Question: Please help with this chart! Thank you! 2. For each case calculate S2's share, the marital deduction, and the taxable estate on the assumption that

Please help with this chart! Thank you!

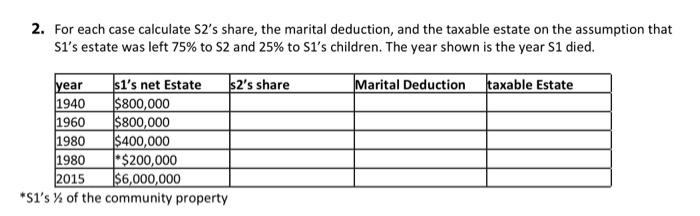

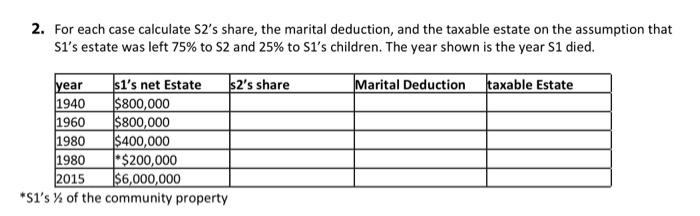

2. For each case calculate S2's share, the marital deduction, and the taxable estate on the assumption that Si's estate was left 75% to 52 and 25% to Si's children. The year shown is the year S1 died. Marital Deduction taxable Estate year s1's net Estate s2's share 1940 $800,000 (1960 $800,000 (1980 $400,000 1980 *$200,000 2015 $6,000,000 *S1's % of the community property

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock