Question: Please help with this accounting !I will give a thumbs up and a like to whoever does it first can you also make it clear

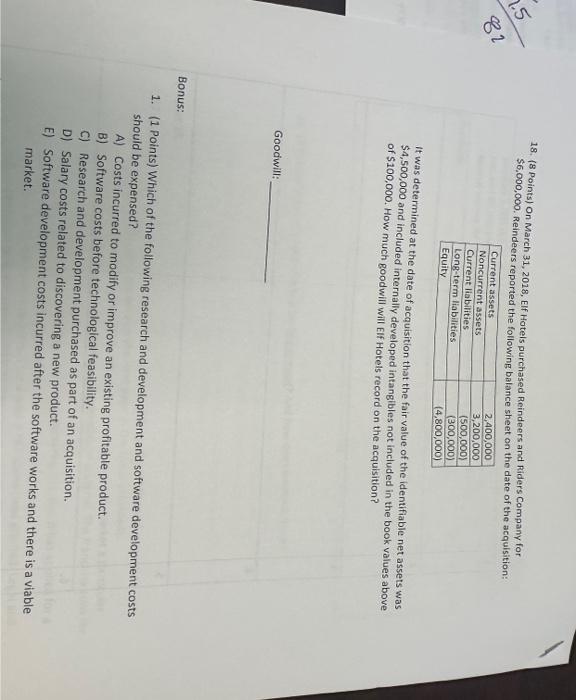

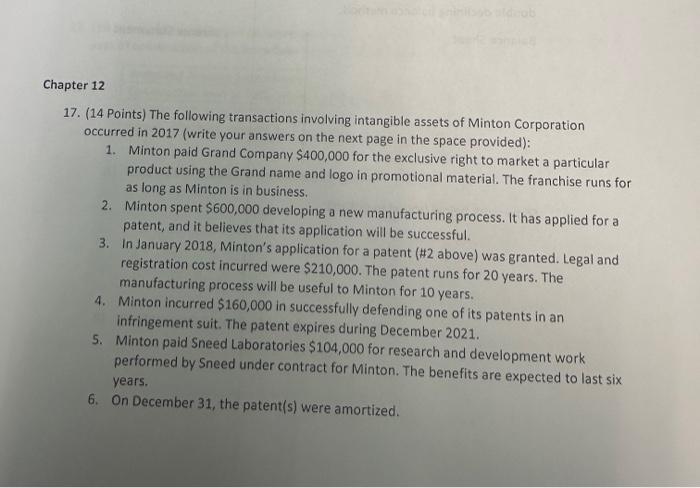

18. (8 Points) On March 31, 2018, Elf Hotels purchased Reindeers and Riders Company for $6,000,000. Reindeers reported the followine balance sheot an the fate of the acquisition: It was determined at the date of acquisition that the fair value of the identifiable net assets was $4,500,000 and included internally developed intangibles not included in the book values above of $100,000. How much goodwill will Elf Hotels record on the acquisition? Goodwill: 1. (1 Points) Which of the following research and development and software development costs should be expensed? A) Costs incurred to modify or improve an existing profitable product. B) Software costs before technological feasibility. C) Research and development purchased as part of an acquisition. D) Salary costs related to discovering a new product. E) Software development costs incurred after the software works and there is a viable market. 17. (14 Points) The following transactions involving intangible assets of Minton Corporation occurred in 2017 (write your answers on the next page in the space provided): 1. Minton paid Grand Company $400,000 for the exclusive right to market a particular product using the Grand name and logo in promotional material. The franchise runs for as long as Minton is in business. 2. Minton spent $600,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3. In January 2018 , Minton's application for a patent ( 2 above) was granted. Legal and registration cost incurred were $210,000. The patent runs for 20 years. The manufacturing process will be useful to Minton for 10 years. 4. Minton incurred $160,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2021. 5. Minton paid Sneed Laboratories $104,000 for research and development work performed by Sneed under contract for Minton. The benefits are expected to last six years. 6. On December 31 , the patent(s) were amortized. 18. (8 Points) On March 31, 2018, Elf Hotels purchased Reindeers and Riders Company for $6,000,000. Reindeers reported the followine balance sheot an the fate of the acquisition: It was determined at the date of acquisition that the fair value of the identifiable net assets was $4,500,000 and included internally developed intangibles not included in the book values above of $100,000. How much goodwill will Elf Hotels record on the acquisition? Goodwill: 1. (1 Points) Which of the following research and development and software development costs should be expensed? A) Costs incurred to modify or improve an existing profitable product. B) Software costs before technological feasibility. C) Research and development purchased as part of an acquisition. D) Salary costs related to discovering a new product. E) Software development costs incurred after the software works and there is a viable market. 17. (14 Points) The following transactions involving intangible assets of Minton Corporation occurred in 2017 (write your answers on the next page in the space provided): 1. Minton paid Grand Company $400,000 for the exclusive right to market a particular product using the Grand name and logo in promotional material. The franchise runs for as long as Minton is in business. 2. Minton spent $600,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3. In January 2018 , Minton's application for a patent ( 2 above) was granted. Legal and registration cost incurred were $210,000. The patent runs for 20 years. The manufacturing process will be useful to Minton for 10 years. 4. Minton incurred $160,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2021. 5. Minton paid Sneed Laboratories $104,000 for research and development work performed by Sneed under contract for Minton. The benefits are expected to last six years. 6. On December 31 , the patent(s) were amortized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts