Question: Please help with these three questions 1. 2. 3. Land costing $41,492 was sold for $87,504 cash. The gain on the sale was reported on

Please help with these three questions

1.

2.

3.

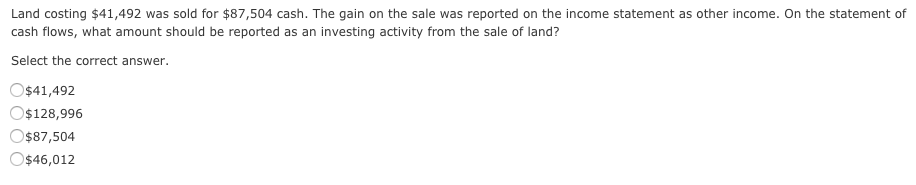

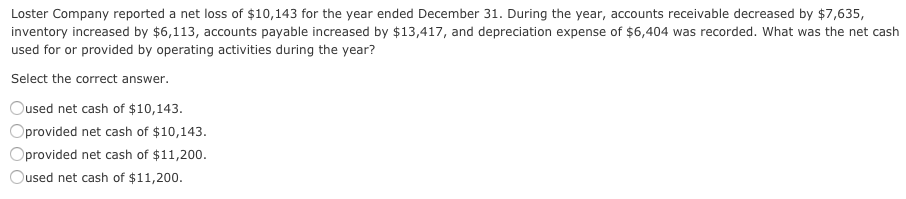

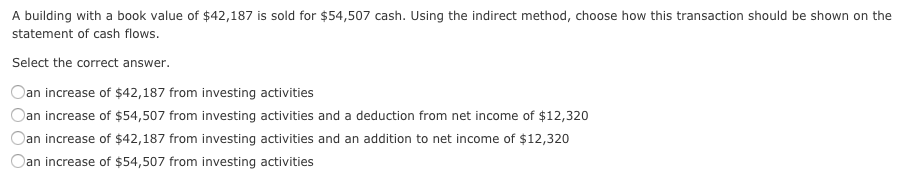

Land costing $41,492 was sold for $87,504 cash. The gain on the sale was reported on the income statement as other income. On the statement of cash flows, what amount should be reported as an investing activity from the sale of land? Select the correct answer. O$41,492 o$128,996 $87,504 $46,012 Loster Company reported a net loss of $10,143 for the year ended December 31. During the year, accounts receivable decreased by $7,635, inventory increased by $6,113, accounts payable increased by $13,417, and depreciation expense of $6,404 was recorded. What was the net cash used for or provided by operating activities during the year? Select the correct answer Oused net cash of $10,143. Oprovided net cash of $10,143. Oprovided net cash of $11,200 Oused net cash of $11,200 A building with a book value of $42,187 is sold for $54,507 cash. Using the indirect method, choose how this transaction should be shown on the statement of cash flows. Select the correct answer. Oan increase of $42,187 from investing activities Oan increase of $54,507 from investing activities and a deduction from net income of $12,320 an increase of $42,187 from investing activities and an addition to net income of $12,320 Oan increase of $54,507 from investing activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts