Question: Please help with this problem. Don't know what I am doing wrong The current assets and current liabilities sections of the balance sheet of Crane

Please help with this problem. Don't know what I am doing wrong

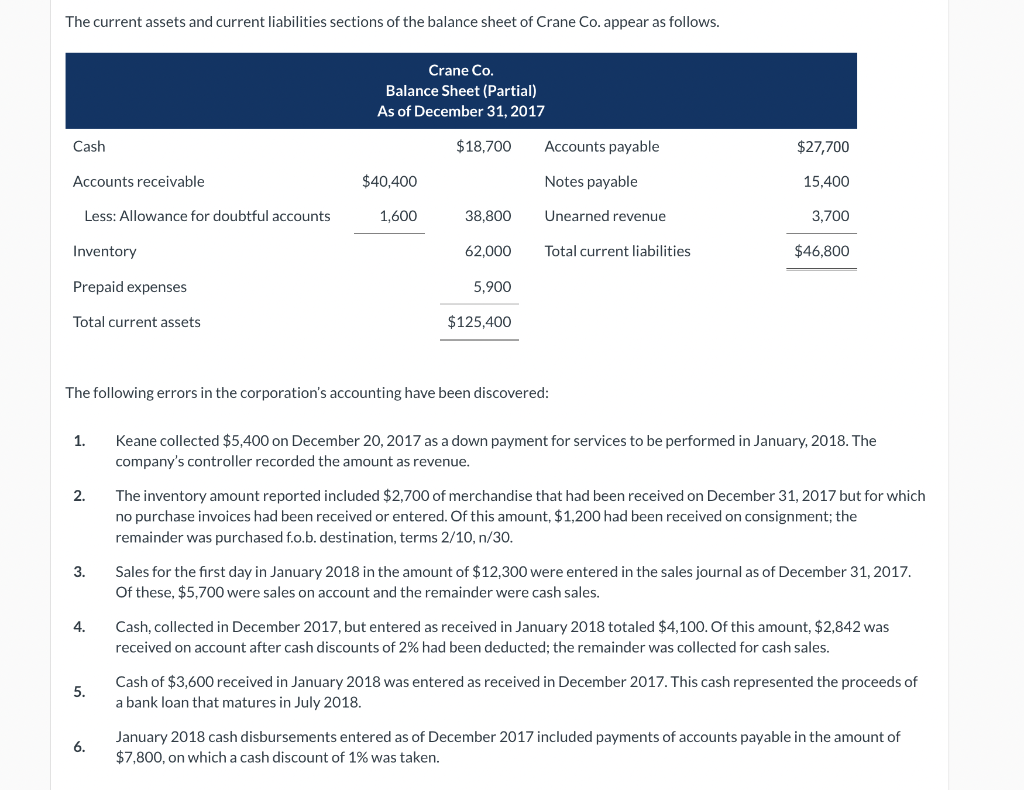

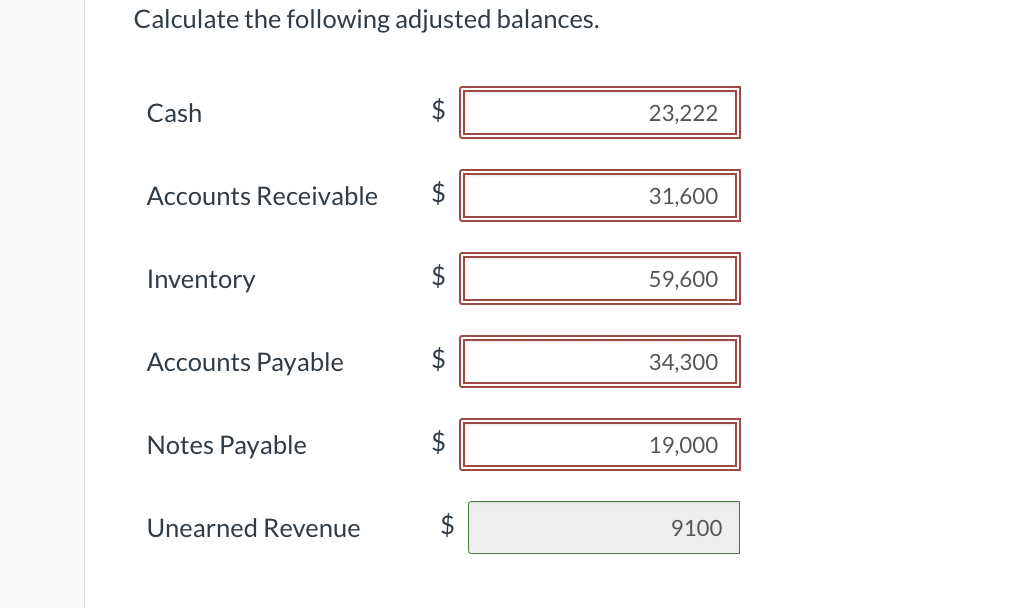

The current assets and current liabilities sections of the balance sheet of Crane Co.appear as follows. Crane Co. Balance Sheet (Partial) As of December 31, 2017 Cash $18,700 Accounts payable $27,700 Accounts receivable $40,400 Notes payable 15,400 Less: Allowance for doubtful accounts 1,600 38,800 Unearned revenue 3,700 Inventory 62,000 Total current liabilities $46,800 Prepaid expenses 5,900 Total current assets $125,400 The following errors in the corporation's accounting have been discovered: 1. Keane collected $5,400 on December 20, 2017 as a down payment for services to be performed in January, 2018. The company's controller recorded the revenue. 2. The inventory amount reported included $2,700 of merchandise that had been received on December 31, 2017 but for which no purchase invoices had been received or entered. Of this amount, $1,200 had been received on consignment; the remainder was purchased f.o.b. destination, terms 2/10, n/30. 3. Sales for the first day in January 2018 in the amount of $12,300 were entered in the sales journal as of December 31, 2017. Of these, $5,700 were sales on account and the remainder were cash sales. 4. Cash, collected in December 2017, but entered as received in January 2018 totaled $4,100. Of this amount, $2,842 was received on account after cash discounts of 2% had been deducted; the remainder was collected for cash sales. 5. Cash of $3,600 received in January 2018 was entered as received in December 2017. This cash represented the proceeds of a bank loan that matures in July 2018. 6. January 2018 cash disbursements entered as of December 2017 included payments of accounts payable in the amount of $7,800, on which a cash discount of 1% was taken. Calculate the following adjusted balances. Cash TA $ 23,222 Accounts Receivable 31,600 Inventory 59,600 Accounts Payable 34,300 Notes Payable 19,000 Unearned Revenue ta 9100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts