Question: Please help with this a. How much would Melanie pay per share for the open-end fund? How much would she pay per share for the

Please help with this

Please help with this

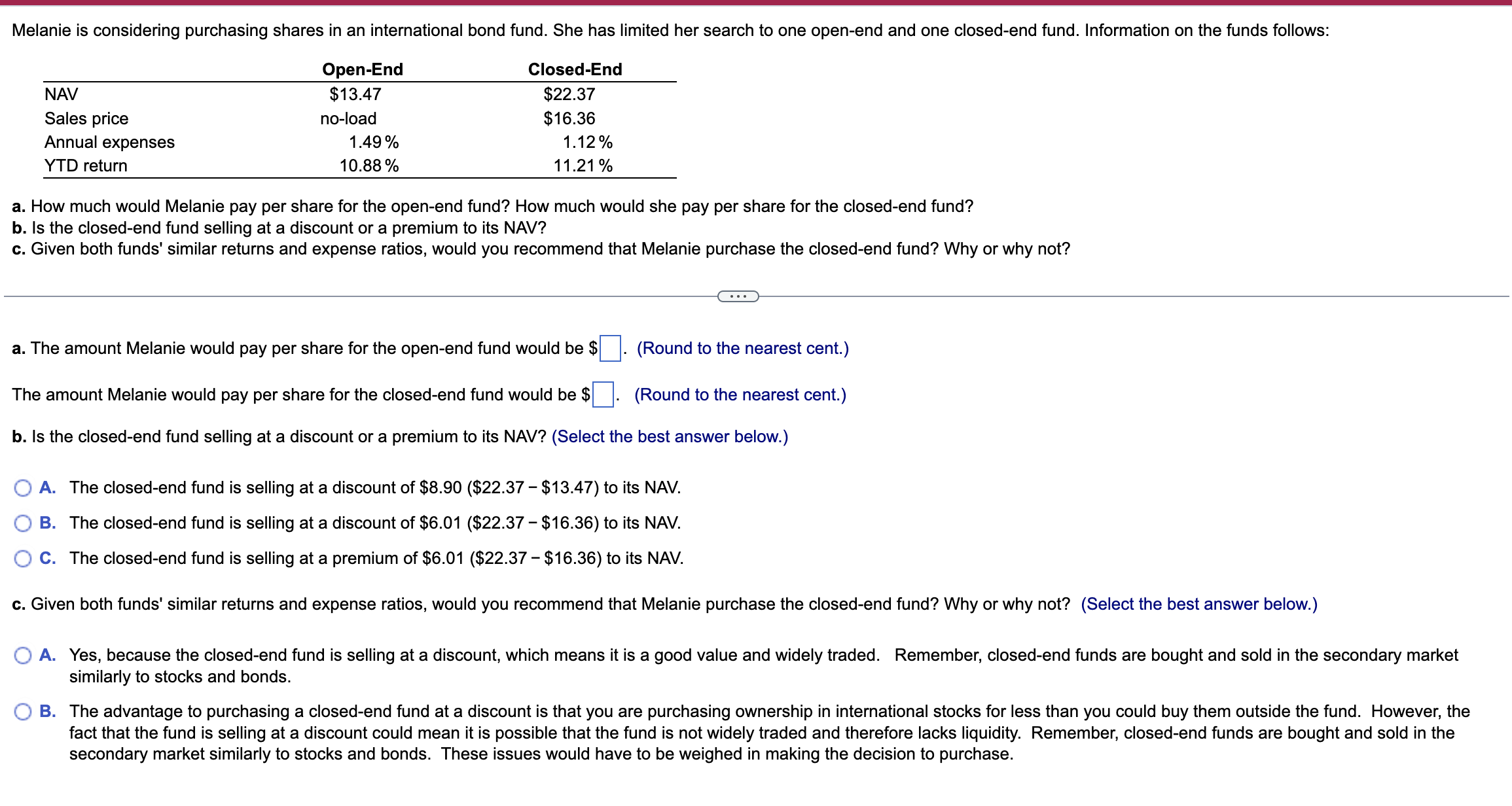

a. How much would Melanie pay per share for the open-end fund? How much would she pay per share for the closed-end fund? b. Is the closed-end fund selling at a discount or a premium to its NAV? c. Given both funds' similar returns and expense ratios, would you recommend that Melanie purchase the closed-end fund? Why or why not? a. The amount Melanie would pay per share for the open-end fund would be \\( \\$ \\quad \\). (Round to the nearest cent.) The amount Melanie would pay per share for the closed-end fund would be \\( \\$ \\quad \\) (Round to the nearest cent.) b. Is the closed-end fund selling at a discount or a premium to its NAV? (Select the best answer below.) A. The closed-end fund is selling at a discount of \\( \\$ 8.90(\\$ 22.37-\\$ 13.47) \\) to its NAV. B. The closed-end fund is selling at a discount of \\( \\$ 6.01(\\$ 22.37-\\$ 16.36) \\) to its NAV. C. The closed-end fund is selling at a premium of \\( \\$ 6.01(\\$ 22.37-\\$ 16.36) \\) to its NAV. c. Given both funds' similar returns and expense ratios, would you recommend that Melanie purchase the closed-end fund? Why or why not? (Select the best answer below.) A. Yes, because the closed-end fund is selling at a discount, which means it is a good value and widely traded. Remember, closed-end funds are bought and sold in the secondary market similarly to stocks and bonds. B. The advantage to purchasing a closed-end fund at a discount is that you are purchasing ownership in international stocks for less than you could buy them outside the fund. However, the fact that the fund is selling at a discount could mean it is possible that the fund is not widely traded and therefore lacks liquidity. Remember, closed-end funds are bought and sold in the secondary market similarly to stocks and bonds. These issues would have to be weighed in making the decision to purchase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts