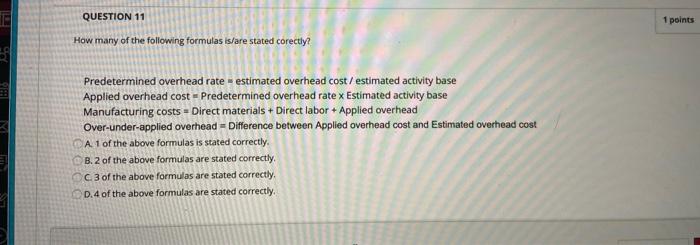

Question: PLEASE HELP WITH THESE QUESTION OR EXPLAIN HOW TO SOLVE THEM TE QUESTION 11 1 points How many of the following formulas is/are stated corectly?

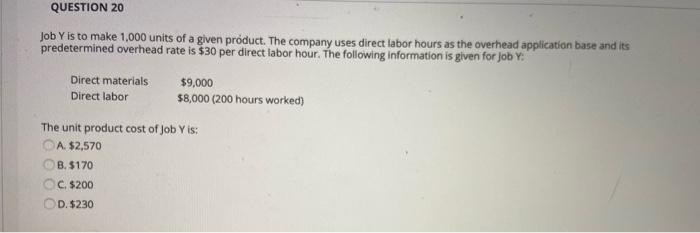

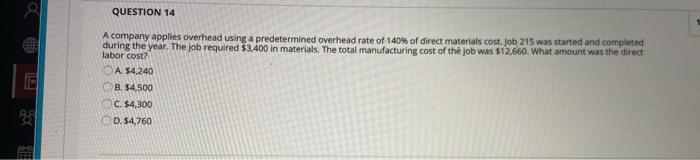

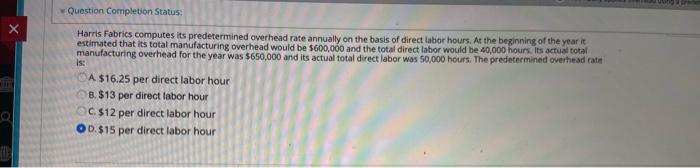

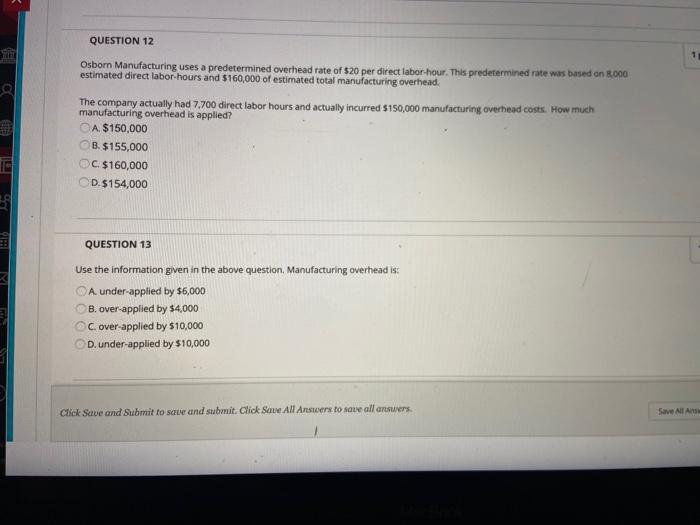

TE QUESTION 11 1 points How many of the following formulas is/are stated corectly? Predetermined overhead rate - estimated overhead cost / estimated activity base Applied overhead cost = Predetermined overhead rate x Estimated activity base Manufacturing costs - Direct materials + Direct labor+ Applied overhead Over-under-applied overhead = Difference between Applied overhead cost and Estimated overhead cost A 1 of the above formulas is stated correctly B. 2 of the above formulas are stated correctly. C 3 of the above formulas are stated correctly D. 4 of the above formulas are stated correctly. QUESTION 20 Job Y is to make 1,000 units of a given product. The company uses direct labor hours as the overhead application base and its predetermined overhead rate is $30 per direct labor hour. The following information is given for Job : Direct materials Direct labor $9,000 $8,000 (200 hours worked) The unit product cost of Job Yis: A $2,570 B. $170 C. $200 D. $230 QUESTION 14 A company applies overhead using a predetermined overhead rate of 140% of direct materials cost. Job 215 was started and completed during the year. The job required $3,400 in materials. The total manufacturing cost of the job was 512,660. What amount was the direct labor cost? A $4.240 B. $4,500 $4,300 D. 54,760 Question Completion Status: Harris Fabrics computes its predetermined overhead rate annually on the basis of direct labor hours. At the beginning of the year it estimated that its total manufacturing overhead would be $600,000 and the total direct labor would be 40,000 hours. its actual total manufacturing overhead for the year was $650,000 and its actual total direct labor was 50,000 hours. The predetermined overhead rate is: A $16.25 per direct labor hour 8. $13 per direct labor hour C. $12 per direct labor hour D. $15 per direct labor hour QUESTION 12 Osborn Manufacturing uses a predetermined overhead rate of $20 per direct labor hour. This predetermined rate was based on 8.000 estimated direct labor hours and $160,000 of estimated total manufacturing overhead The company actually had 7.700 direct labor hours and actually incurred $150,000 manufacturing overhead costs. How much manufacturing overhead is applied? A $150,000 B. $ 155,000 C. $160,000 D. $154,000 QUESTION 13 Use the information given in the above question. Manufacturing overhead is: A under-applied by 56,000 B.over-applied by $4,000 Cover-applied by $10,000 D.under-applied by $10,000 Click Save and Submit to save and submit. Click Save All Answers to save all answers Save All A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts