Question: Please help with these tables below. In your final project, you will assume the role of an accountant and complete the year-end adjustment process for

Please help with these tables below.

In your final project, you will assume the role of an accountant and complete the year-end adjustment process for your company using a provided workbook. This workbook is the first deliverable (Part I) of your final project. In Part II, you will analyze the provided financials of the same company and create a report documenting your findings. For your first milestone, you will complete certain portions of the final project workbook as described in the prompt below. You will complete the entire workbook for your next milestone, due in Module Five. Prompt: Specifically, the following critical elements must be addressed: I. Demonstrate the year-end adjustment process. A. Prepare the adjusting journal entriesin the Adjusting Entries tab in the provided workbook. B. Transfer the values from the Adjusting Entries tab to the proper cells of the Adjusting Entries columns in the Worksheet tab. C. Create the adjusted trial balance by completing the Adjusted Trial Balance columns using the Worksheets tab. D. Close temporary accounts by completing the Closing Entries tab. II. Prepare an income statement for your company by completing the Income Statement tab in the provided workbook

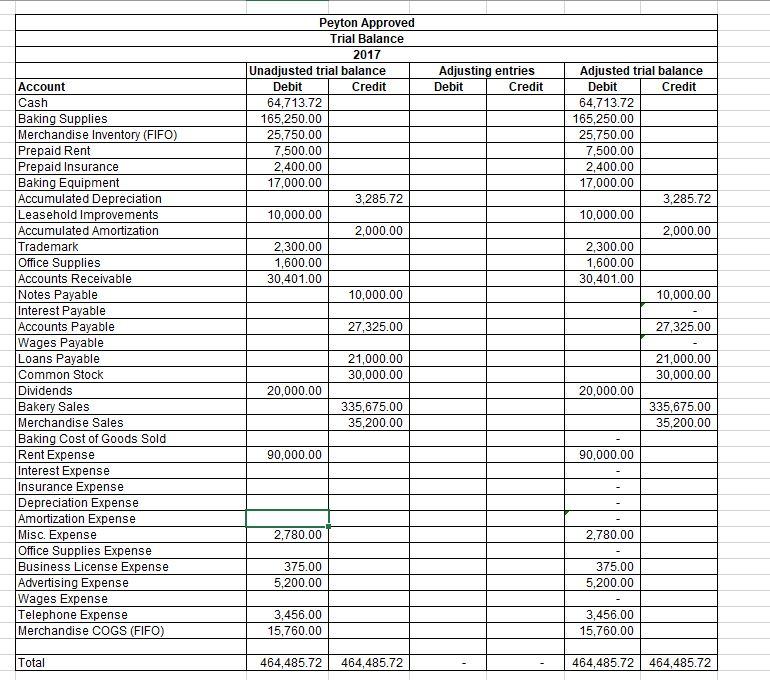

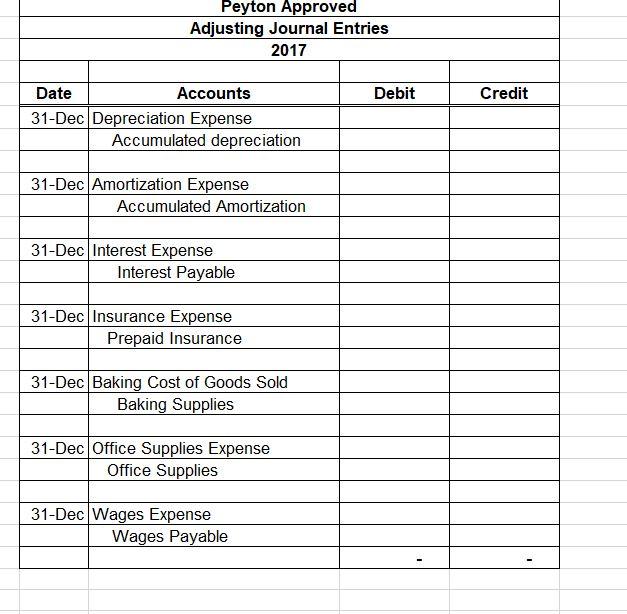

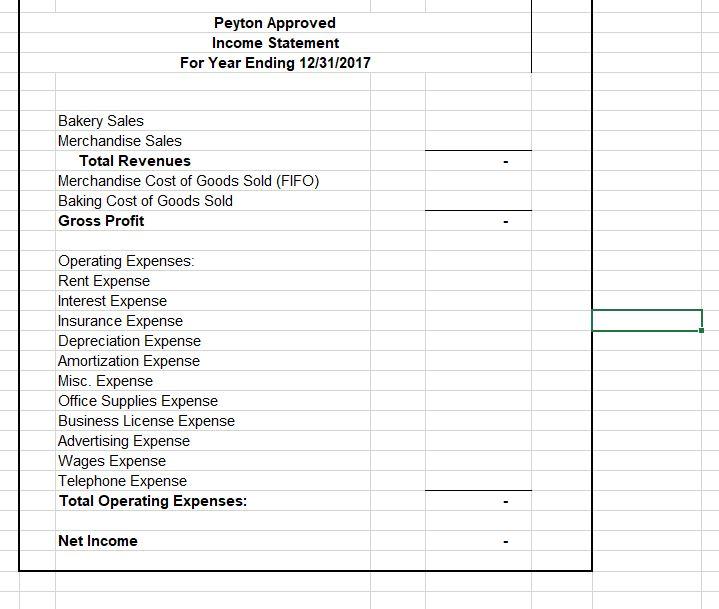

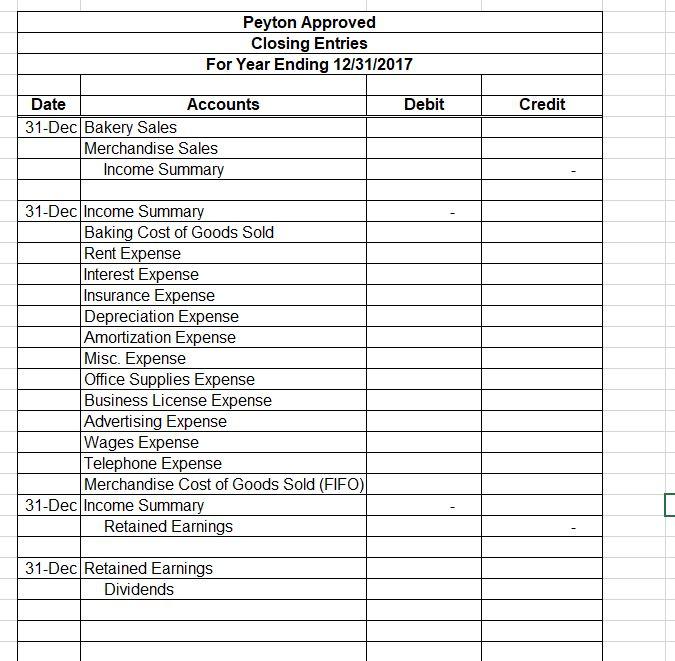

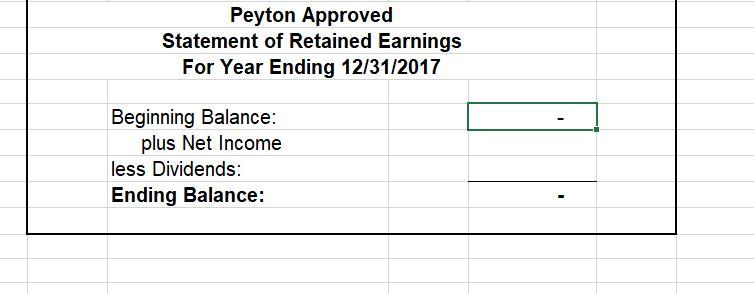

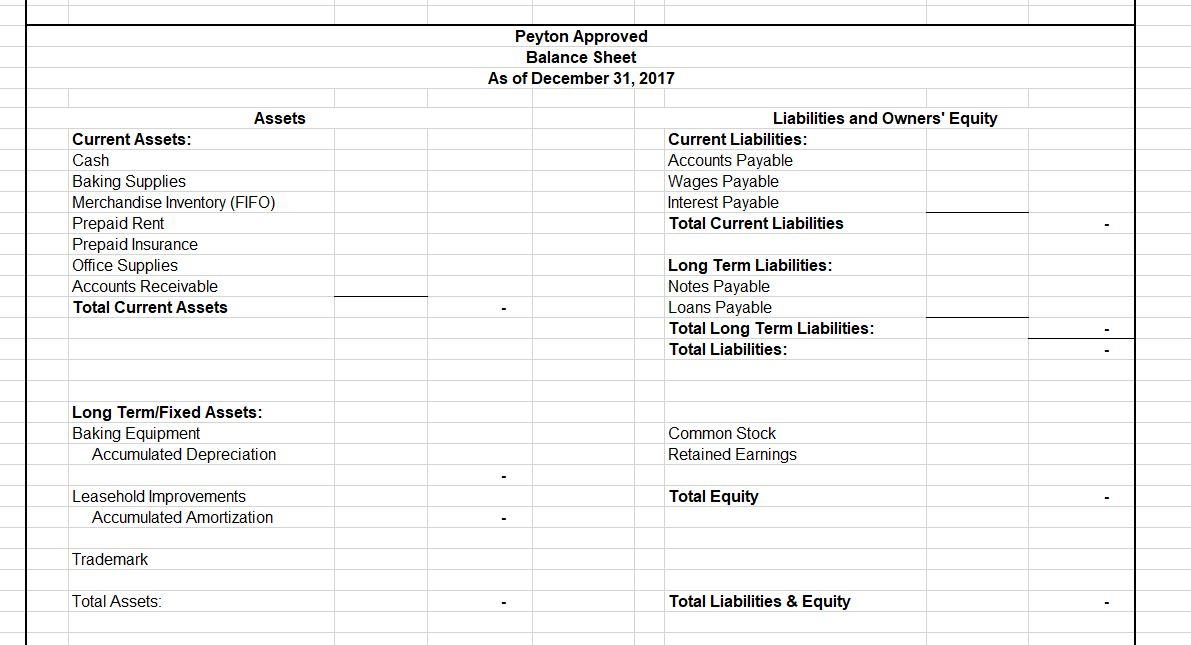

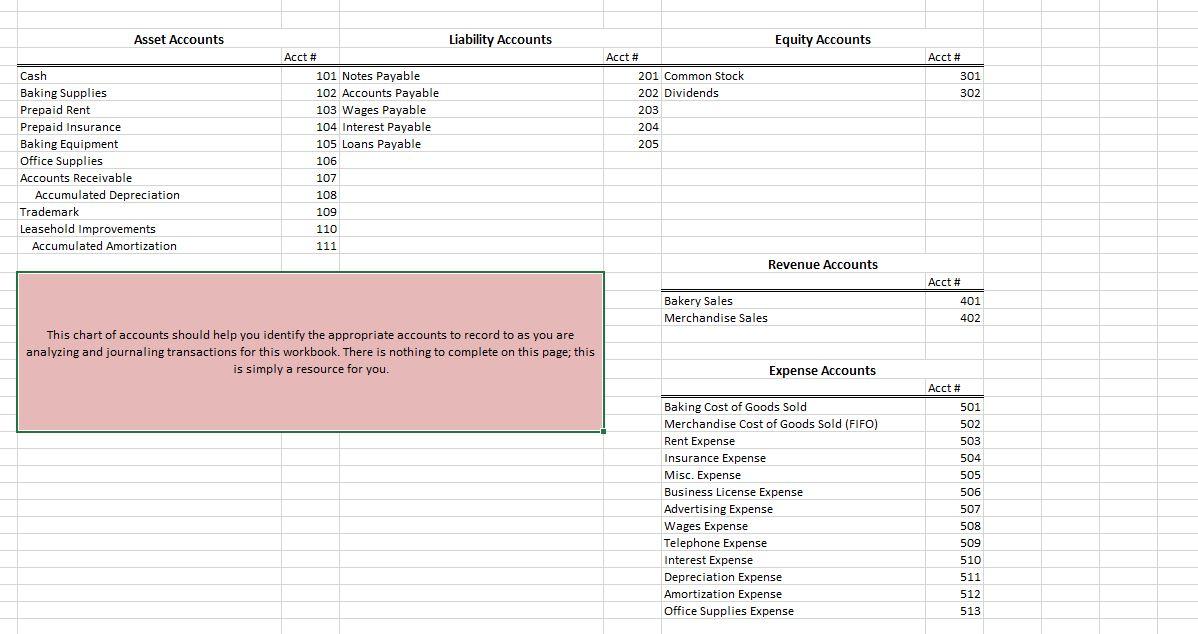

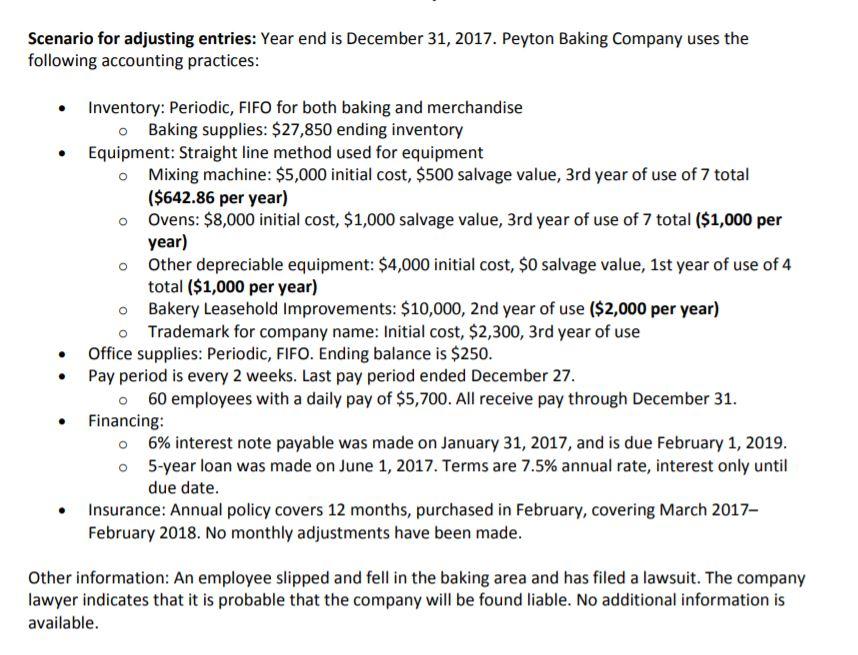

Adjusting entries Debit Credit Peyton Approved Trial Balance 2017 Unadjusted trial balance Debit Credit 64,713.72 165,250.00 25,750.00 7,500.00 2,400.00 17,000.00 3,285.72 10,000.00 2,000.00 2,300.00 1,600.00 30,401.00 10,000.00 Adjusted trial balance Debit Credit 64,713.72 165,250.00 25,750.00 7,500.00 2,400.00 17,000.00 3,285.72 10,000.00 2,000.00 2,300.00 1,600.00 30,401.00 10,000.00 27,325.00 27,325.00 Account Cash Baking Supplies Merchandise Inventory (FIFO) Prepaid Rent Prepaid Insurance Baking Equipment Accumulated Depreciation Leasehold Improvements Accumulated Amortization Trademark Office Supplies Accounts Receivable Notes Payable Interest Payable Accounts Payable Wages Payable Loans Payable Common Stock Dividends Bakery Sales Merchandise Sales Baking Cost of Goods Sold Rent Expense Interest Expense Insurance Expense Depreciation Expense Amortization Expense Misc. Expense Office Supplies Expense Business License Expense Advertising Expense Wages Expense Telephone Expense Merchandise COGS (FIFO) 21,000.00 30,000.00 21,000.00 30,000.00 20,000.00 20,000.00 335,675.00 35,200.00 335,675.00 35,200.00 90,000.00 90,000.00 2,780.00 2,780.00 375.00 5,200.00 375.00 5,200.00 3,456.00 15,760.00 3,456.00 15,760.00 Total 464,485.72 464,485.72 464,485.72 464,485.72 Peyton Approved Adjusting Journal Entries 2017 Debit Credit Date Accounts 31-Dec Depreciation Expense Accumulated depreciation 31-Dec Amortization Expense Accumulated Amortization 31-Dec Interest Expense Interest Payable 31-Dec Insurance Expense Prepaid Insurance 31-Dec Baking Cost of Goods Sold Baking Supplies 31-Dec Office Supplies Expense Office Supplies 31-Dec Wages Expense Wages Payable Peyton Approved Income Statement For Year Ending 12/31/2017 Bakery Sales Merchandise Sales Total Revenues Merchandise Cost of Goods Sold (FIFO) Baking Cost of Goods Sold Gross Profit Operating Expenses: Rent Expense Interest Expense Insurance Expense Depreciation Expense Amortization Expense Misc. Expense Office Supplies Expense Business License Expense Advertising Expense Wages Expense Telephone Expense Total Operating Expenses: Net Income Peyton Approved Closing Entries For Year Ending 12/31/2017 Debit Credit Date Accounts 31-Dec Bakery Sales Merchandise Sales Income Summary 31-Dec Income Summary Baking Cost of Goods Sold Rent Expense Interest Expense Insurance Expense Depreciation Expense Amortization Expense Misc. Expense Office Supplies Expense Business License Expense Advertising Expense Wages Expense Telephone Expense Merchandise Cost of Goods Sold (FIFO) 31-Dec Income Summary Retained Earnings 31-Dec Retained Earnings Dividends Peyton Approved Statement of Retained Earnings For Year Ending 12/31/2017 Beginning Balance: plus Net Income less Dividends: Ending Balance: Peyton Approved Balance Sheet As of December 31, 2017 Assets Current Assets: Cash Baking Supplies Merchandise Inventory (FIFO) Prepaid Rent Prepaid Insurance Office Supplies Accounts Receivable Total Current Assets Liabilities and Owners' Equity Current Liabilities: Accounts Payable Wages Payable Interest Payable Total Current Liabilities Long Term Liabilities: Notes Payable Loans Payable Total Long Term Liabilities: Total Liabilities: Long Term/Fixed Assets: Baking Equipment Accumulated Depreciation Common Stock Retained Earnings Total Equity Leasehold Improvements Accumulated Amortization Trademark Total Assets: Total Liabilities & Equity Asset Accounts Liability Accounts Equity Accounts Acct # 301 302 Acct # 201 Common Stock 202 Dividends 203 204 205 Cash Baking Supplies Prepaid Rent Prepaid Insurance Baking Equipment Office Supplies Accounts Receivable Accumulated Depreciation Trademark Leasehold Improvements Accumulated Amortization Acct # 101 Notes Payable 102 Accounts Payable 103 Wages Payable 104 Interest Payable 105 Loans Payable 106 107 108 109 110 111 Revenue Accounts Acct # Bakery Sales Merchandise Sales 401 402 This chart of accounts should help you identify the appropriate accounts to record to as you are analyzing and journaling transactions for this workbook. There is nothing to complete on this page; this is simply a resource for you. Expense Accounts Acct # 501 Baking Cost of Goods Sold Merchandise Cost of Goods Sold (FIFO) Rent Expense Insurance Expense Misc. Expense Business License Expense Advertising Expense Wages Expense Telephone Expense Interest Expense Depreciation Expense Amortization Expense Office Supplies Expense 502 503 504 505 506 507 508 509 510 511 512 513 Scenario for adjusting entries: Year end is December 31, 2017. Peyton Baking Company uses the following accounting practices: Inventory: Periodic, FIFO for both baking and merchandise o Baking supplies: $27,850 ending inventory Equipment: Straight line method used for equipment O Mixing machine: $5,000 initial cost, $500 salvage value, 3rd year of use of 7 total ($642.86 per year) Ovens: $8,000 initial cost, $1,000 salvage value, 3rd year of use of 7 total ($1,000 per year) Other depreciable equipment: $4,000 initial cost, $0 salvage value, 1st year of use of 4 total ($1,000 per year) Bakery Leasehold Improvements: $10,000, 2nd year of use ($2,000 per year) O Trademark for company name: Initial cost, $2,300, 3rd year of use Office supplies: Periodic, FIFO. Ending balance is $250. Pay period is every 2 weeks. Last pay period ended December 27. o 60 employees with a daily pay of $5,700. All receive pay through December 31. Financing: 06% interest note payable was made on January 31, 2017, and is due February 1, 2019. o 5-year loan was made on June 1, 2017. Terms are 7.5% annual rate, interest only until due date. Insurance: Annual policy covers 12 months, purchased in February, covering March 2017- February 2018. No monthly adjustments have been made. . Other information: An employee slipped and fell in the baking area and has filed a lawsuit. The company lawyer indicates that it is probable that the company will be found liable. No additional information is available

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts