Question: Please help with this multi step problem!! thank you! Required information [The following information applies to the questions displayed below.] Thrillville has $40 million in

![following information applies to the questions displayed below.] Thrillville has $40 million](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6717b4369f8a7_7106717b4363ebf6.jpg)

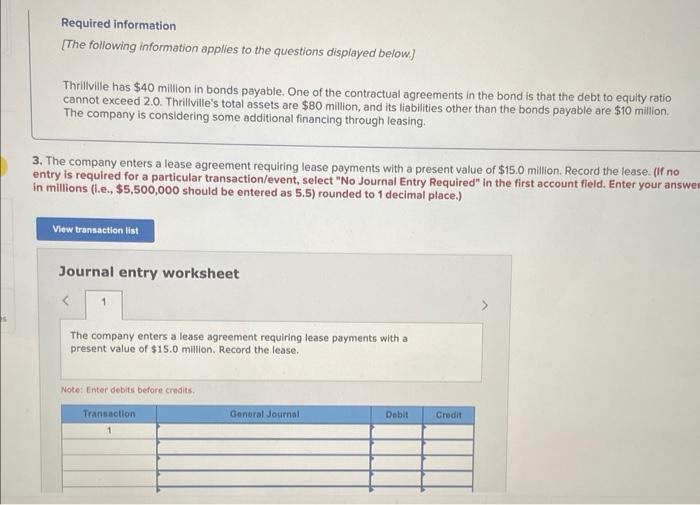

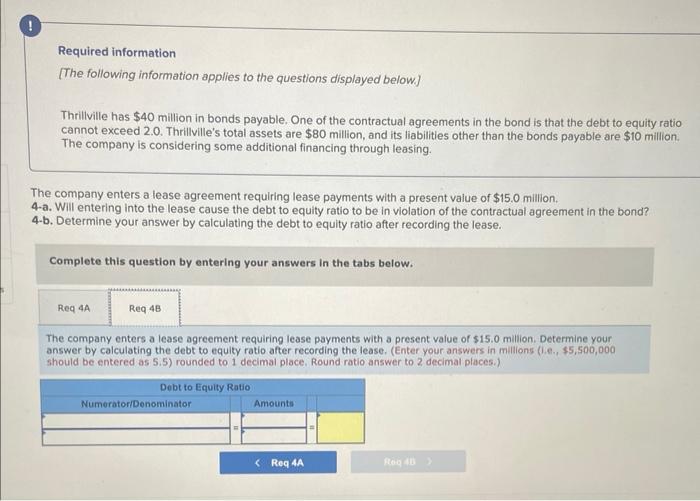

Required information [The following information applies to the questions displayed below.] Thrillville has $40 million in bonds payable. One of the contractual agreements in the bond is that the debt to equity ratio cannot exceed 2.0. Thrillville's total assets are $80 million, and its liabilities other than the bonds payable are $10 million. The company is considering some additional financing through leasing. 3. The company enters a lease agreement requiring lease payments with a present value of $15.0 million. Record the lease. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answe in millions (i.e., $5,500,000 should be entered as 5.5) rounded to 1 decimal place.) Journal entry worksheet The company enters a lease agreement requiring lease payments with a present value of $15.0 million. Record the lease. Notet Lnter debits before credits. Required information [The following information applies to the questions displayed below] Thrillville has $40 million in bonds payable. One of the contractual agreements in the bond is that the debt to equity ratio cannot exceed 2.0. Thrillville's total assets are $80 million, and its liabilities other than the bonds payable are $10 million. The company is considering some additional financing through leasing. he company enters a lease agreement requiring lease payments with a present value of $15.0 million. a. Will entering into the lease cause the debt to equity ratio to be in violation of the contractual agreement in the bond? -b. Determine your answer by calculating the debt to equity ratio after recording the lease. Complete this question by entering your answers in the tabs below. The company enters a lease agreement requiring lease payments with a present value of $15.0 million. Will entering into the lease cause the debt to equity ratio to be in violation of the contractual agreement in the bond? Required information [The following information applies to the questions displayed below] Thrillville has $40 million in bonds payable. One of the contractual agreements in the bond is that the debt to equity ratio cannot exceed 2.0. Thrillville's total assets are $80 million, and its liabilities other than the bonds payable are $10 million. The company is considering some additional financing through leasing. The company enters a lease agreement requiring lease payments with a present value of $15.0 million. 4-a. Will entering into the lease cause the debt to equity ratio to be in violation of the contractual agreement in the bond? 4-b. Determine your answer by calculating the debt to equity ratio after recording the lease. Complete this question by entering your answers in the tabs below. The company enters a lease agreement requiring lease payments with a present value of $15.0 million. Determine your answer by calculating the debt to equity ratio after recording the lease. (Enter your answers in milions (i.e., $5,500,000 should be entered as 5.5) rounded to 1 decimal place. Round ratio answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts