Question: please help with this ASAP thank you !!!! 1)The amount that the kampes estimate will be needed for immediate needs,should frank die, is ? 2)the

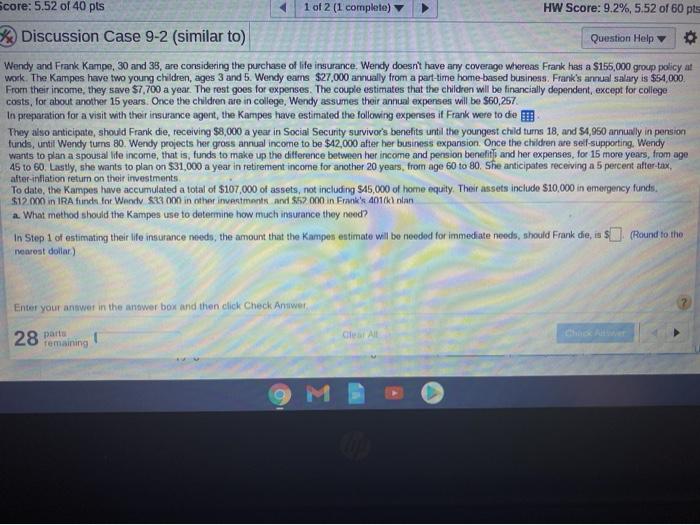

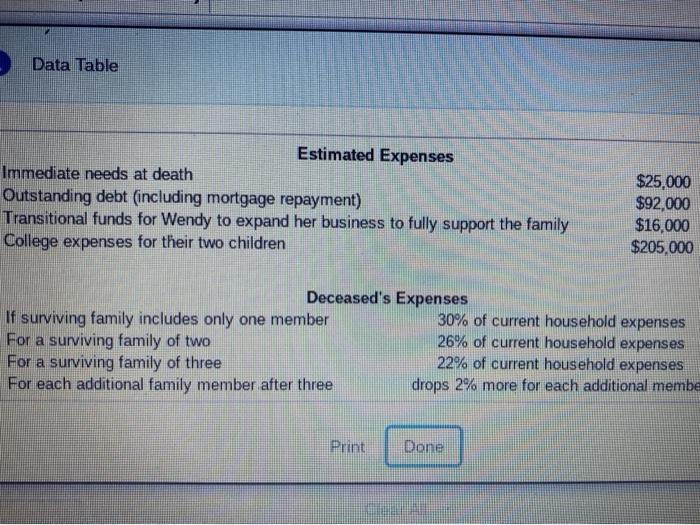

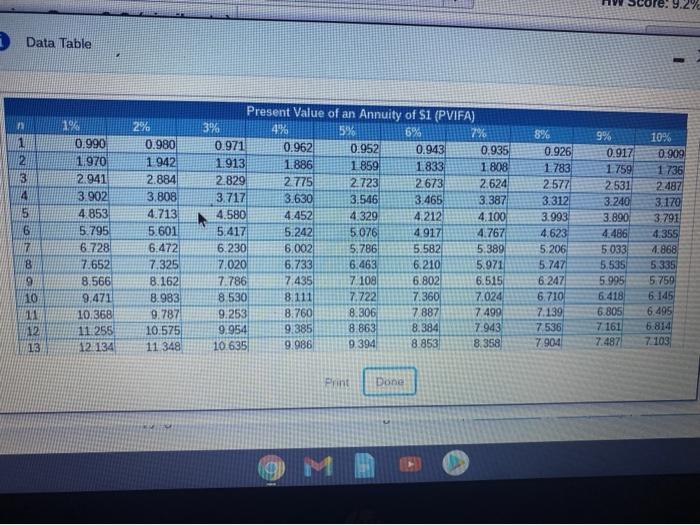

Score: 5.52 of 40 pts 1 of 2 (1 completo) HW Score: 9.2%, 5.52 of 60 pts * Discussion Case 9-2 (similar to) Question Help Wendy and Frank Kampn, 30 and 35, are considering the purchase of life insurance, Wendy doesn't have any coverage whereas Frank has a $155,000 group policy at work. The Kampes have two young children, ages 3 and 5. Wendy ears $27.000 annually from a part-time home-based business, Frank's annual salary is $54.000 From their income, they save $7,700 a year. The rest goes for expenses. The couple estimates that the children will be financially dependent, except for college costs, for about another 15 years. Once the children are in college, Wendy assumes their annual expenses will be $60,257 In preparation for a visit with their insurance agent, the Kampes have estimated the following expenses it Frank were to de They also anticipate, should Frank die, receiving $8,000 a year in Social Security survivor's benefits until the youngest child turns 18 and 54,950 annually in pension tunds, until Wendy turns 80. Wendy projects her gross annual income to be $42,000 after her business expansion Once the children are self-supporting, Wendy wants to plan a spousal life income, that is, funds to make up the difference between her income and pension benefit and her expenses, for 15 more years, from age 45 to 60. Lastly, she wants to plan on $31,000 a year in retirement income for another 20 years from age 60 to 80. She anticipates receiving a 5 percent after-tax, To date, the Kampes have accumulated a total of $107,000 of assets, not including $45,000 of home equity. Their assets include $10,000 in emergency funds. $12.000 in IRA funds for Woody $33 000 in other investments and $57.000 in Frank's 401(kllan a What method should the Kampes use to determine how much insurance they need? In Step 1 of estimating their life insurance noods, the amount that the Kampes estimate will be needed for immediate needs, should Frank die, is $ (Round to the nearest dollar) after-inflation return on their investments Enter your answer in the answer box and then click Check Antwer 28 parto remaining 9 M Data Table Estimated Expenses Immediate needs at death Outstanding debt (including mortgage repayment) Transitional funds for Wendy to expand her business to fully support the family College expenses for their two children $25,000 $92,000 $16,000 $205,000 Deceased's Expenses If surviving family includes only one member 30% of current household expenses For a surviving family of two 26% of current household expenses For a surviving family of three 22% of current household expenses For each additional family member after three drops 2% more for each additional membe Print Done 9.24 Data Table 1% 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9,471 10.368 11 255 12 134 6 7 8 9 10 11 12 13 2% 0.980 1942 2.884 3,808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11 348 Present Value of an Annuity of $1 (PVIFA) 3% 49% 5% 6% 7% 0.971 0.962 0.952 0.943 0.935 1913 1.886 1 859 1833 1 808 2.829 2775 2.723 2 673 2.624 3.717 3.630 3.546 3.465 3.387 4.580 4.452 4.329 4.212 4.100 5.417 5.242 5076 4917 4.767 6.230 6.002 5.786 5.582 5.389 7.020 6.733 6.463 6.210 5.971 7.786 7,435 7 108 6.802 6.515 8.530 8.111 7.722 7.360 7.024 9.253 8.760 8.306 7 887 7499 9.954 9.385 8.863 8.384 7.943 10 635 9.986 9.394 8.853 8.358 8% 0.926 1783 2.577 3.312 3.993 4.623 5. 206 5.747 6 247 6.710 7.139 7536 7.904 9% 0.917 1.759 2.531 3.240 3.890 4.486 5033 5.535 5.995 6.418 6.805 7161 7.487 10% 0.909 1 736 2.487 3.170 3.791 4.355 7.868 5335 5.750 6.145 6.495 6.814 7103 Print Done Score: 5.52 of 40 pts 1 of 2 (1 completo) HW Score: 9.2%, 5.52 of 60 pts * Discussion Case 9-2 (similar to) Question Help Wendy and Frank Kampn, 30 and 35, are considering the purchase of life insurance, Wendy doesn't have any coverage whereas Frank has a $155,000 group policy at work. The Kampes have two young children, ages 3 and 5. Wendy ears $27.000 annually from a part-time home-based business, Frank's annual salary is $54.000 From their income, they save $7,700 a year. The rest goes for expenses. The couple estimates that the children will be financially dependent, except for college costs, for about another 15 years. Once the children are in college, Wendy assumes their annual expenses will be $60,257 In preparation for a visit with their insurance agent, the Kampes have estimated the following expenses it Frank were to de They also anticipate, should Frank die, receiving $8,000 a year in Social Security survivor's benefits until the youngest child turns 18 and 54,950 annually in pension tunds, until Wendy turns 80. Wendy projects her gross annual income to be $42,000 after her business expansion Once the children are self-supporting, Wendy wants to plan a spousal life income, that is, funds to make up the difference between her income and pension benefit and her expenses, for 15 more years, from age 45 to 60. Lastly, she wants to plan on $31,000 a year in retirement income for another 20 years from age 60 to 80. She anticipates receiving a 5 percent after-tax, To date, the Kampes have accumulated a total of $107,000 of assets, not including $45,000 of home equity. Their assets include $10,000 in emergency funds. $12.000 in IRA funds for Woody $33 000 in other investments and $57.000 in Frank's 401(kllan a What method should the Kampes use to determine how much insurance they need? In Step 1 of estimating their life insurance noods, the amount that the Kampes estimate will be needed for immediate needs, should Frank die, is $ (Round to the nearest dollar) after-inflation return on their investments Enter your answer in the answer box and then click Check Antwer 28 parto remaining 9 M Data Table Estimated Expenses Immediate needs at death Outstanding debt (including mortgage repayment) Transitional funds for Wendy to expand her business to fully support the family College expenses for their two children $25,000 $92,000 $16,000 $205,000 Deceased's Expenses If surviving family includes only one member 30% of current household expenses For a surviving family of two 26% of current household expenses For a surviving family of three 22% of current household expenses For each additional family member after three drops 2% more for each additional membe Print Done 9.24 Data Table 1% 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9,471 10.368 11 255 12 134 6 7 8 9 10 11 12 13 2% 0.980 1942 2.884 3,808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11 348 Present Value of an Annuity of $1 (PVIFA) 3% 49% 5% 6% 7% 0.971 0.962 0.952 0.943 0.935 1913 1.886 1 859 1833 1 808 2.829 2775 2.723 2 673 2.624 3.717 3.630 3.546 3.465 3.387 4.580 4.452 4.329 4.212 4.100 5.417 5.242 5076 4917 4.767 6.230 6.002 5.786 5.582 5.389 7.020 6.733 6.463 6.210 5.971 7.786 7,435 7 108 6.802 6.515 8.530 8.111 7.722 7.360 7.024 9.253 8.760 8.306 7 887 7499 9.954 9.385 8.863 8.384 7.943 10 635 9.986 9.394 8.853 8.358 8% 0.926 1783 2.577 3.312 3.993 4.623 5. 206 5.747 6 247 6.710 7.139 7536 7.904 9% 0.917 1.759 2.531 3.240 3.890 4.486 5033 5.535 5.995 6.418 6.805 7161 7.487 10% 0.909 1 736 2.487 3.170 3.791 4.355 7.868 5335 5.750 6.145 6.495 6.814 7103 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts