Question: Please help with this problem; Im not sure where to start to solve this please guide me in the right direction . Modied version of

Please help with this problem; Im not sure where to start to solve this please guide me in the right direction

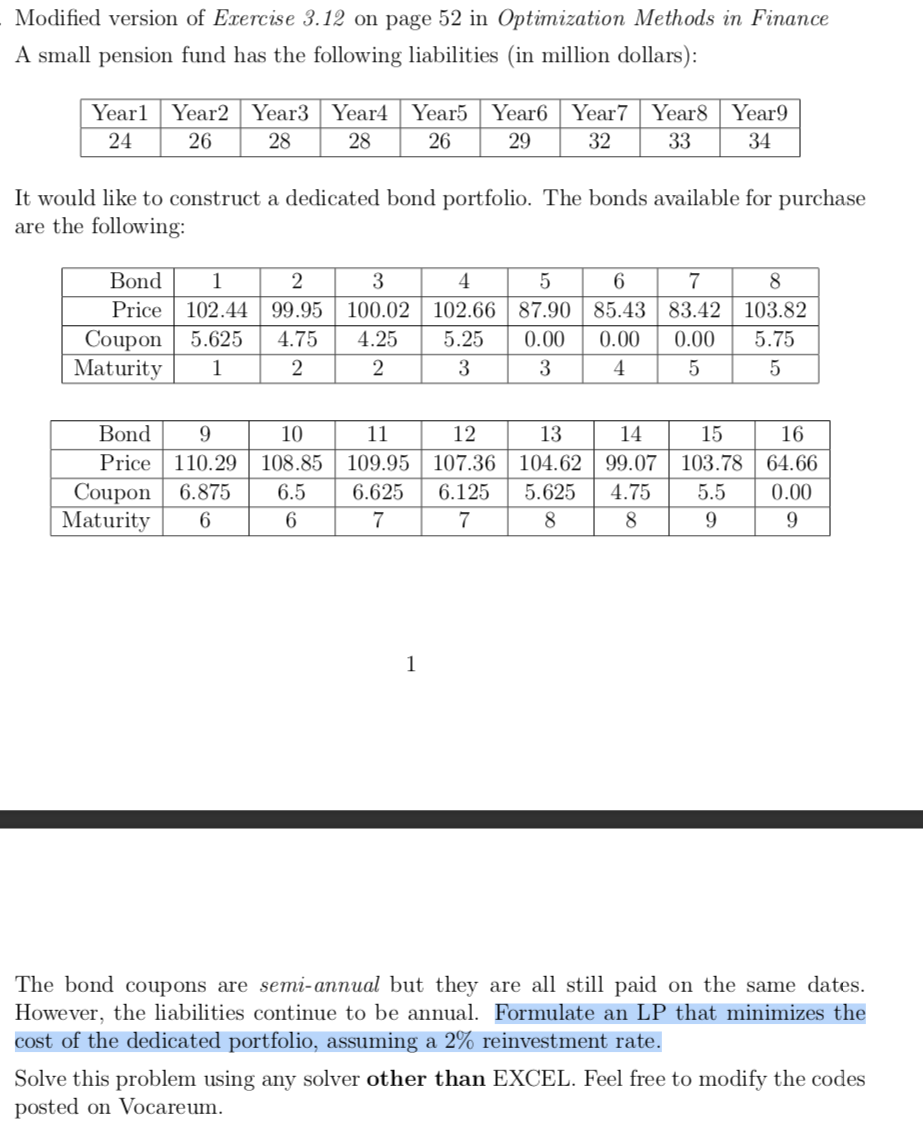

. Modied version of Exercise 3.12? on page 52 in Optimization Methods in Finance A small pension fund has the following liabilities (in million dollars): It would like to construct a dedicated bond portfolio. The bonds available for purchase are the following: "mun\" 100.02 102.00 07.00 103.02 Coupon 5.625 4.75 4.25 5.25 0.00 0.00 0.00 5.75 Maturity 1 2 2 3 3 4 5 5 --n m 110.29 mm 64.66 6.5 5.625 5.5 \"\"1.\" The bond coupons are semi-annual but they are all still paid on the same dates. However, the liabilities continue to be annual. Formulate an LP that mmmusm the cmtofthededicatedportfoliomaaumhgareinvestmentmte. Solve this problem using any solver other than EXCEL. Feel free to modify the codes posted on Vocareum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts