Question: Please help with this 11 part question I am struggling! (Dividend policies) Final earnings estimates for Chilean Health Spa & Fitness Center have been prepared

Please help with this 11 part question I am struggling!

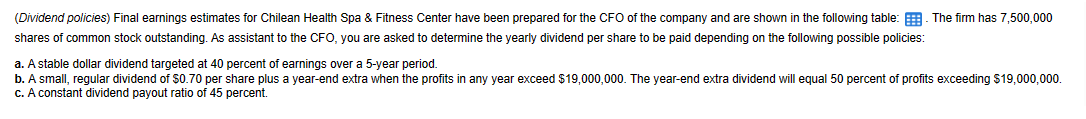

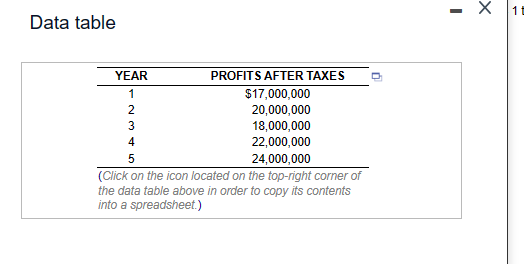

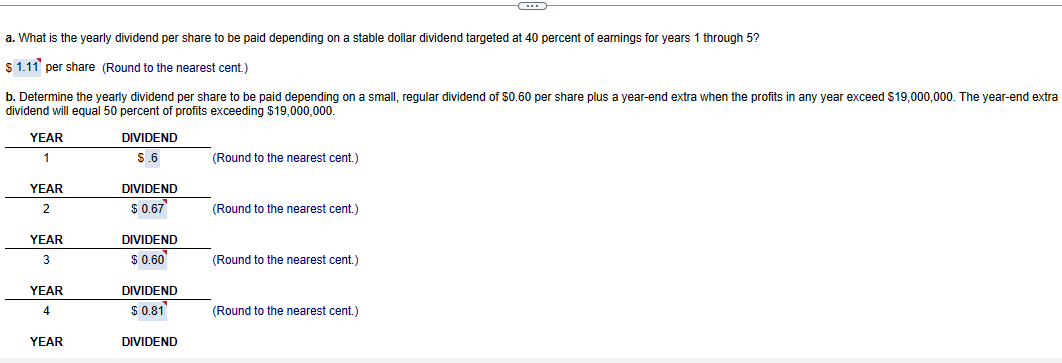

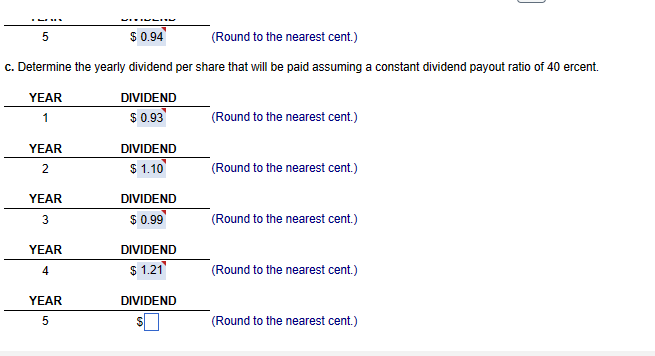

(Dividend policies) Final earnings estimates for Chilean Health Spa \& Fitness Center have been prepared for the CFO of the company and are shown in the following table: shares of common stock outstanding. As assistant to the CFO, you are asked to determine the yearly dividend per share to be paid depending on the following possible policies: a. A stable dollar dividend targeted at 40 percent of earnings over a 5 -year period. b. A small, regular dividend of $0.70 per share plus a year-end extra when the profits in any year exceed $19,000,000. The year-end extra dividend will equal 50 percent of profits exceeding $19,000,000. c. A constant dividend payout ratio of 45 percent. Data table a. What is the yearly dividend per share to be paid depending on a stable dollar dividend targeted at 40 percent of earnings for years 1 through 5 ? per share (Round to the nearest cent) b. Determine the yearly dividend per share to be paid depending on a small, regular dividend of $0.60 per share plus a year-end extra when the profits in any year exceed $19,000,000. The year-end extra dividend will equal 50 percent of profits exceeding $19,000,000. c. Determine the yearly dividend per share that will be paid assuming a constant dividend payout ratio of 40 ercent. \begin{tabular}{ccc} YEAR & DIVIDEND & \\ \cline { 1 - 2 } 1 & $0.93 & \\ YEAR & DIVIDEND & \\ \cline { 1 - 2 } 2 & $1.1 & (Round to the nearest cent.) \\ YEAR & DIVIDEND & \\ \cline { 1 - 2 } 3 & $0.99 & \\ YEAR & DIVIDEND & \\ \hline 4 & $1.21 & (Round to the nearest cent.) \\ YEAR & DIVIDEND & \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts