Question: please help with these two tax calculation questions asap. After completing her tax return, Anne shows a Taxable Income of $210,550.00. Using the tax brackets

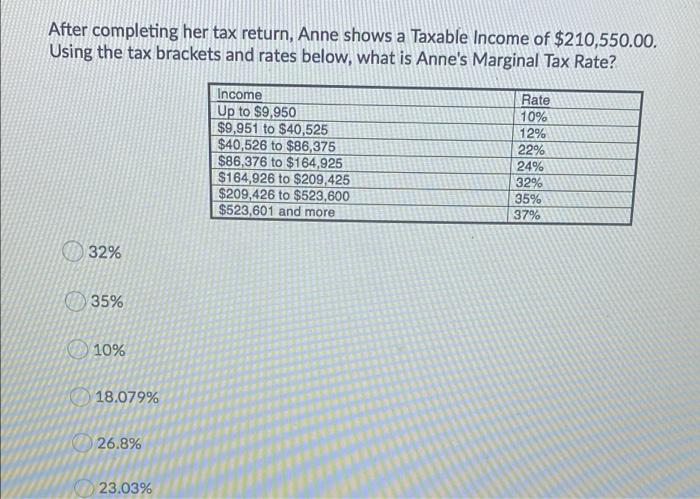

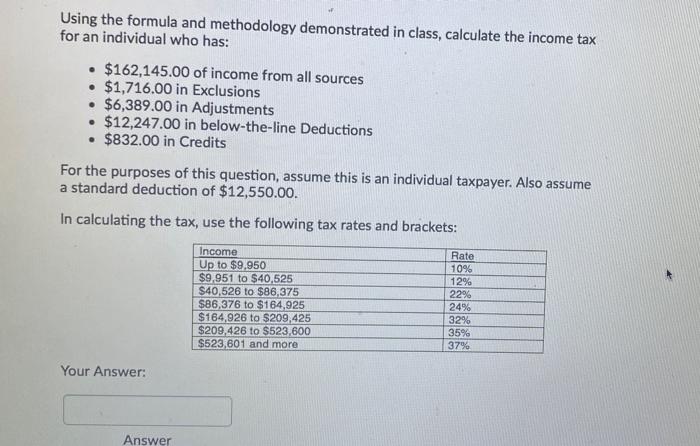

After completing her tax return, Anne shows a Taxable Income of $210,550.00. Using the tax brackets and rates below, what is Anne's Marginal Tax Rate? Income Up to $9,950 $9,951 to $40,525 $40,526 to $86,375 $86,376 to $164.925 $164,926 to $209,425 $209,426 to $523,600 $523,601 and more Rate 10% 12% 22% 24% 32% 35% 37% 32% 35% 10% 18.079% 26.8% 23.03% Using the formula and methodology demonstrated in class, calculate the income tax for an individual who has: $162,145.00 of income from all sources $1,716.00 in Exclusions $6,389.00 in Adjustments $12,247.00 in below-the-line Deductions $832.00 in Credits For the purposes of this question, assume this is an individual taxpayer. Also assume a standard deduction of $12,550.00. In calculating the tax, use the following tax rates and brackets: Income Up to $9.950 $9.951 to $40,525 $40,526 to $86,375 $86,376 to $164,925 $164,926 to $209,425 $209,426 to $523,600 $523,601 and more Rate 10% 12% 22% 24% 32% 35% 37% Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts