Question: please help with this practice problem 2. 2.a Assume that you can either invest all of your wealth in one of two securities, 1 and

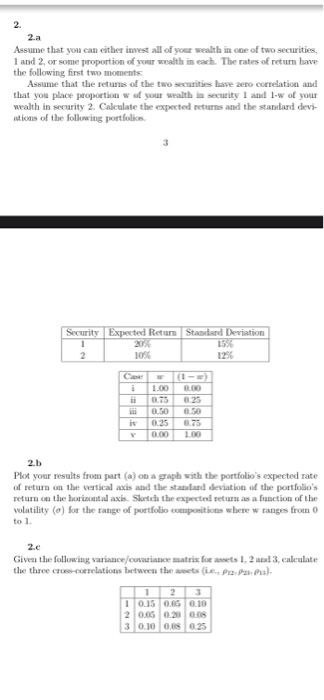

2. 2.a Assume that you can either invest all of your wealth in one of two securities, 1 and 2 or some proportion of your wealth in cach. The rates of return have the following first two moments Assume that the returns of the two securities have zero correlation and that you place proportion of your wealth in security and l-w of your wealth in security 2. Calculate the expected returns and the standard devi- utions of the following portfolics Security Expected Retum Standard Deviation 1 15/ 2 105 1256 25 1.00 0.75 OSO 0.25 0.00 in 0.75 1.00 2.b Plot your results from part (a) on a graph with the portfolio's expected rate of return on the vertical axis and the standard deviation of the portfolio's return on the horizontal axis. Skatch the expected return as a function of the volatility (o) for the range of portfolio compositions where w ranges from to 1 2.c Given the following variance/covariance matrix for awets 1, 2 and 3, calculate the three cro-correlations between the wees (ie, P. Pa Pus). 1 2 10.15 0.06 0.10 20.05 0.20 0.08 30.10 0.0 0.25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts