Question: please help with this practice problem, thanks so much for your help! 2. You are currently analyzing two companies: Phelpsco, and Boltco. Phelpsco has 1

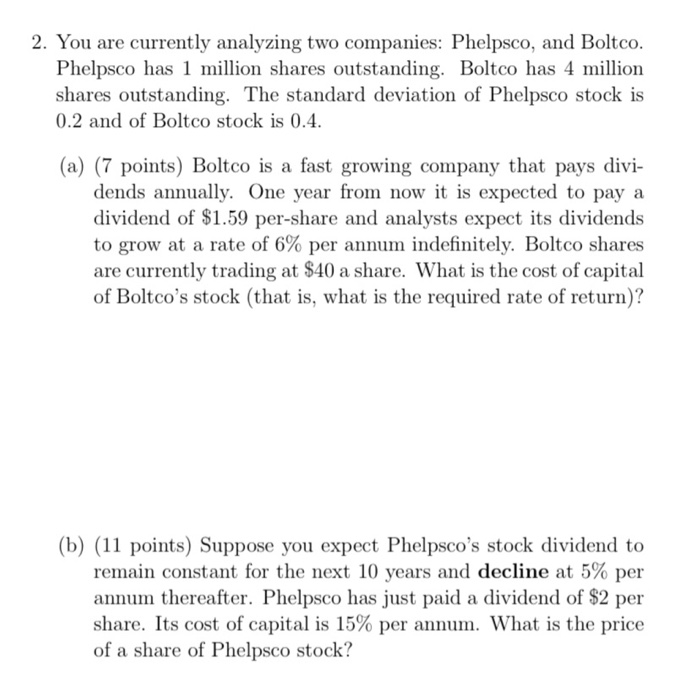

2. You are currently analyzing two companies: Phelpsco, and Boltco. Phelpsco has 1 million shares outstanding. Boltco has 4 million shares outstanding. The standard deviation of Phelpsco stock is 0.2 and of Boltco stock is 0.4. (a) (7 points) Boltco is a fast growing company that pays divi- dends annually. One year from now it is expected to pay a dividend of $1.59 per-share and analysts expect its dividends to grow at a rate of 6% per annum indefinitely. Boltco shares are currently trading at $40 a share. What is the cost of capital of Boltco's stock (that is, what is the required rate of return)? (b) (11 points) Suppose you expect Phelpsco's stock dividend to remain constant for the next 10 years and decline at 5% per annum thereafter. Phelpsco has just paid a dividend of $2 per share. Its cost of capital is 15% per annum. What is the price of a share of Phelpsco stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts