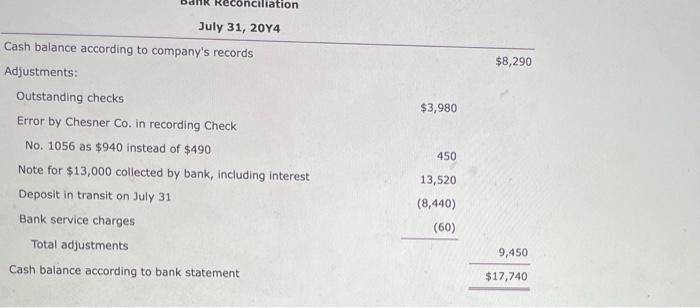

Question: Please help with this, its three pictures into one question. onciliation $8,290 $3,980 July 31, 2014 Cash balance according to company's records Adjustments: Outstanding checks

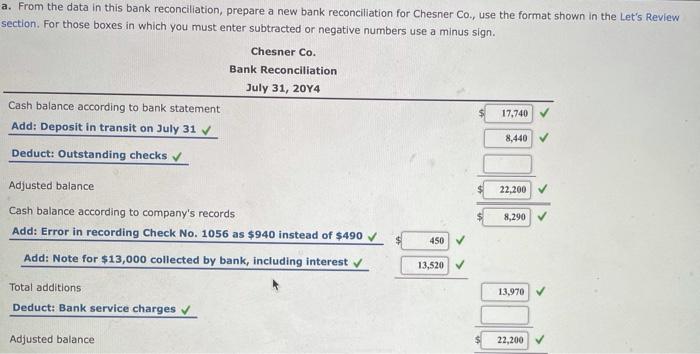

onciliation $8,290 $3,980 July 31, 2014 Cash balance according to company's records Adjustments: Outstanding checks Error by Chesner Co. in recording Check No. 1056 as $940 instead of $490 Note for $13,000 collected by bank, including interest Deposit in transit on July 31 Bank service charges Total adjustments Cash balance according to bank statement 450 13,520 (8,440) (60) 9,450 $17,740 a. From the data in this bank reconciliation, prepare a new bank reconciliation for Chesner Co., use the format shown in the Let's Review section. For those boxes in which you must enter subtracted or negative numbers use a minus sign. Chesner Co. Bank Reconciliation July 31, 2014 Cash balance according to bank statement 17,740 Add: Deposit in transit on July 31 8,440 Deduct: Outstanding checks Adjusted balance 22,200 8,290 Cash balance according to company's records Add: Error in recording Check No. 1056 as $940 instead of $490 V Add: Note for $13,000 collected by bank, including interest 450 13,520 13,970 Total additions Deduct: Bank service charges Adjusted balance 22,200 b. If a balance sheet were prepared for Chesner Co. on July 31, 20Y4, what amount should be reported for cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts