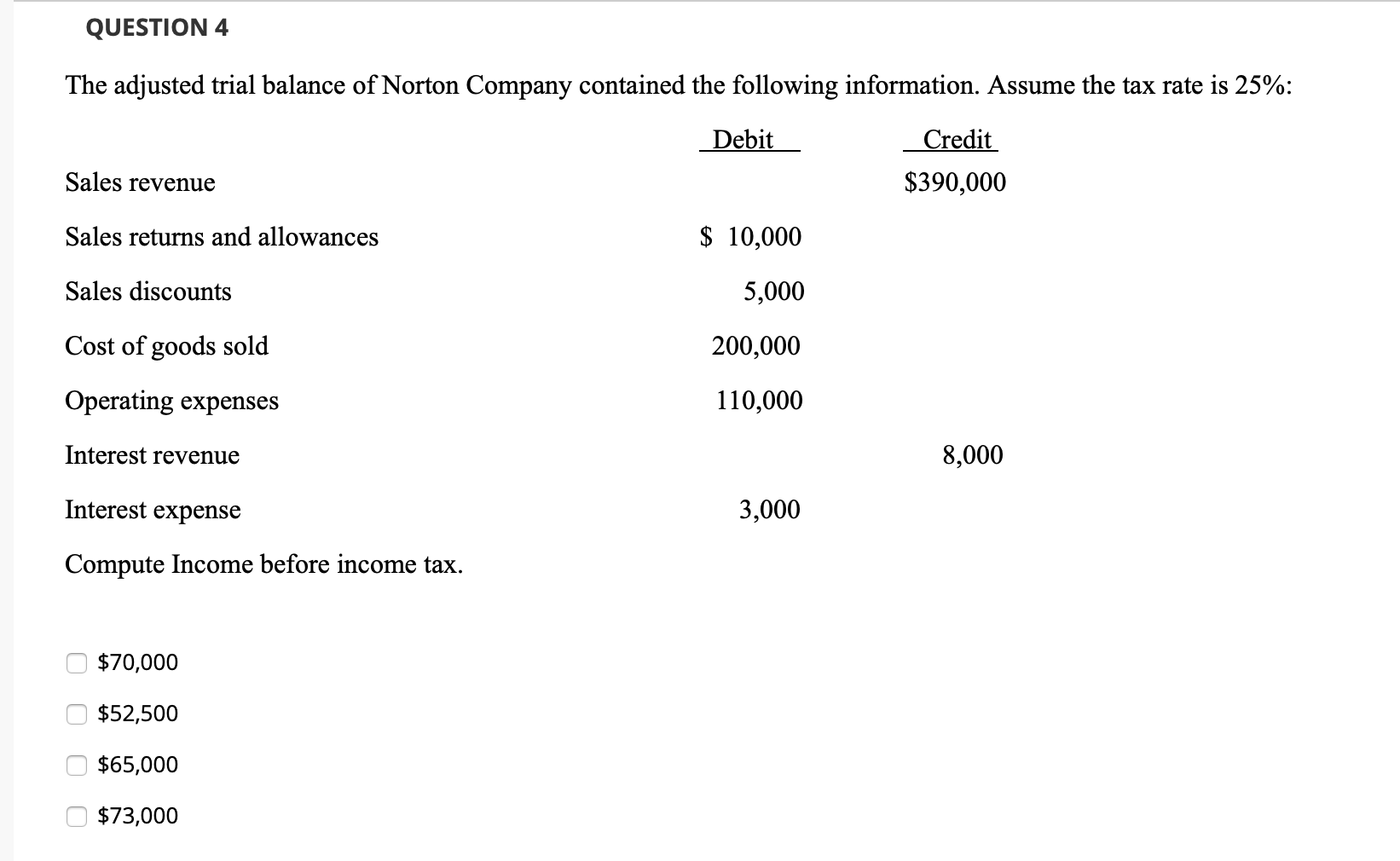

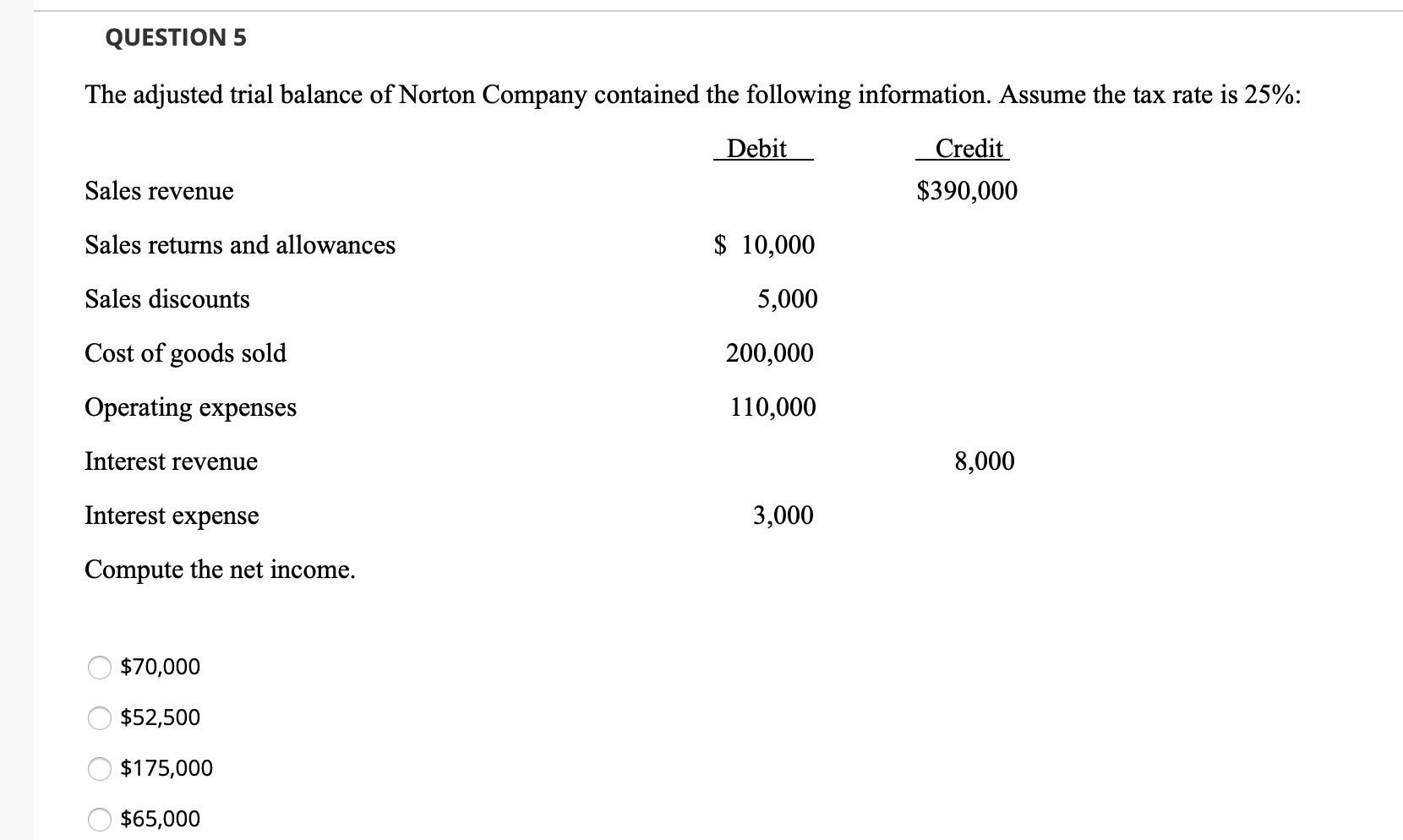

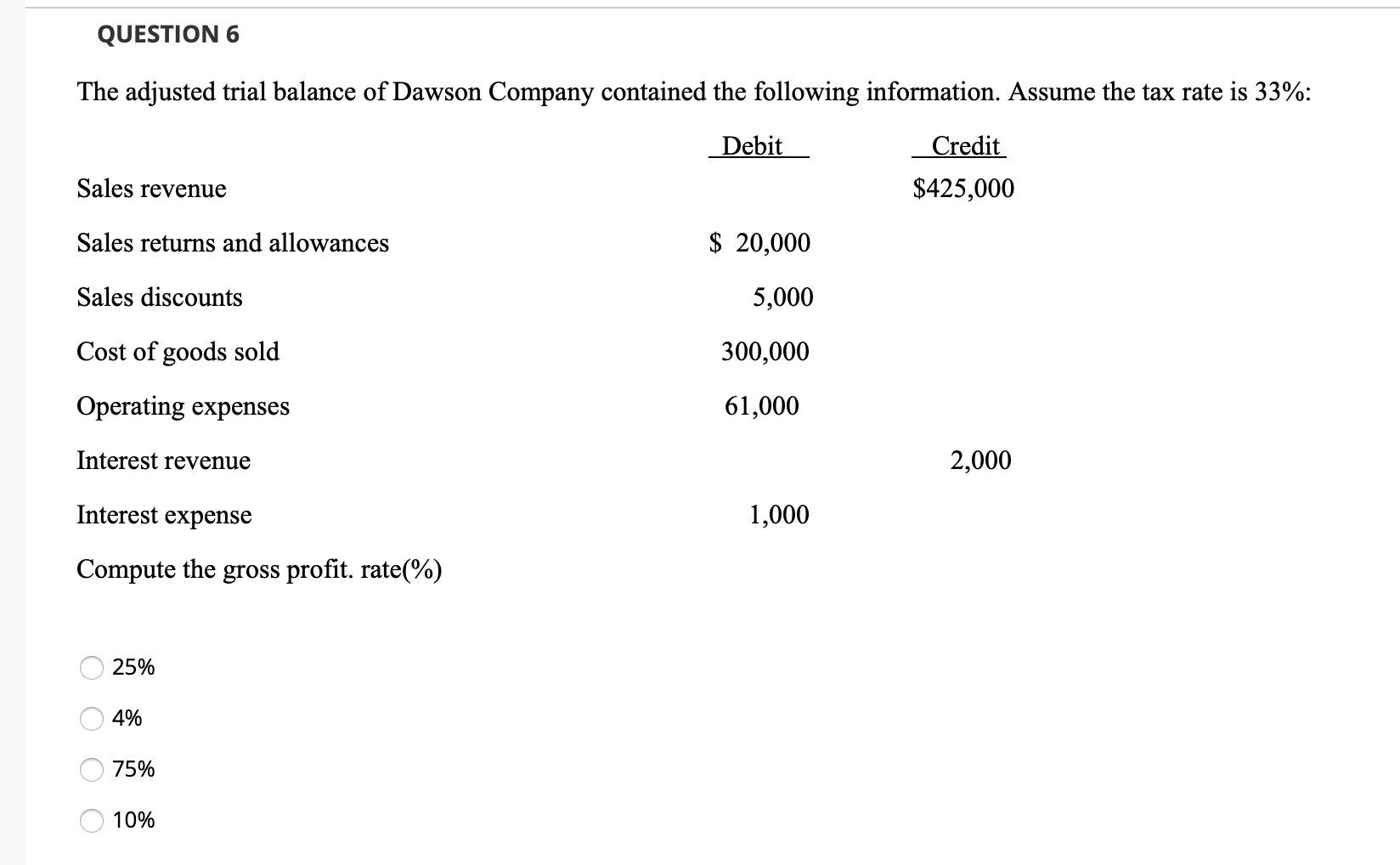

QUESTION 1 The adjusted trial balance of Norton Company contained the following information. Assume the tax rate is25%:: Debit Credit Sales revenue $390,000 Sales returns and allowances $ 10,000 Sales discounts 5,000 Cost of goods sold 200,000 Operating expenses 110,000 Interest revenue 8,000 Interest expense 3,000 Compute the net sales. $375,000 $175,000 $65,000 $52,500 QUESTION 2 The adjusted trial balance of Norton Company contained the following information. Assume the tax rate is 25%: Debit Credit Sales revenue $390,000 Sales returns and allowances $ 10,000 Sales discounts 5,000 Cost of goods sold 200,000 Operating expenses 110,000 Interest revenue 8,000 Interest expense 3,000 Compute the gross profit. $375,000 $175,000 $52,500 $62,000 QUESTION 3 The adjusted trial balance of Norton Company contained the following information. Assume the tax rate is 25%: Debit Credit $390,000 Sales revenue Sales returns and allowances $ 10,000 Sales discounts 5,000 Cost of goods sold 200,000 Operating expenses 110,000 Interest revenue 8,000 Interest expense 3,000 Compute income from operations. $175,000 $65,000 $50,000 $70,000 QUESTION 4 The adjusted trial balance of Norton Company contained the following information. Assume the tax rate is 25%: Debit Credit Sales revenue $390,000 Sales returns and allowances $ 10,000 Sales discounts 5,000 Cost of goods sold 200,000 Operating expenses 110,000 Interest revenue 8,000 Interest expense 3,000 Compute Income before income tax. $70,000 $52,500 0 0 0 0 $65,000 $73,000 QUESTION 5 The adjusted trial balance of Norton Company contained the following information. Assume the tax rate is 25%: Debit Credit Sales revenue $390,000 Sales returns and allowances $ 10,000 Sales discounts 5,000 Cost of goods sold 200,000 Operating expenses 110,000 Interest revenue 8,000 Interest expense 3,000 Compute the net income. $70,000 $52,500 $175,000 $65,000 QUESTION 6 The adjusted trial balance of Dawson Company contained the following information. Assume the tax rate is 33%: Debit Credit Sales revenue $425,000 Sales returns and allowances $ 20,000 Sales discounts 5,000 Cost of goods sold 300,000 Operating expenses 61,000 Interest revenue 2,000 Interest expense 1,000 Compute the gross profit. rate(%) 25% 4% 75% 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts