Question: Please help with this equity security. There are questions A through D and all information to answer questions are above. Thank you! On its December

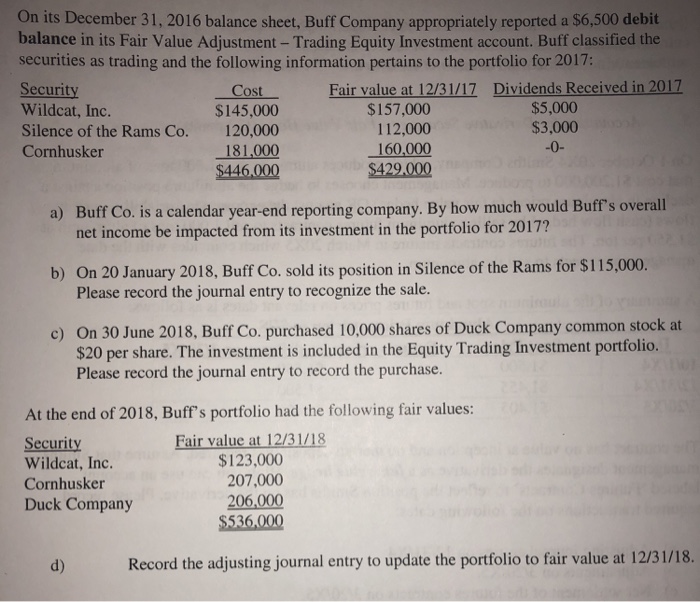

On its December 31, 2016 balance sheet, Buff Company appropriately reported a $6,500 debit balance in its Fair Value Adjustment-Trading Equity Investment account. Buff classified the securities as trading and the following information pertains to the portfolio for 2017: Securit Wildcat, Inc. Silence of the Rams Co. 120,000 Cornhusker Dividends Received in 2017 Cost $145,000 181.000 $446.000 Fair value at 12/31/17 $157,000 112,000 160,000 $429,000 $5,000 $3,000 a) Buff Co. is a calendar year-end reporting company. By how much would Buff's overall b) On 20 January 2018, Buff Co. sold its position in Silence of the Rams for $115,000. c) On 30 June 2018, Buff Co. purchased 10.000 shares of Duck Company common stock at net income be impacted from its investment in the portfolio for 2017? Please record the journal entry to recognize the sale. $20 per share. The investment is included in the Equity Trading Investment portfolio. Please record the journal entry to record the purchase. At the end of 2018, Buff's portfolio had the following fair values: Fair value at 12/31/18 $123,000 207,000 206,000 $536,000 Security Wildcat, Inc. Cornhusker Duck Company d) Record the adjusting journal entry to update the portfolio to fair value at 12/31/18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts