Question: please help with these two tax questions asap. Question 12 (1 point) Listen When Walmart purchases goods from its suppliers, Walmart must pay sales tax

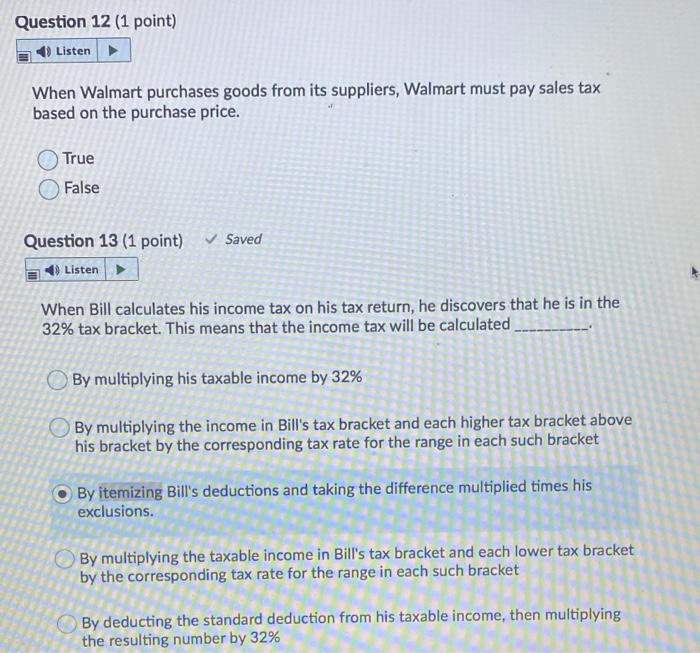

Question 12 (1 point) Listen When Walmart purchases goods from its suppliers, Walmart must pay sales tax based on the purchase price. True False Question 13 (1 point) Saved Listen When Bill calculates his income tax on his tax return, he discovers that he is in the 32% tax bracket. This means that the income tax will be calculated By multiplying his taxable income by 32% By multiplying the income in Bill's tax bracket and each higher tax bracket above his bracket by the corresponding tax rate for the range in each such bracket By itemizing Bill's deductions and taking the difference multiplied times his exclusions. By multiplying the taxable income in Bill's tax bracket and each lower tax bracket by the corresponding tax rate for the range in each such bracket By deducting the standard deduction from his taxable income, then multiplying the resulting number by 32%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts