Question: please help with this problem. i cant seem to get the right answer the right way. 2. (7 Points Total). Sapp Trucking's balance sheet shows

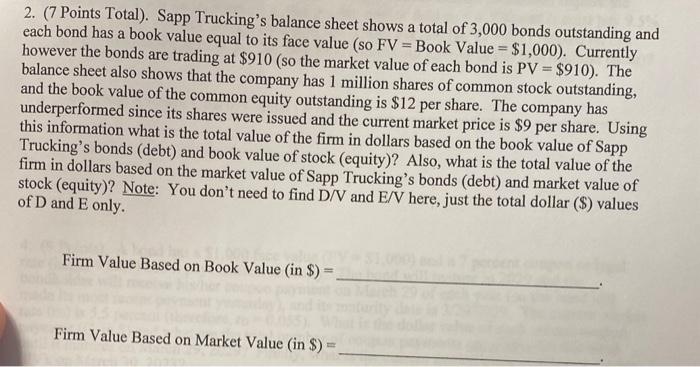

2. (7 Points Total). Sapp Trucking's balance sheet shows a total of 3,000 bonds outstanding and each bond has a book value equal to its face value (so FV= Book Value =$1,000 ). Currently however the bonds are trading at $910 (so the market value of each bond is PV=$910 ). The balance sheet also shows that the company has 1 million shares of common stock outstanding, and the book value of the common equity outstanding is $12 per share. The company has underperformed since its shares were issued and the current market price is $9 per share. Using this information what is the total value of the firm in dollars based on the book value of Sapp Trucking's bonds (debt) and book value of stock (equity)? Also, what is the total value of the firm in dollars based on the market value of Sapp Trucking's bonds (debt) and market value of stock (equity)? Note: You don't need to find D/V and E/V here, just the total dollar (\$) values of D and E only. Firm Value Based on Book Value (in $ ) = Firm Value Based on Market Value ( in $)=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts