Question: PLEASE HELP WITH THIS CASE!!!! please show work (preferably in excel) as it will help me learn how to actually do it and see where

PLEASE HELP WITH THIS CASE!!!! please show work (preferably in excel) as it will help me learn how to actually do it and see where the numbers are coming from, and explain why you did what you did.

NEWCORE, INC.

Ted sat at his office desk pondering over what was discussed at his last meeting with Treasurer, Sophie Camden.

Sophie received a memo from the board asking her to review and rectify the company's credit management problem

as soon as possible. 100% of their sales are on credit, and they are simply carrying their customers for too long of a

time period. Sophie called her assistant, Ted and briefed him of the situation.

Newcore has been in business since 1975, producing small and medium sized specialty machinery. Its primary

customer base is local and regional manufacturers and repair shops. Sales have steadily increased over the years, until

recently. Over the past year, there has been a slowdown as higher interest rates and a weakening economy have

caused a slump in the sector. Newcore has found most of its clients are strapped for cash and are accustomed to fairly

flexible credit terms. The firm has been hard pressed to offer terms of net 60 to its clients in order to counter

competition and to maintain good customer relationships.

As Ted reviews the financial statements and the aging schedule of receivables, he realizes that despite the fairly

liberal credit terms, on average, 40% of the credit sales are being collected 10 days late. The company has not

implemented a policy of charging interest or late fees for fear of losing customers. He also noticed that over the past

year, the number of bad debts has increased from 1% of gross sales to its current level of 2% of gross sales.

As Ted considers changes to the firm's collection policy, he consults the sales department regarding the expected

impact of tightening the credit policy. He's advised that a switch to the 2/10 net 45 policy under consideration would

likely decrease sales by about 10%. The sales staff has built up a good relationship with customers and are confident

that they can retain most of the accounts, especially with an incentive to pay early. If Ted's other possible policy

change to terms of 2/10 net 60 is instituted, the sales staff believes there will be no drop in sales.

Under either of the new terms, Ted estimates that 50% of sales will be collected in the discount period. Of the

remaining 50% for the 2/10 net 45 policy, about 60% will pay within the credit period and the remainder are expected

to be 25 days late. Of the remaining 50% for the 2/10 net 60 policy, 70% are expected to pay on time and the

remainder are expected to continue paying 10 days late. At least in the short term, Ted expects no change in the 2%

bad debt rate.

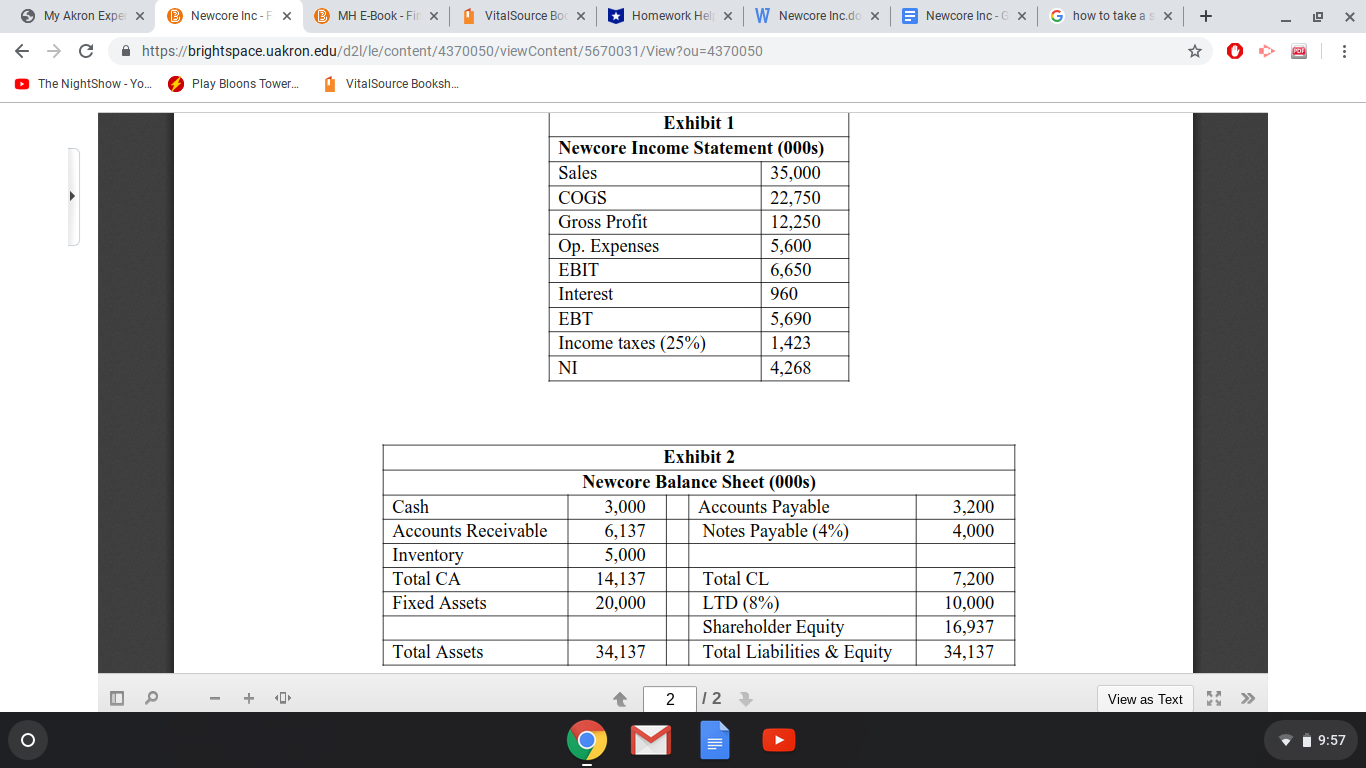

In order to make a fairly quick, but informed decision, Ted gathers up simplified versions of Newcore's most recent

income statement (Exhibit 1) and balance sheet (Exhibit 2), and settles in to consider the following questions:

1.

What is the amount of annual expense to the firm as a result of the delay in collections?

2.

Estimate the cost of foregoing the 2% cash discount offered under the 2/10 net 45 and 2/10 net 60 terms

respectively. Given that most customer firms could take short-term bank loans at an annual rate of 8%, what

would you recommend?

3.

Analyze the net marginal benefit/marginal cost of switching to the 2/10 net 45 or 2/10 net 60 credit policy

alternative, respectively.

4.

Develop the pro forma financial statements for the company under the 2/10 net 45 and 2/10 net 60 credit policy

alternative, respectively.

5.

Which policy should Ted recommend to the board

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts