Question: Please help with this project ill really appreciate it. Let me know if you need anymore info. Thanks so much!! The NextGen project is an

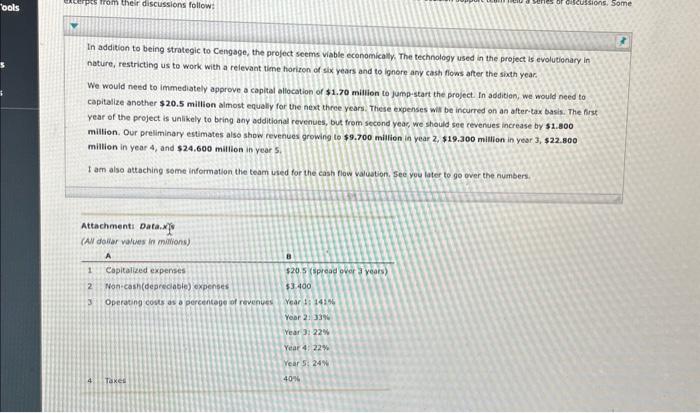

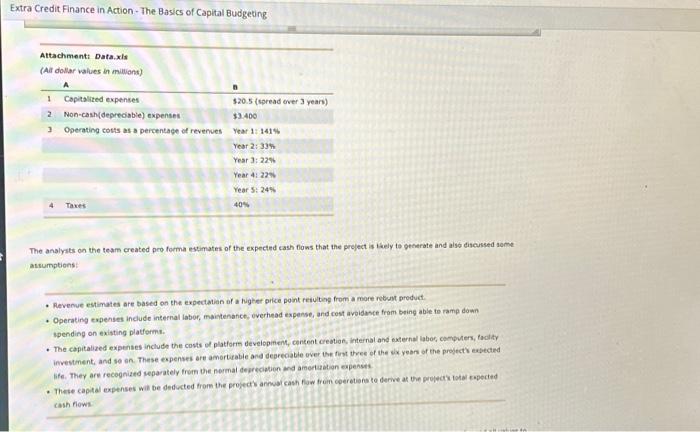

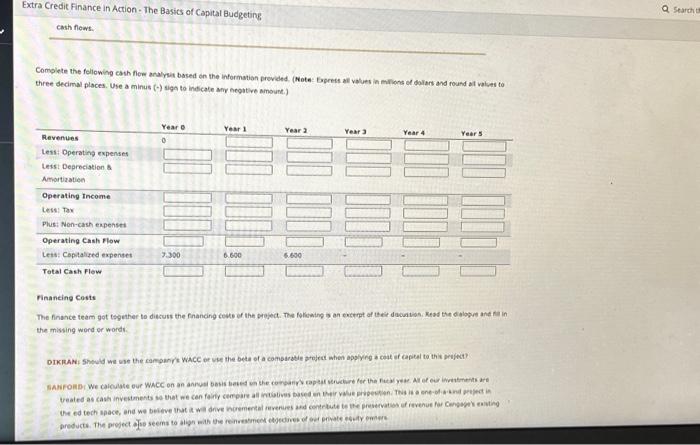

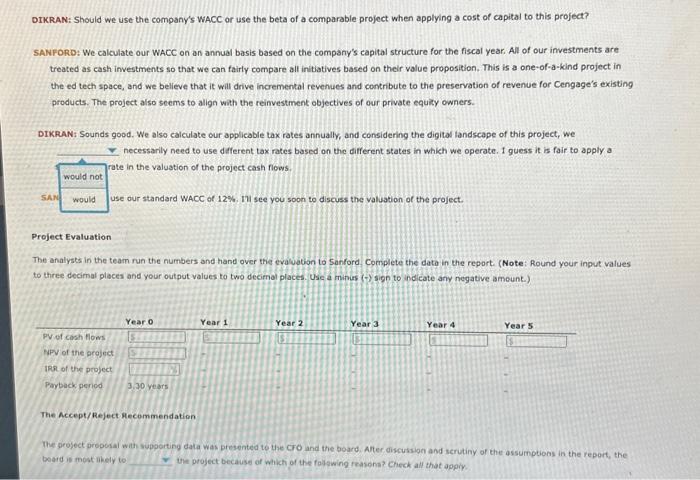

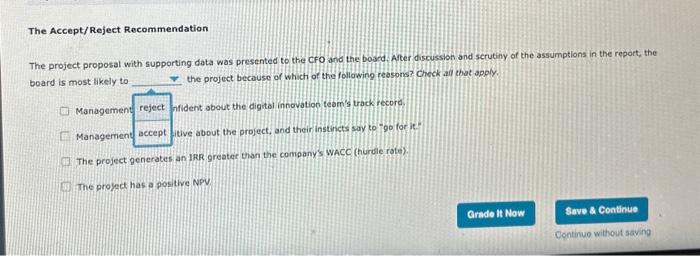

The NextGen project is an example of how the financial appraisal of an investment project is conducted at Cengage Learning. The NextGen project passed through several stages of the capital investment process, which required the finance team to evaluate if and to what extent the project would drive inicremental revenue or contribute toward revenue preservation. Instructions: Review the following stages of the financiat appraisal process for this project and complete missing information as needed. Project Overview The innovation team proposed a digital learning platform that will create a personalired learning experience for each student. The platform consists of a set of fexible tools that will allow students to customixe the technology to suit their persorial learning needs. The executive team believes that the value proposition offered by the NextGen project will be one of a kind in the digital learning space and give the company a first-mover advantage. The finance team conducted the financial appraisal of the project to evaluate if and to what cextent the project would drive incremental revenue or contribute soward revenut preservakion. Relevant Cash Flows The finance team schoouled a senes of meetings to docoss the different aspects of the project analysis. Sanford Tassel, Senior Vice President, Finance and Operadors, Dikran Yapoujan, Vice President, Finance and other members of the finance-decision support team held a series of discussions. Some excerpts from their discussians folion: In addition to being strategic to Cengage, the project seems viable economicaly, The technology used in the project is evolutionary in nature, restricting us to work with a relevant time horiron of six years and to ignore any cash fiows after the sinth year. We would need to immediately approve a capital allocation of $1.70 miliion to jumpistart the project In addition, we would need to capitalize another $20.5 million almost equally for the next three years. These expenses wis be incurred on an after-tax basis. The hrst year of the project is unlikely to bring any additional revenues, but from second year, we should see revenues increase by $1.800 million. Our preliminary estimates also show revenues growing to $9.700 milion in year 2, $19.300 million in year 3,$22.800 mition in year 4 , and 524.600 million in year 5 . I aen also attaching seme information the team uted for the cash flow valuation, Gee you later to go over the numbers. Extra Credit Finance in Action - The Basics of Capital Budgeting The analysts on the team created pro forma estimates of the expected cash foows that the preject is thely to gecierate and alsd diseussed aeme astumptiens: - Revenue estimates are based an the expectatian of a higher price point reiulting from an more rebust product. * Operating expenses include ineernal labor, maintenafice, everhead expense, and cost avbidasce from being able fo ramp down spending on existing platfermu. - The capitalized expenses include the costs of platform deveiopinen, content areation, internal and outernal labor, cemquter, faclaty life. They are recogniztd meparately tromm bhe normal de preciabion and ameruatian eupensts. - These cagital expenses wil be deducted from the projects anmul cash fiaw frem coeretaena to derive at the probectu total capected cash fiows: Extra Credit Finance in Action - The Basics of Capital Budgeting cash flows: three dedimal places. Use a minus () siga to indicate my acgutive amount.) Financing Cots the misving word or word. DIKRAN: Should we use the company's wACC or use the beta of a comparable project when applying a cost of capital to this project? SANFORD: We calculate our WACC on an annual basis based on the company's capital structure for the fiscal year. All of our investments are treated as cash investments so that we can fairly compare all initiatives based on their volue proposition. This is a one-of-a-kind project in the ed tech space, and we believe that it will drive incremental revenues and contribute to the preservation of revenue for Cengage's existing products. The project also seems to align with the reinvestment objectives of our private equiky owners. DIKRAN: Sounds good. We also calculate cur applicable tax rates annually, and considering the digitad landscape of this project, we necessarly need to use diferent tax rates based on the different states in which we operate. I guess it is fair to apply a ate in the valuation of the project cash flows. Project Evaluation The analysts in the team run the numbers and hand over the evaluation to Sanford. Complete the dato in the report. (Note: Round your input values to three decimal places and your outpot values to two decimal places. Usic a minus (-y sipn to indicate any negative ameunt.) The Accept/Reject recommendation The peoject proposal with supporting data was presented to the CrO and the board. Ater discuision and serutiny of the assumptions in the report, the beard is most nikely to the project because of whikh of the fotswing reasona? check all that appik. The Accept/Reject Recommendation The project proposal with supporting data was presented to the cfo and the board Aiter discussion and scrutiny of the assumptions in the report, the board is most likely to the project because of which of the following reasons? Check and that apply. Management reject afident about the digral innovation team's track record Management accept itive about the project, and their instincts say to go for it." The project generates an IRR greater than the company's WACC (hurdie rate). The project has a postive NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts