Question: Please help with these questions Sam has $100 and he has decided to borrow an additional $300. The interest rate on the loan is 6%

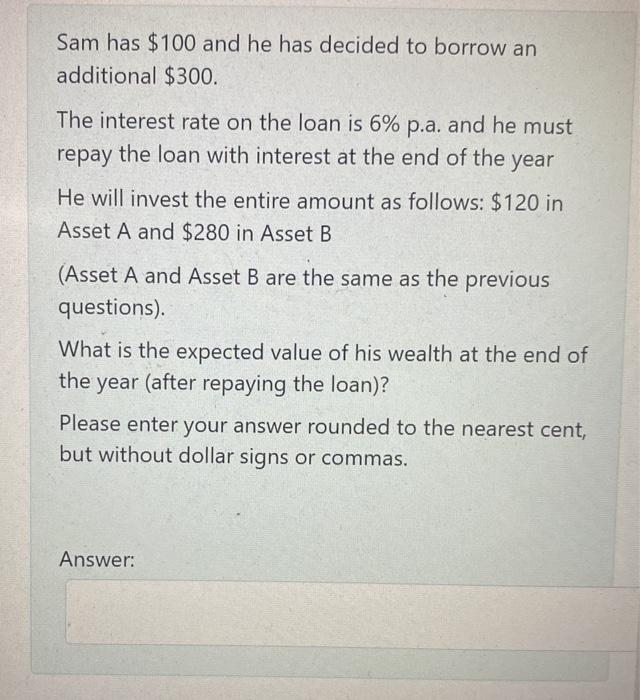

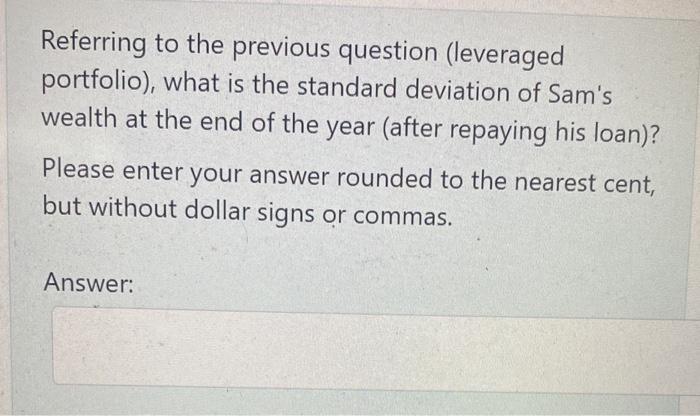

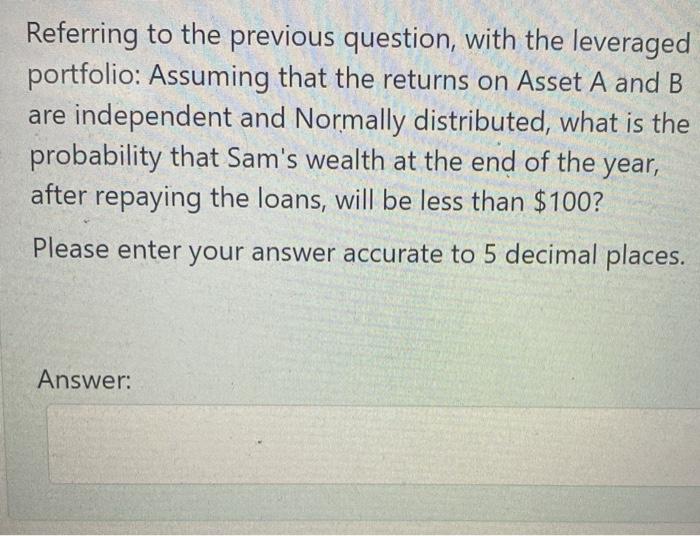

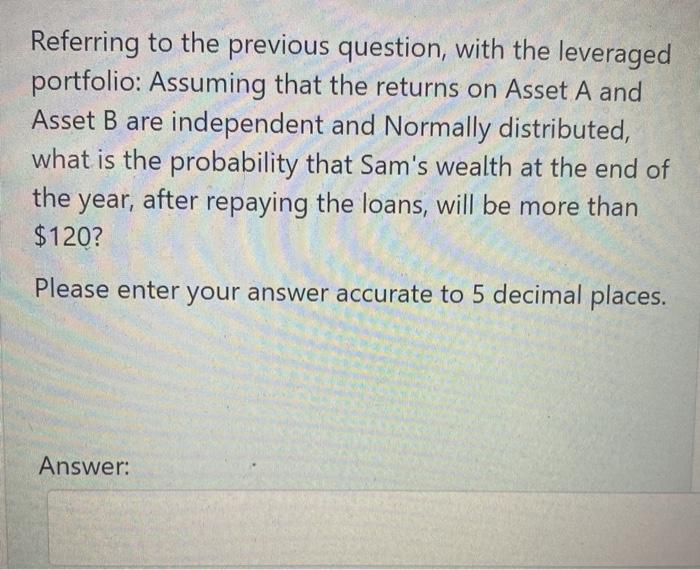

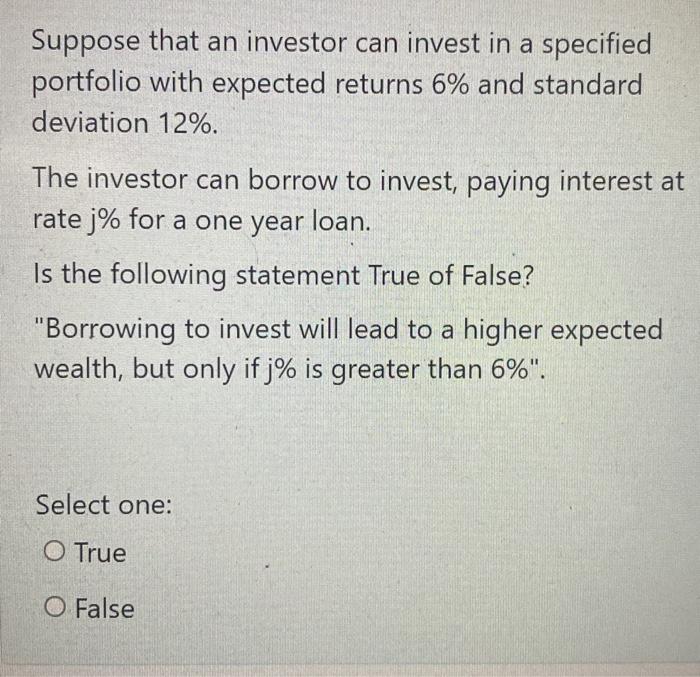

Sam has $100 and he has decided to borrow an additional $300. The interest rate on the loan is 6% p.a. and he must repay the loan with interest at the end of the year He will invest the entire amount as follows: $120 in Asset A and $280 in Asset B (Asset A and Asset B are the same as the previous questions) What is the expected value of his wealth at the end of the year (after repaying the loan)? Please enter your answer rounded to the nearest cent, but without dollar signs or commas. Answer: Referring to the previous question (leveraged portfolio), what is the standard deviation of Sam's wealth at the end of the year (after repaying his loan)? Please enter your answer rounded to the nearest cent, but without dollar signs or commas. Answer: Referring to the previous question, with the leveraged portfolio: Assuming that the returns on Asset A and B are independent and Normally distributed, what is the probability that Sam's wealth at the end of the year, after repaying the loans, will be less than $100? Please enter your answer accurate to 5 decimal places. Answer: Referring to the previous question, with the leveraged portfolio: Assuming that the returns on Asset A and Asset B are independent and Normally distributed, what is the probability that Sam's wealth at the end of the year, after repaying the loans, will be more than $120? Please enter your answer accurate to 5 decimal places. Answer: Suppose that an investor can invest in a specified portfolio with expected returns 6% and standard deviation 12%. The investor can borrow to invest, paying interest at rate j% for a one year loan. Is the following statement True of False? "Borrowing to invest will lead to a higher expected wealth, but only if j% is greater than 6%". Select one: O True O False Sam has $100 and he has decided to borrow an additional $300. The interest rate on the loan is 6% p.a. and he must repay the loan with interest at the end of the year He will invest the entire amount as follows: $120 in Asset A and $280 in Asset B (Asset A and Asset B are the same as the previous questions) What is the expected value of his wealth at the end of the year (after repaying the loan)? Please enter your answer rounded to the nearest cent, but without dollar signs or commas. Answer: Referring to the previous question (leveraged portfolio), what is the standard deviation of Sam's wealth at the end of the year (after repaying his loan)? Please enter your answer rounded to the nearest cent, but without dollar signs or commas. Answer: Referring to the previous question, with the leveraged portfolio: Assuming that the returns on Asset A and B are independent and Normally distributed, what is the probability that Sam's wealth at the end of the year, after repaying the loans, will be less than $100? Please enter your answer accurate to 5 decimal places. Answer: Referring to the previous question, with the leveraged portfolio: Assuming that the returns on Asset A and Asset B are independent and Normally distributed, what is the probability that Sam's wealth at the end of the year, after repaying the loans, will be more than $120? Please enter your answer accurate to 5 decimal places. Answer: Suppose that an investor can invest in a specified portfolio with expected returns 6% and standard deviation 12%. The investor can borrow to invest, paying interest at rate j% for a one year loan. Is the following statement True of False? "Borrowing to invest will lead to a higher expected wealth, but only if j% is greater than 6%". Select one: O True O False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts