Question: please help with these :) Question 6 1 pts The matching principle calls for the accountant of a firm to none of the above match

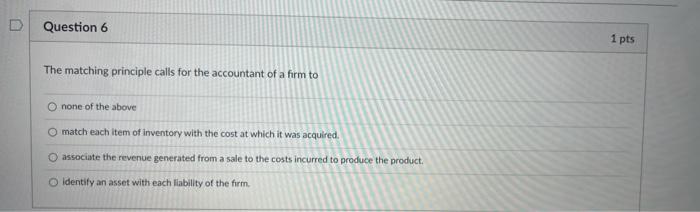

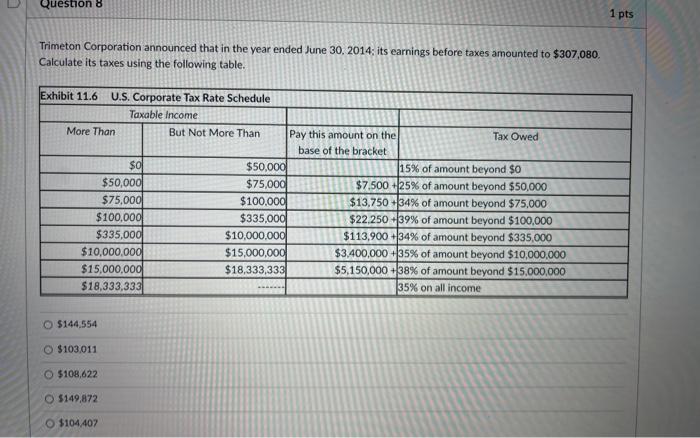

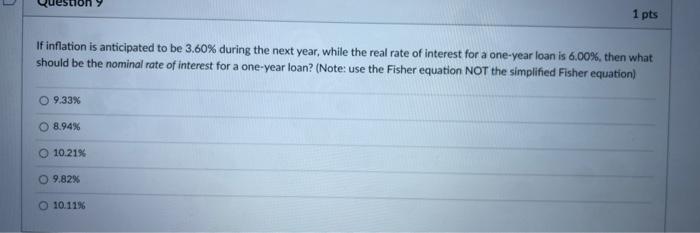

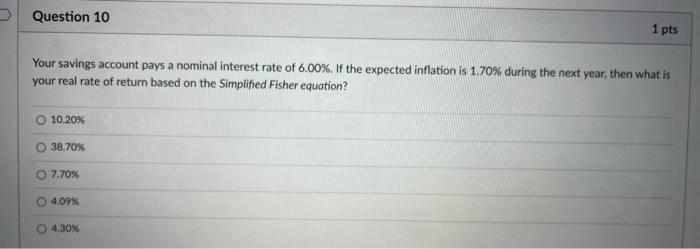

Question 6 1 pts The matching principle calls for the accountant of a firm to none of the above match each item of inventory with the cost at which it was acquired associate the revenue generated from a sale to the costs incurred to produce the product O identify an asset with each liability of the form Question 8 1 pts Trimeton Corporation announced that in the year ended June 30, 2014, its earnings before taxes amounted to $307,080 Calculate its taxes using the following table. Exhibit 11.6 U.S. Corporate Tax Rate Schedule Taxable income More Than But Not More Than Pay this amount on the Tax Owed base of the bracket $0 $50,000 15% of amount beyond $0 $50,000 $75,000 $7.500 +25% of amount beyond $50,000 $75,000 $100,000 $13,750 34% of amount beyond $75,000 $100,000 $335.000 $22.250 39% of amount beyond $100,000 $335,000 $10,000,000 $113,900 +34% of amount beyond $335,000 $10,000,000 $15,000,000 $3,400,000 + 35% of amount beyond $10,000,000 $15,000,000 $18,333,333 $5,150,000 -38% of amount beyond $15,000,000 $18,333,333 35% on all income O $144.554 $103,011 O $108,622 $149,872 $104,407 1 pts If inflation is anticipated to be 3.60% during the next year, while the real rate of interest for a one-year loan is 6.00%, then what should be the nominal rate of interest for a one-year loan? (Note: use the Fisher equation NOT the simplified Fisher equation) 9.33% O 8.94% 10.21% 9.82% O 10.11% Question 10 1 pts Your savings account pays a nominal interest rate of 6.00%. If the expected inflation is 1.70% during the next year, then what is your real rate of return based on the Simplified Fisher equation? 10.20% 38.70% O 7.70% 4.09% 4.30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts