Question: Please help with this practice question. A tax is levied on sellers of candy bars. The figure below shows the market for candy bars where

Please help with this practice question.

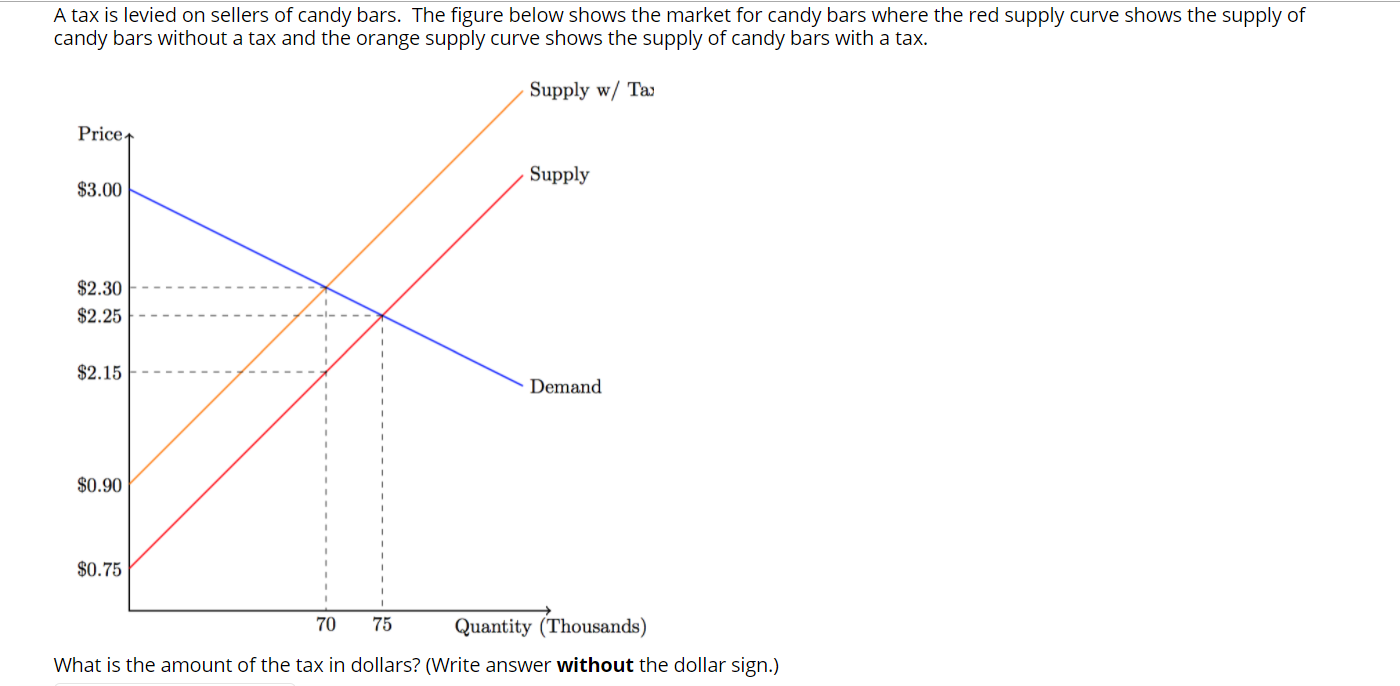

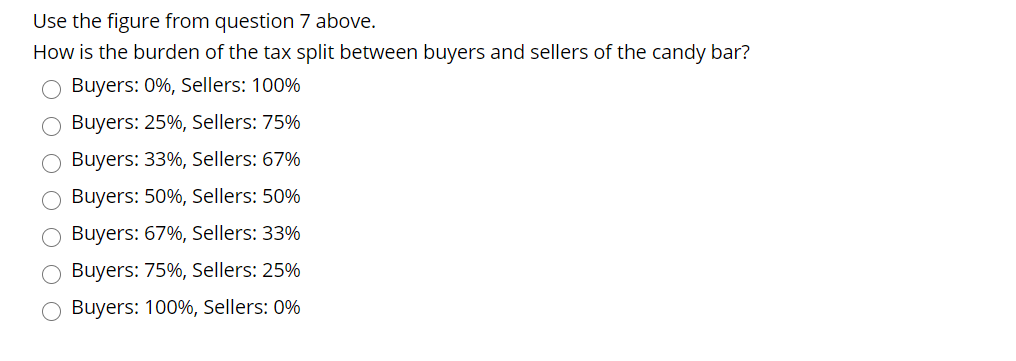

A tax is levied on sellers of candy bars. The figure below shows the market for candy bars where the red supply curve shows the supply of candy bars without a tax and the orange supply curve shows the supply of candy bars with a tax. Suppl)r w/ Ta: Price s 1 $3.00 "pp y $2.30 $2.25 $115 Demand $0.90 $0.75 70 75 Quantity (Thousands) What is the amount of the tax in dollars? (Write answer without the dollar Sign.) Use the gure from question 7 above. How is the burden of the tax split between buyers and sellers of the candy bar? 0 Buyers: 0%, Sellers: 100% 0 Buyers: 25%, Sellers: 75% 0 Buyers: 33%, Sellers: 67% 0 Buyers: 50%, Sellers: 50% 0 Buyers: 67%, Sellers: 33% 0 Buyers: 75%, Sellers: 25% 0 Buyers: 100%, Sellers: 0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts